Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

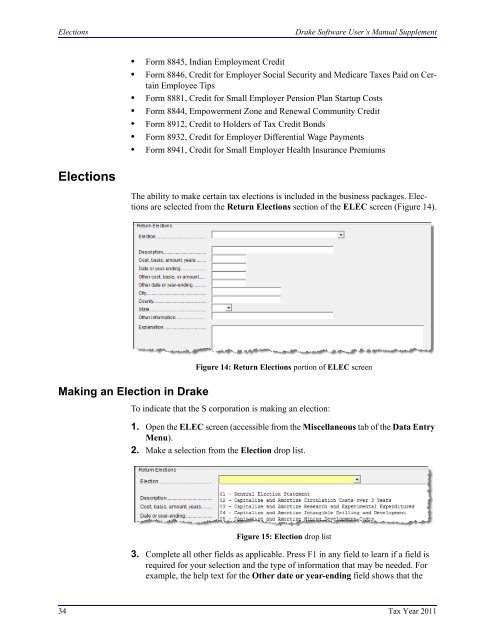

Elections<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>• Form 8845, Indian Employment Credit• Form 8846, Credit for Employer Social Security and Medicare <strong>Tax</strong>es Paid on CertainEmployee Tips• Form 8881, Credit for Small Employer Pension Plan Startup Costs• Form 8844, Empowerment Zone and Renewal Community Credit• Form 8912, Credit to Holders of <strong>Tax</strong> Credit Bonds• Form 8932, Credit for Employer Differential Wage Payments• Form 8941, Credit for Small Employer Health Insurance PremiumsElectionsThe ability to make certain tax elections is included in the business packages. Electionsare selected from the Return Elections section of the ELEC screen (Figure 14).Making an Election in <strong>Drake</strong>Figure 14: Return Elections portion of ELEC screenTo indicate that the S corporation is making an election:1. Open the ELEC screen (accessible from the Miscellaneous tab of the Data EntryMenu).2. Make a selection from the Election drop list.Figure 15: Election drop list3. Complete all other fields as applicable. Press F1 in any field to learn if a field isrequired for your selection and the type of information that may be needed. Forexample, the help text for the Other date or year-ending field shows that the34 <strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>