Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

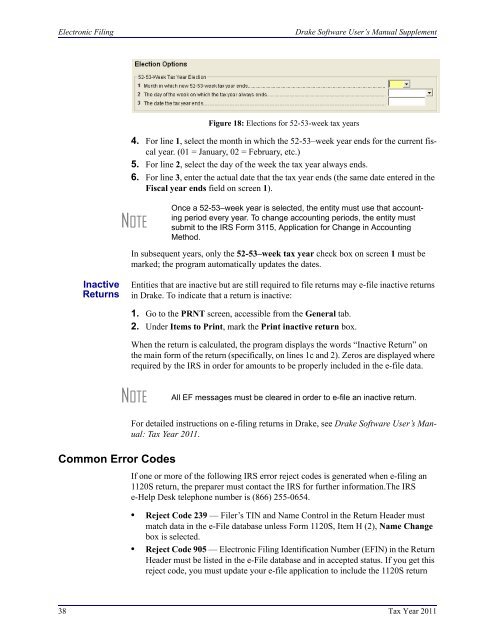

Electronic Filing<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Figure 18: Elections for 52-53-week tax years4. For line 1, select the month in which the 52-53–week year ends for the current fiscalyear. (01 = January, 02 = February, etc.)5. For line 2, select the day of the week the tax year always ends.6. For line 3, enter the actual date that the tax year ends (the same date entered in theFiscal year ends field on screen 1).NOTEOnce a 52-53–week year is selected, the entity must use that accountingperiod every year. To change accounting periods, the entity mustsubmit to the IRS Form 3115, Application for Change in AccountingMethod.In subsequent years, only the 52-53–week tax year check box on screen 1 must bemarked; the program automatically updates the dates.InactiveReturnsEntities that are inactive but are still required to file returns may e-file inactive returnsin <strong>Drake</strong>. To indicate that a return is inactive:1. Go to the PRNT screen, accessible from the General tab.2. Under Items to Print, mark the Print inactive return box.When the return is calculated, the program displays the words “Inactive Return” onthe main form of the return (specifically, on lines 1c and 2). Zeros are displayed whererequired by the IRS in order for amounts to be properly included in the e-file data.NOTEAll EF messages must be cleared in order to e-file an inactive return.Common Error CodesFor detailed instructions on e-filing returns in <strong>Drake</strong>, see <strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong>:<strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>.If one or more of the following IRS error reject codes is generated when e-filing an1120S return, the preparer must contact the IRS for further information.The IRSe-Help Desk telephone number is (866) 255-0654.• Reject Code 239 — Filer’s TIN and Name Control in the Return Header mustmatch data in the e-File database unless Form 1120S, Item H (2), Name Changebox is selected.• Reject Code 905 — Electronic Filing Identification Number (EFIN) in the ReturnHeader must be listed in the e-File database and in accepted status. If you get thisreject code, you must update your e-file application to include the 1120S return38 <strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>