Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

102<br />

INFORMATION ABOUT <strong>ANF</strong><br />

Reports and <strong>in</strong><strong>format</strong>ion for <strong>the</strong> Shareholders’ Meet<strong>in</strong>g<br />

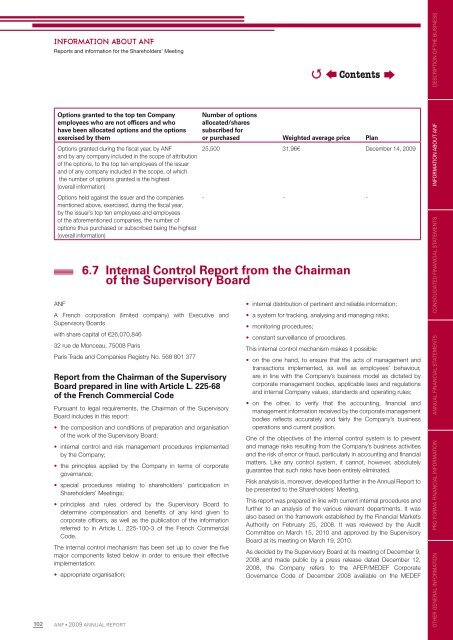

Options granted to <strong>the</strong> top ten Company<br />

employees who are not offi cers and who<br />

have been allocated options and <strong>the</strong> options<br />

exercised by <strong>the</strong>m<br />

Options granted dur<strong>in</strong>g <strong>the</strong> fi scal year, by <strong>ANF</strong><br />

and by any company <strong>in</strong>cluded <strong>in</strong> <strong>the</strong> scope of attribution<br />

of <strong>the</strong> options, to <strong>the</strong> top ten employees of <strong>the</strong> issuer<br />

and of any company <strong>in</strong>cluded <strong>in</strong> <strong>the</strong> scope, of which<br />

<strong>the</strong> number of options granted is <strong>the</strong> highest<br />

(overall <strong>in</strong><strong>format</strong>ion)<br />

Options held aga<strong>in</strong>st <strong>the</strong> issuer and <strong>the</strong> companies<br />

mentioned above, exercised, dur<strong>in</strong>g <strong>the</strong> fi scal year,<br />

by <strong>the</strong> issuer’s top ten employees and employees<br />

of <strong>the</strong> aforementioned companies, <strong>the</strong> number of<br />

options thus purchased or subscribed be<strong>in</strong>g <strong>the</strong> highest<br />

(overall <strong>in</strong><strong>format</strong>ion)<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

Number of options<br />

allocated/shares<br />

subscribed for<br />

or purchased Weighted average price Plan<br />

25,500 31,96€ December 14, <strong>2009</strong><br />

- - -<br />

6.7 Internal Control Report from <strong>the</strong> Chairman<br />

of <strong>the</strong> Supervisory Board<br />

<strong>ANF</strong><br />

A French corporation (limited company) with Executive and<br />

Supervisory Boards<br />

with share capital of €26,070,846<br />

32 rue de Monceau, 75008 Paris<br />

Paris Trade and Companies Registry No. 568 801 377<br />

Report from <strong>the</strong> Chairman of <strong>the</strong> Supervisory<br />

Board prepared <strong>in</strong> l<strong>in</strong>e with Article L. 225-68<br />

of <strong>the</strong> French Commercial Code<br />

Pursuant to legal requirements, <strong>the</strong> Chairman of <strong>the</strong> Supervisory<br />

Board <strong>in</strong>cludes <strong>in</strong> this <strong>report</strong>:<br />

• <strong>the</strong> composition and conditions of preparation and organisation<br />

of <strong>the</strong> work of <strong>the</strong> Supervisory Board;<br />

• <strong>in</strong>ternal control and risk management procedures implemented<br />

by <strong>the</strong> Company;<br />

• <strong>the</strong> pr<strong>in</strong>ciples applied by <strong>the</strong> Company <strong>in</strong> terms of corporate<br />

governance;<br />

• special procedures relat<strong>in</strong>g to shareholders’ participation <strong>in</strong><br />

Shareholders’ Meet<strong>in</strong>gs;<br />

• pr<strong>in</strong>ciples and rules ordered by <strong>the</strong> Supervisory Board to<br />

determ<strong>in</strong>e compensation and benefi ts of any k<strong>in</strong>d given to<br />

corporate offi cers, as well as <strong>the</strong> publication of <strong>the</strong> <strong>in</strong><strong>format</strong>ion<br />

referred to <strong>in</strong> Article L. 225-100-3 of <strong>the</strong> French Commercial<br />

Code.<br />

The <strong>in</strong>ternal control mechanism has been set up to cover <strong>the</strong> fi ve<br />

major components listed below <strong>in</strong> order to ensure <strong>the</strong>ir effective<br />

implementation:<br />

• appropriate organisation;<br />

• <strong>in</strong>ternal distribution of pert<strong>in</strong>ent and reliable <strong>in</strong><strong>format</strong>ion;<br />

• a system for track<strong>in</strong>g, analys<strong>in</strong>g and manag<strong>in</strong>g risks;<br />

• monitor<strong>in</strong>g procedures;<br />

�<br />

• constant surveillance of procedures.<br />

Contents<br />

This <strong>in</strong>ternal control mechanism makes it possible:<br />

• on <strong>the</strong> one hand, to ensure that <strong>the</strong> acts of management and<br />

transactions implemented, as well as employees’ behaviour,<br />

are <strong>in</strong> l<strong>in</strong>e with <strong>the</strong> Company’s bus<strong>in</strong>ess model as dictated by<br />

corporate management bodies, applicable laws and regulations<br />

and <strong>in</strong>ternal Company values, standards and operat<strong>in</strong>g rules;<br />

• on <strong>the</strong> o<strong>the</strong>r, to verify that <strong>the</strong> account<strong>in</strong>g, fi nancial and<br />

management <strong>in</strong><strong>format</strong>ion received by <strong>the</strong> corporate management<br />

bodies refl ects accurately and fairly <strong>the</strong> Company’s bus<strong>in</strong>ess<br />

operations and current position.<br />

One of <strong>the</strong> objectives of <strong>the</strong> <strong>in</strong>ternal control system is to prevent<br />

and manage risks result<strong>in</strong>g from <strong>the</strong> Company’s bus<strong>in</strong>ess activities<br />

and <strong>the</strong> risk of error or fraud, particularly <strong>in</strong> account<strong>in</strong>g and fi nancial<br />

matters. Like any control system, it cannot, however, absolutely<br />

guarantee that such risks have been entirely elim<strong>in</strong>ated.<br />

Risk analysis is, moreover, developed fur<strong>the</strong>r <strong>in</strong> <strong>the</strong> Annual Report to<br />

be presented to <strong>the</strong> Shareholders’ Meet<strong>in</strong>g.<br />

This <strong>report</strong> was prepared <strong>in</strong> l<strong>in</strong>e with current <strong>in</strong>ternal procedures and<br />

fur<strong>the</strong>r to an analysis of <strong>the</strong> various relevant departments. It was<br />

also based on <strong>the</strong> framework established by <strong>the</strong> F<strong>in</strong>ancial Markets<br />

Authority on February 25, 2008. It was reviewed by <strong>the</strong> Audit<br />

Committee on March 15, 2010 and approved by <strong>the</strong> Supervisory<br />

Board at its meet<strong>in</strong>g on March 19, 2010.<br />

As decided by <strong>the</strong> Supervisory Board at its meet<strong>in</strong>g of December 9,<br />

2008 and made public by a press release dated December 12,<br />

2008, <strong>the</strong> Company refers to <strong>the</strong> AFEP/MEDEF Corporate<br />

Governance Code of December 2008 available on <strong>the</strong> MEDEF<br />

OTHER GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS