Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

S<strong>in</strong>ce June 1, 2006, lessors are required, at <strong>the</strong> time a lease is signed,<br />

to provide <strong>the</strong>ir lessees with <strong>in</strong><strong>format</strong>ion relat<strong>in</strong>g to <strong>the</strong> existence of<br />

certa<strong>in</strong> environmental risks (Article L. 125-5 and Articles R. 125-23<br />

to R. 125-27 of <strong>the</strong> Environment Code. A statement of natural<br />

3.2 Market risks<br />

Interest rate risks<br />

Equity <strong>in</strong>vestment risks<br />

As of December 31, <strong>2009</strong>, <strong>the</strong> Company owned 137,835 <strong>ANF</strong><br />

shares (<strong>in</strong>clud<strong>in</strong>g <strong>the</strong> <strong>ANF</strong> shares <strong>in</strong> <strong>the</strong> liquidity contract), hold<strong>in</strong>gs<br />

<strong>in</strong> mutual funds and commercial paper worth an overall total of<br />

€16 million. As a result, <strong>ANF</strong> does not feel it faces any signifi cant<br />

risks related to equity <strong>in</strong>vestments.<br />

INFORMATION ABOUT <strong>ANF</strong><br />

Risk management, risk factors and <strong>in</strong>surance<br />

and technological risks must <strong>the</strong>refore be attached to <strong>the</strong> lease. If<br />

<strong>the</strong> statement of risks is not provided, <strong>the</strong> lessee may request <strong>the</strong><br />

term<strong>in</strong>ation of <strong>the</strong> lease or seek a reduction <strong>in</strong> rent from <strong>the</strong> judge.<br />

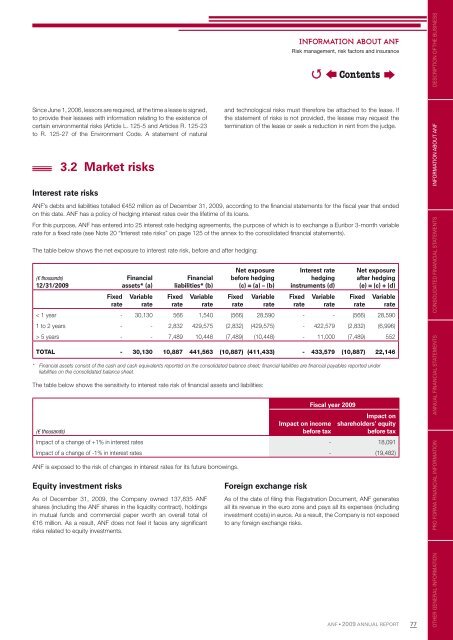

<strong>ANF</strong>’s debts and liabilities totalled €452 million as of December 31, <strong>2009</strong>, accord<strong>in</strong>g to <strong>the</strong> fi nancial statements for <strong>the</strong> fi scal year that ended<br />

on this date. <strong>ANF</strong> has a policy of hedg<strong>in</strong>g <strong>in</strong>terest rates over <strong>the</strong> lifetime of its loans.<br />

For this purpose, <strong>ANF</strong> has entered <strong>in</strong>to 25 <strong>in</strong>terest rate hedg<strong>in</strong>g agreements, <strong>the</strong> purpose of which is to exchange a Euribor 3-month variable<br />

rate for a fi xed rate (see Note 20 “Interest rate risks” on page 125 of <strong>the</strong> annex to <strong>the</strong> consolidated fi nancial statements).<br />

The table below shows <strong>the</strong> net exposure to <strong>in</strong>terest rate risk, before and after hedg<strong>in</strong>g:<br />

(€ thousands)<br />

12/31/<strong>2009</strong><br />

Fixed<br />

rate<br />

F<strong>in</strong>ancial<br />

assets* (a)<br />

Variable<br />

rate<br />

F<strong>in</strong>ancial<br />

liabilities* (b)<br />

Fixed<br />

rate<br />

Variable<br />

rate<br />

Net exposure<br />

before hedg<strong>in</strong>g<br />

(c) = (a) – (b)<br />

Fixed<br />

rate<br />

Variable<br />

rate<br />

Foreign exchange risk<br />

Interest rate<br />

hedg<strong>in</strong>g<br />

<strong>in</strong>struments (d)<br />

Fixed<br />

rate<br />

Variable<br />

rate<br />

Net exposure<br />

after hedg<strong>in</strong>g<br />

(e) = (c) + (d)<br />

Fixed<br />

rate<br />

Variable<br />

rate<br />

< 1 year - 30,130 566 1,540 (566) 28,590 - - (566) 28,590<br />

1 to 2 years - - 2,832 429,575 (2,832) (429,575) - 422,579 (2,832) (6,996)<br />

> 5 years - - 7,489 10,448 (7,489) (10,448) - 11,000 (7,489) 552<br />

TOTAL - 30,130 10,887 441,563 (10,887) (411,433) - 433,579 (10,887) 22,146<br />

* F<strong>in</strong>ancial assets consist of <strong>the</strong> cash and cash equivalents <strong>report</strong>ed on <strong>the</strong> consolidated balance sheet; f<strong>in</strong>ancial liabilities are f<strong>in</strong>ancial payables <strong>report</strong>ed under<br />

liabilities on <strong>the</strong> consolidated balance sheet.<br />

The table below shows <strong>the</strong> sensitivity to <strong>in</strong>terest rate risk of fi nancial assets and liabilities:<br />

Fiscal year <strong>2009</strong><br />

Impact on <strong>in</strong>come<br />

Impact on<br />

shareholders’ equity<br />

(€ thousands)<br />

before tax<br />

before tax<br />

Impact of a change of +1% <strong>in</strong> <strong>in</strong>terest rates - 18,091<br />

Impact of a change of -1% <strong>in</strong> <strong>in</strong>terest rates - (19,482)<br />

<strong>ANF</strong> is exposed to <strong>the</strong> risk of changes <strong>in</strong> <strong>in</strong>terest rates for its future borrow<strong>in</strong>gs.<br />

�<br />

Contents<br />

As of <strong>the</strong> date of fi l<strong>in</strong>g this Registration Document, <strong>ANF</strong> generates<br />

all its revenue <strong>in</strong> <strong>the</strong> euro zone and pays all its expenses (<strong>in</strong>clud<strong>in</strong>g<br />

<strong>in</strong>vestment costs) <strong>in</strong> euros. As a result, <strong>the</strong> Company is not exposed<br />

to any foreign exchange risks.<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

77<br />

OTHER GENERAL GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS