Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

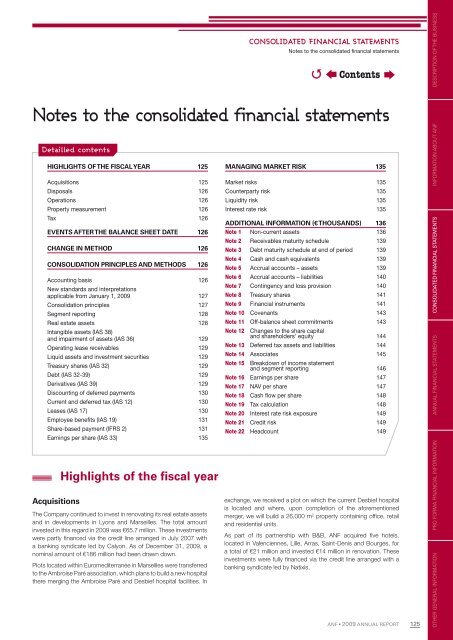

Detailled contents<br />

HIGHLIGHTS OF THE FISCAL YEAR 125<br />

Acquisitions 125<br />

Disposals 126<br />

Operations 126<br />

Property measurement 126<br />

Tax 126<br />

EVENTS AFTER THE BALANCE SHEET DATE 126<br />

CHANGE IN METHOD 126<br />

CONSOLIDATION PRINCIPLES AND METHODS 126<br />

Account<strong>in</strong>g basis<br />

New standards and <strong>in</strong>terpretations<br />

126<br />

applicable from January 1, <strong>2009</strong> 127<br />

Consolidation pr<strong>in</strong>ciples 127<br />

Segment <strong>report</strong><strong>in</strong>g 128<br />

Real estate assets<br />

Intangible assets (IAS 38)<br />

128<br />

and impairment of assets (IAS 36) 129<br />

Operat<strong>in</strong>g lease receivables 129<br />

Liquid assets and <strong>in</strong>vestment securities 129<br />

Treasury shares (IAS 32) 129<br />

Debt (IAS 32-39) 129<br />

Derivatives (IAS 39) 129<br />

Discount<strong>in</strong>g of deferred payments 130<br />

Current and deferred tax (IAS 12) 130<br />

Leases (IAS 17) 130<br />

Employee benefi ts (IAS 19) 131<br />

Share-based payment (IFRS 2) 131<br />

Earn<strong>in</strong>gs per share (IAS 33) 135<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to <strong>the</strong> consolidated fi nancial statements<br />

Notes to <strong>the</strong> consolidated f<strong>in</strong>ancial statements<br />

Acquisitions<br />

Highlights of <strong>the</strong> fi scal year<br />

The Company cont<strong>in</strong>ued to <strong>in</strong>vest <strong>in</strong> renovat<strong>in</strong>g its real estate assets<br />

and <strong>in</strong> developments <strong>in</strong> Lyons and Marseilles. The total amount<br />

<strong>in</strong>vested <strong>in</strong> this regard <strong>in</strong> <strong>2009</strong> was €65.7 million. These <strong>in</strong>vestments<br />

were partly fi nanced via <strong>the</strong> credit l<strong>in</strong>e arranged <strong>in</strong> July 2007 with<br />

a bank<strong>in</strong>g syndicate led by Calyon. As of December 31, <strong>2009</strong>, a<br />

nom<strong>in</strong>al amount of €186 million had been drawn down.<br />

Plots located with<strong>in</strong> Euromediterranée <strong>in</strong> Marseilles were transferred<br />

to <strong>the</strong> Ambroise Paré association, which plans to build a new hospital<br />

<strong>the</strong>re merg<strong>in</strong>g <strong>the</strong> Ambroise Paré and Desbief hospital facilities. In<br />

�<br />

Contents<br />

MANAGING MARKET RISK 135<br />

Market risks 135<br />

Counterparty risk 135<br />

Liquidity risk 135<br />

Interest rate risk 135<br />

ADDITIONAL INFORMATION (€ THOUSANDS) 136<br />

Note 1 Non-current assets 136<br />

Note 2 Receivables maturity schedule 139<br />

Note 3 Debt maturity schedule at end of period 139<br />

Note 4 Cash and cash equivalents 139<br />

Note 5 Accrual accounts – assets 139<br />

Note 6 Accrual accounts – liabilities 140<br />

Note 7 Cont<strong>in</strong>gency and loss provision 140<br />

Note 8 Treasury shares 141<br />

Note 9 F<strong>in</strong>ancial <strong>in</strong>struments 141<br />

Note 10 Covenants 143<br />

Note 11 Off-balance sheet commitments 143<br />

Note 12 Changes to <strong>the</strong> share capital<br />

and shareholders’ equity 144<br />

Note 13 Deferred tax assets and liabilities 144<br />

Note 14 Associates 145<br />

Note 15 Breakdown of <strong>in</strong>come statement<br />

and segment <strong>report</strong><strong>in</strong>g 146<br />

Note 16 Earn<strong>in</strong>gs per share 147<br />

Note 17 NAV per share 147<br />

Note 18 Cash fl ow per share 148<br />

Note 19 Tax calculation 148<br />

Note 20 Interest rate risk exposure 149<br />

Note 21 Credit risk 149<br />

Note 22 Headcount 149<br />

exchange, we received a plot on which <strong>the</strong> current Desbief hospital<br />

is located and where, upon completion of <strong>the</strong> aforementioned<br />

merger, we will build a 26,000 m2 property conta<strong>in</strong><strong>in</strong>g offi ce, retail<br />

and residential units.<br />

As part of its partnership with B&B, <strong>ANF</strong> acquired fi ve hotels,<br />

located <strong>in</strong> Valenciennes, Lille, Arras, Sa<strong>in</strong>t-Denis and Bourges, for<br />

a total of €21 million and <strong>in</strong>vested €14 million <strong>in</strong> renovation. These<br />

<strong>in</strong>vestments were fully fi nanced via <strong>the</strong> credit l<strong>in</strong>e arranged with a<br />

bank<strong>in</strong>g syndicate led by Natixis.<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

125<br />

OTHER GENERAL GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS