Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

148<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to <strong>the</strong> consolidated fi nancial statements<br />

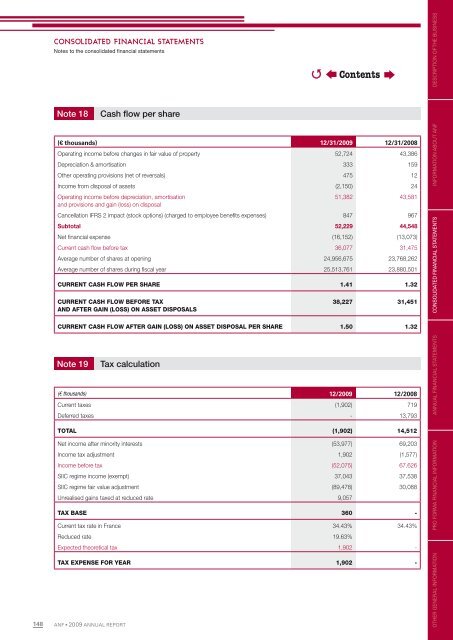

Note 18 Cash fl ow per share<br />

(€ thousands) 12/31/<strong>2009</strong> 12/31/2008<br />

Operat<strong>in</strong>g <strong>in</strong>come before changes <strong>in</strong> fair value of property 52,724 43,386<br />

Depreciation & amortisation 333 159<br />

O<strong>the</strong>r operat<strong>in</strong>g provisions (net of reversals) 475 12<br />

Income from disposal of assets (2,150) 24<br />

Operat<strong>in</strong>g <strong>in</strong>come before depreciation, amortisation<br />

and provisions and ga<strong>in</strong> (loss) on disposal<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

51,382 43,581<br />

Cancellation IFRS 2 impact (stock options) (charged to employee benefi ts expenses) 847 967<br />

Subtotal 52,229 44,548<br />

Net fi nancial expense (16,152) (13,073)<br />

Current cash fl ow before tax 36,077 31,475<br />

Average number of shares at open<strong>in</strong>g 24,956,675 23,768,262<br />

Average number of shares dur<strong>in</strong>g fi scal year 25,513,761 23,880,501<br />

CURRENT CASH FLOW PER SHARE 1.41 1.32<br />

CURRENT CASH FLOW BEFORE TAX<br />

AND AFTER GAIN (LOSS) ON ASSET DISPOSALS<br />

38,227 31,451<br />

CURRENT CASH FLOW AFTER GAIN (LOSS) ON ASSET DISPOSAL PER SHARE 1.50 1.32<br />

Note 19 Tax calculation<br />

(€ thousands) 12/<strong>2009</strong> 12/2008<br />

Current taxes (1,902) 719<br />

Deferred taxes - 13,793<br />

TOTAL (1,902) 14,512<br />

Net <strong>in</strong>come after m<strong>in</strong>ority <strong>in</strong>terests (53,977) 69,203<br />

Income tax adjustment 1,902 (1,577)<br />

Income before tax (52,075) 67,626<br />

SIIC regime <strong>in</strong>come (exempt) 37,043 37,538<br />

SIIC regime fair value adjustment (89,478) 30,088<br />

Unrealised ga<strong>in</strong>s taxed at reduced rate 9,057<br />

TAX BASE 360 -<br />

Current tax rate <strong>in</strong> France 34.43% 34.43%<br />

Reduced rate 19.63%<br />

Expected <strong>the</strong>oretical tax 1,902 -<br />

TAX EXPENSE FOR YEAR 1,902 -<br />

�<br />

Contents<br />

OTHER GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS