Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

132<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to <strong>the</strong> consolidated fi nancial statements<br />

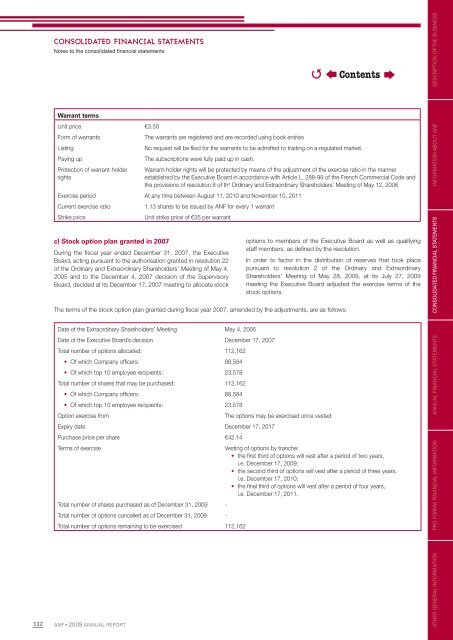

Warrant terms<br />

Unit price €3.50<br />

Form of warrants The warrants are registered and are recorded us<strong>in</strong>g book entries<br />

List<strong>in</strong>g No request will be fi led for <strong>the</strong> warrants to be admitted to trad<strong>in</strong>g on a regulated market.<br />

Pay<strong>in</strong>g up The subscriptions were fully paid up <strong>in</strong> cash.<br />

Protection of warrant-holder<br />

rights<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

Warrant-holder rights will be protected by means of <strong>the</strong> adjustment of <strong>the</strong> exercise ratio <strong>in</strong> <strong>the</strong> manner<br />

established by <strong>the</strong> Executive Board <strong>in</strong> accordance with Article L. 288-99 of <strong>the</strong> French Commercial Code and<br />

<strong>the</strong> provisions of resolution 8 of th e Ord<strong>in</strong>ary and Extraord<strong>in</strong>ary Shareholders’ Meet<strong>in</strong>g of May 12, 2006<br />

Exercise period At any time between August 11, 2010 and November 10, 2011<br />

Current exercise ratio 1.13 shares to be issued by <strong>ANF</strong> for every 1 warrant<br />

Strike price Unit strike price of €35 per warrant<br />

c) Stock option plan granted <strong>in</strong> 2007<br />

Dur<strong>in</strong>g <strong>the</strong> fi scal year ended December 31, 2007, <strong>the</strong> Executive<br />

Board, act<strong>in</strong>g pursuant to <strong>the</strong> authorisation granted <strong>in</strong> resolution 22<br />

of <strong>the</strong> Ord<strong>in</strong>ary and Extraord<strong>in</strong>ary Shareholders’ Meet<strong>in</strong>g of May 4,<br />

2005 and to <strong>the</strong> December 4, 2007 decision of <strong>the</strong> Supervisory<br />

Board, decided at its December 17, 2007 meet<strong>in</strong>g to allocate stock<br />

options to members of <strong>the</strong> Executive Board as well as qualify<strong>in</strong>g<br />

staff members, as defi ned by <strong>the</strong> resolution.<br />

In order to factor <strong>in</strong> <strong>the</strong> distribution of reserves that took place<br />

pursuant to resolution 2 of <strong>the</strong> Ord<strong>in</strong>ary and Extraord<strong>in</strong>ary<br />

Shareholders’ Meet<strong>in</strong>g of May 28, <strong>2009</strong>, at its July 27, <strong>2009</strong><br />

meet<strong>in</strong>g <strong>the</strong> Executive Board adjusted <strong>the</strong> exercise terms of <strong>the</strong><br />

stock options.<br />

The terms of <strong>the</strong> stock option plan granted dur<strong>in</strong>g fi scal year 2007, amended by <strong>the</strong> adjustments, are as follows:<br />

Date of <strong>the</strong> Extraord<strong>in</strong>ary Shareholders’ Meet<strong>in</strong>g May 4, 2005<br />

Date of <strong>the</strong> Executive Board’s decision December 17, 2007<br />

Total number of options allocated: 112,162<br />

• Of which Company offi cers: 88,584<br />

• Of which top 10 employee recipients: 23,578<br />

Total number of shares that may be purchased: 112,162<br />

• Of which Company offi cers: 88,584<br />

• Of which top 10 employee recipients: 23,578<br />

Option exercise from The options may be exercised once vested<br />

Expiry date December 17, 2017<br />

Purchase price per share €42.14<br />

Terms of exercise Vest<strong>in</strong>g of options by tranche:<br />

• <strong>the</strong> fi rst third of options will vest after a period of two years,<br />

i.e. December 17, <strong>2009</strong>;<br />

• <strong>the</strong> second third of options will vest after a period of three years,<br />

i.e. December 17, 2010;<br />

• <strong>the</strong> fi nal third of options will vest after a period of four years,<br />

i.e. December 17, 2011.<br />

Total number of shares purchased as of December 31, <strong>2009</strong> -<br />

Total number of options cancelled as of December 31, <strong>2009</strong> -<br />

Total number of options rema<strong>in</strong><strong>in</strong>g to be exercised 112,162<br />

�<br />

Contents<br />

OTHER GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS