Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

142<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to <strong>the</strong> consolidated fi nancial statements<br />

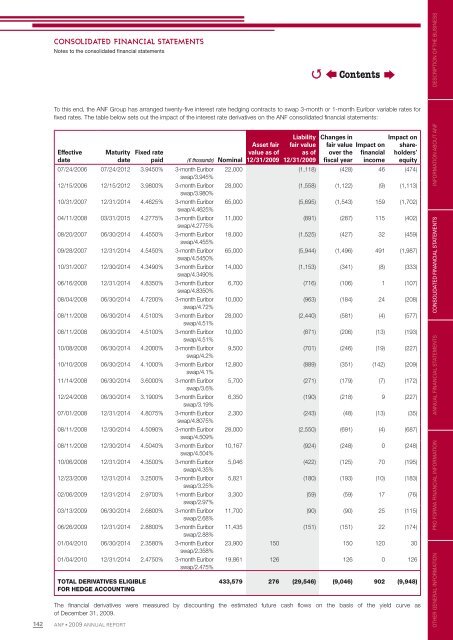

To this end, <strong>the</strong> <strong>ANF</strong> Group has arranged twenty-fi ve <strong>in</strong>terest rate hedg<strong>in</strong>g contracts to swap 3-month or 1-month Euribor variable rates for<br />

fi xed rates. The table below sets out <strong>the</strong> impact of <strong>the</strong> <strong>in</strong>terest rate derivatives on <strong>the</strong> <strong>ANF</strong> consolidated fi nancial statements:<br />

Effective<br />

date<br />

Maturity<br />

date<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

Fixed rate<br />

paid (€ thousands) Nom<strong>in</strong>al<br />

07/24/2006 07/24/2012 3.9450% 3-month Euribor<br />

swap/3.945%<br />

12/15/2006 12/15/2012 3.9800% 3-month Euribor<br />

swap/3.980%<br />

10/31/2007 12/31/2014 4.4625% 3-month Euribor<br />

swap/4.4625%<br />

04/11/2008 03/31/2015 4.2775% 3-month Euribor<br />

swap/4.2775%<br />

08/20/2007 06/30/2014 4.4550% 3-month Euribor<br />

swap/4.455%<br />

09/28/2007 12/31/2014 4.5450% 3-month Euribor<br />

swap/4.5450%<br />

10/31/2007 12/30/2014 4.3490% 3-month Euribor<br />

swap/4.3490%<br />

06/16/2008 12/31/2014 4.8350% 3-month Euribor<br />

swap/4.8350%<br />

08/04/2008 06/30/2014 4.7200% 3-month Euribor<br />

swap/4.72%<br />

08/11/2008 06/30/2014 4.5100% 3-month Euribor<br />

swap/4.51%<br />

08/11/2008 06/30/2014 4.5100% 3-month Euribor<br />

swap/4.51%<br />

10/08/2008 06/30/2014 4.2000% 3-month Euribor<br />

swap/4.2%<br />

10/10/2008 06/30/2014 4.1000% 3-month Euribor<br />

swap/4.1%<br />

11/14/2008 06/30/2014 3.6000% 3-month Euribor<br />

swap/3.6%<br />

12/24/2008 06/30/2014 3.1900% 3-month Euribor<br />

swap/3.19%<br />

07/01/2008 12/31/2014 4.8075% 3-month Euribor<br />

swap/4.8075%<br />

08/11/2008 12/30/2014 4.5090% 3-month Euribor<br />

swap/4.509%<br />

08/11/2008 12/30/2014 4.5040% 3-month Euribor<br />

swap/4.504%<br />

10/06/2008 12/31/2014 4.3500% 3-month Euribor<br />

swap/4.35%<br />

12/23/2008 12/31/2014 3.2500% 3-month Euribor<br />

swap/3.25%<br />

02/06/<strong>2009</strong> 12/31/2014 2.9700% 1-month Euribor<br />

swap/2.97%<br />

03/13/<strong>2009</strong> 06/30/2014 2.6800% 3-month Euribor<br />

swap/2.68%<br />

06/26/<strong>2009</strong> 12/31/2014 2.8800% 3-month Euribor<br />

swap/2.88%<br />

01/04/2010 06/30/2014 2.3580% 3-month Euribor<br />

swap/2.358%<br />

01/04/2010 12/31/2014 2.4750% 3-month Euribor<br />

swap/2.475%<br />

TOTAL DERIVATIVES ELIGIBLE<br />

FOR HEDGE ACCOUNTING<br />

Asset fair<br />

value as of<br />

12/31/<strong>2009</strong><br />

Liability<br />

fair value<br />

as of<br />

12/31/<strong>2009</strong><br />

Changes <strong>in</strong><br />

fair value Impact on<br />

over <strong>the</strong> fi nancial<br />

fi scal year <strong>in</strong>come<br />

Impact on<br />

shareholders’<br />

equity<br />

22,000 (1,118) (428) 46 (474)<br />

28,000 (1,558) (1,122) (9) (1,113)<br />

65,000 (5,695) (1,543) 159 (1,702)<br />

11,000 (891) (287) 115 (402)<br />

18,000 (1,525) (427) 32 (459)<br />

65,000 (5,944) (1,496) 491 (1,987)<br />

14,000 (1,153) (341) (8) (333)<br />

6,700 (716) (106) 1 (107)<br />

10,000 (963) (184) 24 (208)<br />

28,000 (2,440) (581) (4) (577)<br />

10,000 (871) (206) (13) (193)<br />

9,500 (701) (246) (19) (227)<br />

12,800 (889) (351) (142) (209)<br />

5,700 (271) (179) (7) (172)<br />

6,350 (190) (218) 9 (227)<br />

2,300 (243) (48) (13) (35)<br />

28,000 (2,550) (691) (4) (687)<br />

10,167 (924) (248) 0 (248)<br />

5,046 (422) (125) 70 (195)<br />

5,821 (180) (193) (10) (183)<br />

3,300 (59) (59) 17 (76)<br />

11,700 (90) (90) 25 (115)<br />

11,435 (151) (151) 22 (174)<br />

23,900 150 150 120 30<br />

19,861 126 126 0 126<br />

433,579 276 (29,546) (9,046) 902 (9,948)<br />

The fi nancial derivatives were measured by discount<strong>in</strong>g <strong>the</strong> estimated future cash fl ows on <strong>the</strong> basis of <strong>the</strong> yield curve as<br />

of December 31, <strong>2009</strong>.<br />

�<br />

Contents<br />

OTHER GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS