Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

64<br />

INFORMATION ABOUT <strong>ANF</strong><br />

Corporate governance<br />

The criteria for <strong>the</strong> application of <strong>the</strong> allowance require <strong>the</strong> payment<br />

of one third of <strong>the</strong> allowance be based on an <strong>in</strong>crease <strong>in</strong> Net Asset<br />

Value (NAV). This allowance will only be paid if <strong>the</strong> <strong>in</strong>crease <strong>in</strong> NAV<br />

(exclud<strong>in</strong>g transfer taxes) averages at least 4% per year over <strong>the</strong><br />

period <strong>in</strong> question.<br />

This allowance cannot be added to <strong>the</strong> allowance due under <strong>the</strong><br />

employment contract.<br />

At <strong>ANF</strong>, <strong>the</strong> o<strong>the</strong>r members of <strong>the</strong> Executive Board and Supervisory<br />

Board do not receive any allowance, benefi ts or compensation of<br />

any type as a result of <strong>the</strong> term<strong>in</strong>ation of or change <strong>in</strong> <strong>the</strong>ir positions.<br />

Amounts of pension and o<strong>the</strong>r employee<br />

benefi t obligations<br />

In exchange for <strong>the</strong> services provided <strong>in</strong> carry<strong>in</strong>g out his duties, Xavier<br />

de Lacoste Lareymondie, as well as non-Board senior executives<br />

of Eurazeo, has an additional defi ned retirement fund, <strong>in</strong> order to<br />

provide <strong>the</strong>m with complementary retirement compensation. This<br />

additional retirement is based on <strong>the</strong>ir compensation and <strong>the</strong>ir<br />

seniority at <strong>the</strong> time <strong>the</strong>y retire.<br />

The total amount of <strong>the</strong> additional retirement plan granted to Xavier<br />

de Lacoste Lareymondie, <strong>in</strong> compliance with all <strong>the</strong> provisions of<br />

<strong>the</strong> retirement regulation, equals 2.5% of <strong>the</strong> base compensation<br />

Stock options and performance shares<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

per year of seniority (with a maximum of 24 years). The base<br />

compensation used to calculate benefi ts is based exclusively on<br />

<strong>the</strong> follow<strong>in</strong>g items: gross <strong>annual</strong> salary and variable compensation.<br />

This base compensation used to calculate benefi ts is limited to<br />

twice <strong>the</strong> gross <strong>annual</strong> salary. Xavier de Lacoste Lareymondie must<br />

rema<strong>in</strong> employed by <strong>the</strong> Company until retirement <strong>in</strong> order to be<br />

granted this benefi t.<br />

Xavier de Lacoste Lareymondie was granted this benefi t under <strong>the</strong><br />

same terms as non-Board member executives.<br />

With<strong>in</strong> <strong>the</strong> context of implementation of <strong>the</strong> AFEP/MEDEF’s<br />

Corporate Governance Code recommendations, <strong>the</strong> collective<br />

regime applicable to all senior Company executives has been<br />

changed to provide for an additional seniority requirement of four<br />

years with <strong>the</strong> Company and <strong>the</strong> consideration, with regard to <strong>the</strong><br />

reference compensation used to calculate <strong>the</strong> retirement pension,<br />

of <strong>the</strong> average gross compensation (fi xed and variable portion) for<br />

<strong>the</strong> previous 36 months, pursuant to <strong>the</strong> procedures laid down by<br />

<strong>the</strong> retirement regulation.<br />

The o<strong>the</strong>r members of <strong>the</strong> Executive Board and Supervisory Board<br />

of <strong>ANF</strong> do not have any pensions, additional defi ned retirement<br />

funds or any o<strong>the</strong>r benefi ts whatsoever from <strong>ANF</strong> <strong>in</strong> exchange for<br />

<strong>the</strong> performance of <strong>the</strong>ir duties.<br />

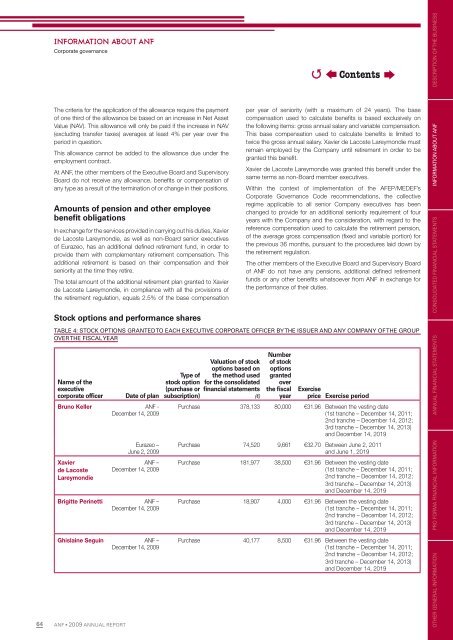

TABLE 4: STOCK OPTIONS GRANTED TO EACH EXECUTIVE CORPORATE OFFICER BY THE ISSUER AND ANY COMPANY OF THE GROUP<br />

OVER THE FISCAL YEAR<br />

Name of <strong>the</strong><br />

executive<br />

corporate offi cer Date of plan<br />

Bruno Keller <strong>ANF</strong> -<br />

December 14, <strong>2009</strong><br />

Xavier<br />

de Lacoste<br />

Lareymondie<br />

Eurazeo –<br />

June 2, <strong>2009</strong><br />

<strong>ANF</strong> –<br />

December 14, <strong>2009</strong><br />

Brigitte Per<strong>in</strong>etti <strong>ANF</strong> –<br />

December 14, <strong>2009</strong><br />

Ghisla<strong>in</strong>e Segu<strong>in</strong> <strong>ANF</strong> –<br />

December 14, <strong>2009</strong><br />

Type of<br />

stock option<br />

(purchase or<br />

subscription)<br />

Valuation of stock<br />

options based on<br />

<strong>the</strong> method used<br />

for <strong>the</strong> consolidated<br />

fi nancial statements<br />

(€)<br />

Number<br />

of stock<br />

options<br />

granted<br />

over<br />

<strong>the</strong> fi scal<br />

year<br />

�<br />

Contents<br />

Exercise<br />

price Exercise period<br />

Purchase 378,133 80,000 €31.96 Between <strong>the</strong> vest<strong>in</strong>g date<br />

(1st tranche – December 14, 2011;<br />

2nd tranche – December 14, 2012;<br />

3rd tranche – December 14, 2013)<br />

and December 14, 2019<br />

Purchase 74,520 9,661 €32.70 Between June 2, 2011<br />

and June 1, 2019<br />

Purchase 181,977 38,500 €31.96 Between <strong>the</strong> vest<strong>in</strong>g date<br />

(1st tranche – December 14, 2011;<br />

2nd tranche – December 14, 2012;<br />

3rd tranche – December 14, 2013)<br />

and December 14, 2019<br />

Purchase 18,907 4,000 €31.96 Between <strong>the</strong> vest<strong>in</strong>g date<br />

(1st tranche – December 14, 2011;<br />

2nd tranche – December 14, 2012;<br />

3rd tranche – December 14, 2013)<br />

and December 14, 2019<br />

Purchase 40,177 8,500 €31.96 Between <strong>the</strong> vest<strong>in</strong>g date<br />

(1st tranche – December 14, 2011;<br />

2nd tranche – December 14, 2012;<br />

3rd tranche – December 14, 2013)<br />

and December 14, 2019<br />

OTHER GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS