Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

84<br />

INFORMATION ABOUT <strong>ANF</strong><br />

<strong>ANF</strong> and its shareholders<br />

Description of <strong>the</strong> 2010 buyback programme<br />

which shall be submitted to <strong>the</strong> Ord<strong>in</strong>ary and<br />

Extraord<strong>in</strong>ary General Meet<strong>in</strong>g of May 6, 2010<br />

pursuant to Articles 241-2 and 241-3 of <strong>the</strong><br />

General Regulations of <strong>the</strong> F<strong>in</strong>ancial Markets<br />

Authority<br />

The Ord<strong>in</strong>ary and Extraord<strong>in</strong>ary General Meet<strong>in</strong>g of May 6, 2010 has<br />

been called, as per <strong>the</strong> 7th resolution, for <strong>the</strong> purpose of adopt<strong>in</strong>g<br />

a share buyback programme pursuant to <strong>the</strong> provisions of Article<br />

L. 225-209 of <strong>the</strong> French Commercial Code.<br />

The various objectives of this share buyback programme, as stated<br />

<strong>in</strong> <strong>the</strong> 7th resolution, which shall be submitted to <strong>the</strong> Company’s<br />

Ord<strong>in</strong>ary and Extraord<strong>in</strong>ary General Meet<strong>in</strong>g of May 6, 2010, are<br />

those of <strong>the</strong> previous share buyback described above.<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

The buyback authorisation to be granted to <strong>the</strong> Executive Board,<br />

with<strong>in</strong> <strong>the</strong> framework of <strong>the</strong> buyback programme, is for a maximum<br />

of 10% of <strong>the</strong> capital on <strong>the</strong> date such purchases take place.<br />

Based on <strong>the</strong> capital of €26,070,846 as of May 6, 2010, date of <strong>the</strong><br />

Ord<strong>in</strong>ary and Extraord<strong>in</strong>ary General Meet<strong>in</strong>g, <strong>the</strong> maximum number<br />

of shares would be 2,607,084.<br />

The maximum buyback price under <strong>the</strong> share purchase programme<br />

is €70 per share.<br />

The share buyback programme is planned for a term of 18 months<br />

from <strong>the</strong> date of <strong>the</strong> Ord<strong>in</strong>ary and Extraord<strong>in</strong>ary General Meet<strong>in</strong>g of<br />

May 6, 2010, which is called upon to adopt it, until November 6,<br />

2011.<br />

The share buybacks carried out by <strong>the</strong> Company with<strong>in</strong> <strong>the</strong><br />

framework of <strong>the</strong> previous share buyback programme are<br />

summarised <strong>in</strong> <strong>the</strong> follow<strong>in</strong>g table.<br />

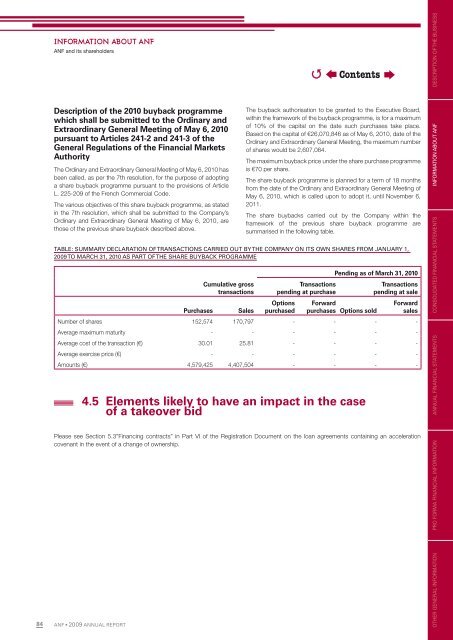

TABLE: SUMMARY DECLARATION OF TRANSACTIONS CARRIED OUT BY THE COMPANY ON ITS OWN SHARES FROM JANUARY 1,<br />

<strong>2009</strong> TO MARCH 31, 2010 AS PART OF THE SHARE BUYBACK PROGRAMME<br />

Cumulative gross<br />

transactions<br />

Transactions<br />

pend<strong>in</strong>g at purchase<br />

Pend<strong>in</strong>g as of March 31, 2010<br />

Transactions<br />

pend<strong>in</strong>g at sale<br />

Options Forward<br />

Forward<br />

Purchases Sales purchased purchases Options sold sales<br />

Number of shares 152,574 170,797 - - - -<br />

Average maximum maturity - - - - - -<br />

Average cost of <strong>the</strong> transaction (€) 30.01 25.81 - - - -<br />

Average exercise price (€) - - - - - -<br />

Amounts (€) 4,579,425 4,407,504 - - - -<br />

4.5 Elements likely to have an impact <strong>in</strong> <strong>the</strong> case<br />

of a takeover bid<br />

Please see Section 5.3”F<strong>in</strong>anc<strong>in</strong>g contracts” <strong>in</strong> Part VI of <strong>the</strong> Registration Document on <strong>the</strong> loan agreements conta<strong>in</strong><strong>in</strong>g an acceleration<br />

covenant <strong>in</strong> <strong>the</strong> event of a change of ownership.<br />

�<br />

Contents<br />

OTHER GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS