Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

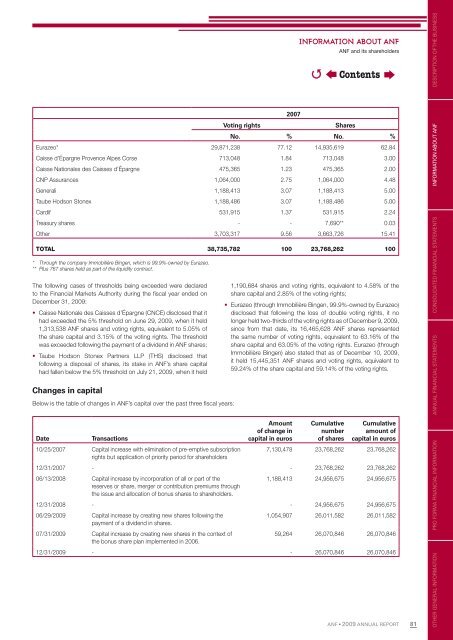

2007<br />

INFORMATION ABOUT <strong>ANF</strong><br />

Vot<strong>in</strong>g rights Shares<br />

<strong>ANF</strong> and its shareholders<br />

No. % No. %<br />

Eurazeo* 29,871,238 77.12 14,935,619 62.84<br />

Caisse d’Épargne Provence Alpes Corse 713,048 1.84 713,048 3.00<br />

Caisse Nationales des Caisses d’Épargne 475,365 1.23 475,365 2.00<br />

CNP Assurances 1,064,000 2.75 1,064,000 4.48<br />

Generali 1,188,413 3.07 1,188,413 5.00<br />

Taube Hodson Stonex 1,188,486 3.07 1,188,486 5.00<br />

Cardif 531,915 1.37 531,915 2.24<br />

Treasury shares - - 7,690** 0.03<br />

O<strong>the</strong>r 3,703,317 9.56 3,663,726 15.41<br />

TOTAL 38,735,782 100 23,768,262 100<br />

* Through <strong>the</strong> company Immobilière B<strong>in</strong>gen, which is 99.9%-owned by Eurazeo.<br />

** Plus 767 shares held as part of <strong>the</strong> liquidity contract.<br />

The follow<strong>in</strong>g cases of thresholds be<strong>in</strong>g exceeded were declared<br />

to <strong>the</strong> F<strong>in</strong>ancial Markets Authority dur<strong>in</strong>g <strong>the</strong> fi scal year ended on<br />

December 31, <strong>2009</strong>:<br />

• Caisse Nationale des Caisses d’Épargne (CNCE) disclosed that it<br />

had exceeded <strong>the</strong> 5% threshold on June 29, <strong>2009</strong>, when it held<br />

1,313,538 <strong>ANF</strong> shares and vot<strong>in</strong>g rights, equivalent to 5.05% of<br />

<strong>the</strong> share capital and 3.15% of <strong>the</strong> vot<strong>in</strong>g rights. The threshold<br />

was exceeded follow<strong>in</strong>g <strong>the</strong> payment of a dividend <strong>in</strong> <strong>ANF</strong> shares;<br />

• Taube Hodson Stonex Partners LLP (THS) disclosed that<br />

follow<strong>in</strong>g a disposal of shares, its stake <strong>in</strong> <strong>ANF</strong>’s share capital<br />

had fallen below <strong>the</strong> 5% threshold on July 21, <strong>2009</strong>, when it held<br />

Changes <strong>in</strong> capital<br />

Below is <strong>the</strong> table of changes <strong>in</strong> <strong>ANF</strong>’s capital over <strong>the</strong> past three fi scal years:<br />

1,190,684 shares and vot<strong>in</strong>g rights, equivalent to 4.58% of <strong>the</strong><br />

share capital and 2.85% of <strong>the</strong> vot<strong>in</strong>g rights;<br />

• Eurazeo (through Immobilière B<strong>in</strong>gen, 99.9%-owned by Eurazeo)<br />

disclosed that follow<strong>in</strong>g <strong>the</strong> loss of double vot<strong>in</strong>g rights, it no<br />

longer held two-thirds of <strong>the</strong> vot<strong>in</strong>g rights as of December 9, <strong>2009</strong>,<br />

s<strong>in</strong>ce from that date, its 16,465,628 <strong>ANF</strong> shares represented<br />

<strong>the</strong> same number of vot<strong>in</strong>g rights, equivalent to 63.16% of <strong>the</strong><br />

share capital and 63.05% of <strong>the</strong> vot<strong>in</strong>g rights. Eurazeo (through<br />

Immobilière B<strong>in</strong>gen) also stated that as of December 10, <strong>2009</strong>,<br />

it held 15,445,351 <strong>ANF</strong> shares and vot<strong>in</strong>g rights, equivalent to<br />

59.24% of <strong>the</strong> share capital and 59.14% of <strong>the</strong> vot<strong>in</strong>g rights.<br />

Amount Cumulative Cumulative<br />

of change <strong>in</strong> number amount of<br />

Date Transactions<br />

capital <strong>in</strong> euros of shares capital <strong>in</strong> euros<br />

10/25/2007 Capital <strong>in</strong>crease with elim<strong>in</strong>ation of pre-emptive subscription<br />

rights but application of priority period for shareholders<br />

7,130,478 23,768,262 23,768,262<br />

12/31/2007 - - 23,768,262 23,768,262<br />

06/13/2008 Capital <strong>in</strong>crease by <strong>in</strong>corporation of all or part of <strong>the</strong><br />

reserves or share, merger or contribution premiums through<br />

<strong>the</strong> issue and allocation of bonus shares to shareholders.<br />

1,188,413 24,956,675 24,956,675<br />

12/31/2008 - - 24,956,675 24,956,675<br />

06/29/<strong>2009</strong> Capital <strong>in</strong>crease by creat<strong>in</strong>g new shares follow<strong>in</strong>g <strong>the</strong><br />

payment of a dividend <strong>in</strong> shares.<br />

07/31/<strong>2009</strong> Capital <strong>in</strong>crease by creat<strong>in</strong>g new shares <strong>in</strong> <strong>the</strong> context of<br />

<strong>the</strong> bonus share plan implemented <strong>in</strong> 2006.<br />

1,054,907 26,011,582 26,011,582<br />

59,264 26,070,846 26,070,846<br />

12/31/<strong>2009</strong> - - 26,070,846 26,070,846<br />

�<br />

Contents<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

81<br />

OTHER GENERAL GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS