Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

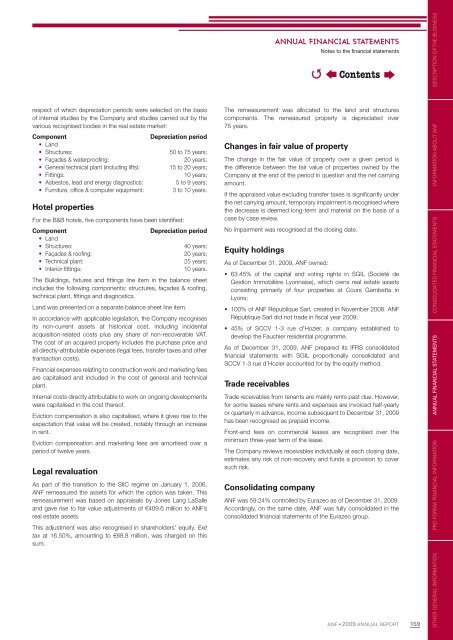

espect of which depreciation periods were selected on <strong>the</strong> basis<br />

of <strong>in</strong>ternal studies by <strong>the</strong> Company and studies carried out by <strong>the</strong><br />

various recognised bodies <strong>in</strong> <strong>the</strong> real estate market:<br />

Component<br />

• Land<br />

Depreciation period<br />

• Structures: 50 to 75 years;<br />

• Façades & waterproofi ng: 20 years;<br />

• General technical plant (<strong>in</strong>clud<strong>in</strong>g lifts): 15 to 20 years;<br />

• Fitt<strong>in</strong>gs: 10 years;<br />

• Asbestos, lead and energy diagnostics: 5 to 9 years;<br />

• Furniture, offi ce & computer equipment: 3 to 10 years.<br />

Hotel properties<br />

For <strong>the</strong> B&B hotels, fi ve components have been identifi ed:<br />

Component<br />

• Land<br />

Depreciation period<br />

• Structures: 40 years;<br />

• Façades & roofi ng: 20 years;<br />

• Technical plant: 25 years;<br />

• Interior fi tt<strong>in</strong>gs: 10 years.<br />

The Build<strong>in</strong>gs, fi xtures and fi tt<strong>in</strong>gs l<strong>in</strong>e item <strong>in</strong> <strong>the</strong> balance sheet<br />

<strong>in</strong>cludes <strong>the</strong> follow<strong>in</strong>g components: structures, façades & roofi ng,<br />

technical plant, fi tt<strong>in</strong>gs and diagnostics.<br />

Land was presented on a separate balance sheet l<strong>in</strong>e item.<br />

In accordance with applicable legislation, <strong>the</strong> Company recognises<br />

its non-current assets at historical cost, <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>cidental<br />

acquisition-related costs plus any share of non-recoverable VAT.<br />

The cost of an acquired property <strong>in</strong>cludes <strong>the</strong> purchase price and<br />

all directly-attributable expenses (legal fees, transfer taxes and o<strong>the</strong>r<br />

transaction costs).<br />

F<strong>in</strong>ancial expenses relat<strong>in</strong>g to construction work and market<strong>in</strong>g fees<br />

are capitalised and <strong>in</strong>cluded <strong>in</strong> <strong>the</strong> cost of general and technical<br />

plant.<br />

Internal costs directly attributable to work on ongo<strong>in</strong>g developments<br />

were capitalised <strong>in</strong> <strong>the</strong> cost <strong>the</strong>reof.<br />

Eviction compensation is also capitalised, where it gives rise to <strong>the</strong><br />

expectation that value will be created, notably through an <strong>in</strong>crease<br />

<strong>in</strong> rent.<br />

Eviction compensation and market<strong>in</strong>g fees are amortised over a<br />

period of twelve years.<br />

Legal revaluation<br />

As part of <strong>the</strong> transition to <strong>the</strong> SIIC regime on January 1, 2006,<br />

<strong>ANF</strong> remeasured <strong>the</strong> assets for which <strong>the</strong> option was taken. This<br />

remeasurement was based on appraisals by Jones Lang LaSalle<br />

and gave rise to fair value adjustments of €409.6 million to <strong>ANF</strong>’s<br />

real estate assets.<br />

This adjustment was also recognised <strong>in</strong> shareholders’ equity. Exit<br />

tax at 16.50%, amount<strong>in</strong>g to €68.8 million, was charged on this<br />

sum.<br />

ANNUAL FINANCIAL STATEMENTS<br />

Notes to <strong>the</strong> fi nancial statements<br />

The remeasurement was allocated to <strong>the</strong> land and structures<br />

components. The remeasured property is depreciated over<br />

75 years.<br />

Changes <strong>in</strong> fair value of property<br />

The change <strong>in</strong> <strong>the</strong> fair value of property over a given period is<br />

<strong>the</strong> difference between <strong>the</strong> fair value of properties owned by <strong>the</strong><br />

Company at <strong>the</strong> end of <strong>the</strong> period <strong>in</strong> question and <strong>the</strong> net carry<strong>in</strong>g<br />

amount.<br />

If <strong>the</strong> appraised value exclud<strong>in</strong>g transfer taxes is signifi cantly under<br />

<strong>the</strong> net carry<strong>in</strong>g amount, temporary impairment is recognised where<br />

<strong>the</strong> decrease is deemed long-term and material on <strong>the</strong> basis of a<br />

case by case review.<br />

No impairment was recognised at <strong>the</strong> clos<strong>in</strong>g date.<br />

Equity hold<strong>in</strong>gs<br />

As of December 31, <strong>2009</strong>, <strong>ANF</strong> owned:<br />

• 63.45% of <strong>the</strong> capital and vot<strong>in</strong>g rights <strong>in</strong> SGIL (Société de<br />

Gestion Immobilière Lyonnaise), which owns real estate assets<br />

consist<strong>in</strong>g primarily of four properties at Cours Gambetta <strong>in</strong><br />

Lyons;<br />

• 100% of <strong>ANF</strong> République Sarl, created <strong>in</strong> November 2008. <strong>ANF</strong><br />

République Sarl did not trade <strong>in</strong> fi scal year <strong>2009</strong>;<br />

• 45% of SCCV 1-3 rue d’Hozier, a company established to<br />

develop <strong>the</strong> Fauchier residential programme.<br />

As of December 31, <strong>2009</strong>, <strong>ANF</strong> prepared its IFRS consolidated<br />

fi nancial statements with SGIL proportionally consolidated and<br />

SCCV 1-3 rue d’Hozier accounted for by <strong>the</strong> equity method.<br />

Trade receivables<br />

Trade receivables from tenants are ma<strong>in</strong>ly rents past due. However,<br />

for some leases where rents and expenses are <strong>in</strong>voiced half-yearly<br />

or quarterly <strong>in</strong> advance, <strong>in</strong>come subsequent to December 31, <strong>2009</strong><br />

has been recognised as prepaid <strong>in</strong>come.<br />

Front-end fees on commercial leases are recognised over <strong>the</strong><br />

m<strong>in</strong>imum three-year term of <strong>the</strong> lease.<br />

The Company reviews receivables <strong>in</strong>dividually at each clos<strong>in</strong>g date,<br />

estimates any risk of non-recovery and funds a provision to cover<br />

such risk.<br />

Consolidat<strong>in</strong>g company<br />

�<br />

Contents<br />

<strong>ANF</strong> was 59.24% controlled by Eurazeo as of December 31, <strong>2009</strong>.<br />

Accord<strong>in</strong>gly, on <strong>the</strong> same date, <strong>ANF</strong> was fully consolidated <strong>in</strong> <strong>the</strong><br />

consolidated fi nancial statements of <strong>the</strong> Eurazeo group.<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

159<br />

OTHER GENERAL GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS