Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

70<br />

INFORMATION ABOUT <strong>ANF</strong><br />

Corporate governance<br />

• “Value of share before payout” means <strong>ANF</strong>’s weighted average<br />

share price <strong>in</strong> <strong>the</strong> last three market sessions before <strong>the</strong> payout<br />

date, i.e. €26.<br />

As a result, <strong>the</strong> warrant exercise ratio stands at 1.13 shares for<br />

1 warrant, while <strong>the</strong> number of warrants and <strong>the</strong>ir exercise price<br />

rema<strong>in</strong> unchanged.<br />

Stock options<br />

(i) Options granted by <strong>ANF</strong><br />

Stock options granted <strong>in</strong> fi scal year 2007<br />

Dur<strong>in</strong>g <strong>the</strong> fi scal year ended December 31, 2007, <strong>the</strong> Executive<br />

Board, at its meet<strong>in</strong>g on December 17, 2007, made an allocation<br />

of stock options, <strong>the</strong> pr<strong>in</strong>cipal characteristics of which are set out <strong>in</strong><br />

Table 8 of <strong>the</strong> paragraph “Stock options and performance shares”<br />

<strong>in</strong> Section 2.5 of Part II of <strong>the</strong> Registration Document.<br />

In order to protect <strong>the</strong> rights of <strong>the</strong> recipients of stock options<br />

follow<strong>in</strong>g <strong>the</strong> distribution of reserves, <strong>ANF</strong>’s Executive Board<br />

adjusted <strong>the</strong> exercise terms on July 27, <strong>2009</strong>, as follows:<br />

a) Adjustment of <strong>the</strong> purchase price of stock options<br />

The share purchase price (€43.75 (1) ) was multiplied by <strong>the</strong> follow<strong>in</strong>g<br />

adjustment factor:<br />

Value of payout per share<br />

1<br />

1 – (Amount of payout per share)/<br />

(Value of share prior to payout)<br />

Where:<br />

• <strong>the</strong> “Value of payout per share” means an amount <strong>in</strong> euros equal<br />

to <strong>the</strong> follow<strong>in</strong>g division:<br />

23,820,747.62<br />

24,956,675<br />

• “Value of share before payout” means <strong>ANF</strong>’s weighted average<br />

share price <strong>in</strong> <strong>the</strong> last three market sessions before <strong>the</strong> payout<br />

date, i.e. €26.<br />

b) Adjustment of <strong>the</strong> number of stock options<br />

The <strong>in</strong>itial number of stock options for each recipient was multiplied<br />

by <strong>the</strong> follow<strong>in</strong>g adjustment factor:<br />

Purchase price of stock options<br />

Adjusted purchase price of stock options<br />

Where:<br />

• <strong>the</strong> purchase price of stock options is €43.75;<br />

• <strong>the</strong> adjusted purchase price of stock options represents <strong>the</strong><br />

purchase price of <strong>the</strong> stock options determ<strong>in</strong>ed accord<strong>in</strong>g to <strong>the</strong><br />

procedure described <strong>in</strong> paragraph a) above (i.e. €42.14).<br />

Accord<strong>in</strong>gly, <strong>the</strong> new purchase price of stock options is €42.14 and<br />

<strong>the</strong> number of stock options for each benefi ciary breaks down as<br />

follows:<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

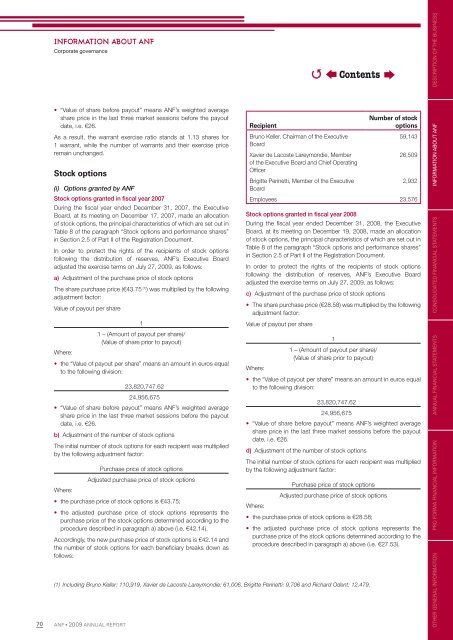

Recipient<br />

Bruno Keller, Chairman of <strong>the</strong> Executive<br />

Board<br />

Xavier de Lacoste Lareymondie, Member<br />

of <strong>the</strong> Executive Board and Chief Operat<strong>in</strong>g<br />

Offi cer<br />

Brigitte Per<strong>in</strong>etti, Member of <strong>the</strong> Executive<br />

Board<br />

Number of stock<br />

options<br />

59,143<br />

26,509<br />

2,932<br />

Employees 23,576<br />

Stock options granted <strong>in</strong> fi scal year 2008<br />

Dur<strong>in</strong>g <strong>the</strong> fi scal year ended December 31, 2008, <strong>the</strong> Executive<br />

Board, at its meet<strong>in</strong>g on December 19, 2008, made an allocation<br />

of stock options, <strong>the</strong> pr<strong>in</strong>cipal characteristics of which are set out <strong>in</strong><br />

Table 8 of <strong>the</strong> paragraph “Stock options and performance shares”<br />

<strong>in</strong> Section 2.5 of Part II of <strong>the</strong> Registration Document.<br />

In order to protect <strong>the</strong> rights of <strong>the</strong> recipients of stock options<br />

follow<strong>in</strong>g <strong>the</strong> distribution of reserves, <strong>ANF</strong>’s Executive Board<br />

adjusted <strong>the</strong> exercise terms on July 27, <strong>2009</strong>, as follows:<br />

c) Adjustment of <strong>the</strong> purchase price of stock options<br />

• The share purchase price (€28.58) was multiplied by <strong>the</strong> follow<strong>in</strong>g<br />

adjustment factor:<br />

Value of payout per share<br />

Where:<br />

1<br />

1 – (Amount of payout per share)/<br />

(Value of share prior to payout)<br />

• <strong>the</strong> “Value of payout per share” means an amount <strong>in</strong> euros equal<br />

to <strong>the</strong> follow<strong>in</strong>g division:<br />

23,820,747.62<br />

24,956,675<br />

• “Value of share before payout” means <strong>ANF</strong>’s weighted average<br />

share price <strong>in</strong> <strong>the</strong> last three market sessions before <strong>the</strong> payout<br />

date, i.e. €26.<br />

d) Adjustment of <strong>the</strong> number of stock options<br />

The <strong>in</strong>itial number of stock options for each recipient was multiplied<br />

by <strong>the</strong> follow<strong>in</strong>g adjustment factor:<br />

Purchase price of stock options<br />

Adjusted purchase price of stock options<br />

Where:<br />

• <strong>the</strong> purchase price of stock options is €28.58;<br />

• <strong>the</strong> adjusted purchase price of stock options represents <strong>the</strong><br />

purchase price of <strong>the</strong> stock options determ<strong>in</strong>ed accord<strong>in</strong>g to <strong>the</strong><br />

procedure described <strong>in</strong> paragraph a) above (i.e. €27.53).<br />

(1) Includ<strong>in</strong>g Bruno Keller: 110,919, Xavier de Lacoste Lareymondie: 61,006, Brigitte Per<strong>in</strong>etti: 9,706 and Richard Odent: 12,479.<br />

�<br />

Contents<br />

OTHER GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS