Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

Download the 2009 annual report in PDF format - ANF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

78<br />

INFORMATION ABOUT <strong>ANF</strong><br />

Risk management, risk factors and <strong>in</strong>surance<br />

3.3 Risks related to liquidity and cash fl ow<br />

<strong>ANF</strong>’s strategy relies on its ability to use fi nancial resources to make<br />

<strong>in</strong>vestments, purchase property and refi nance borrow<strong>in</strong>gs as <strong>the</strong>y<br />

fall due. <strong>ANF</strong> may (i) not always have <strong>the</strong> desired access to capital<br />

markets, or (ii) may be required to obta<strong>in</strong> fi nanc<strong>in</strong>g under terms that<br />

are less favourable than <strong>in</strong>itially planned. This could result notably<br />

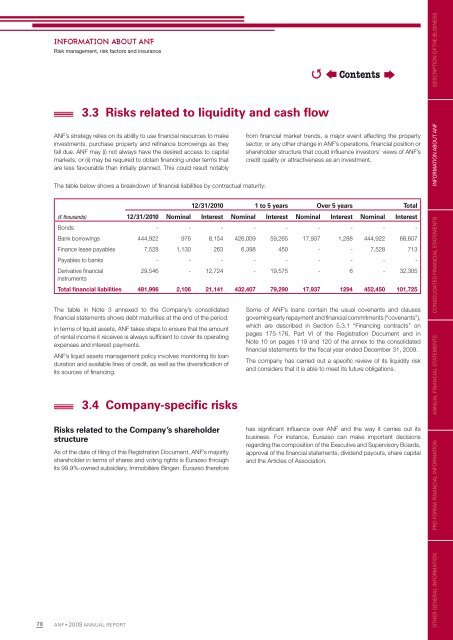

The table below shows a breakdown of fi nancial liabilities by contractual maturity:<br />

<strong>ANF</strong> • <strong>2009</strong> ANNUAL REPORT<br />

from fi nancial market trends, a major event affect<strong>in</strong>g <strong>the</strong> property<br />

sector, or any o<strong>the</strong>r change <strong>in</strong> <strong>ANF</strong>’s operations, fi nancial position or<br />

shareholder structure that could <strong>in</strong>fl uence <strong>in</strong>vestors’ views of <strong>ANF</strong>’s<br />

credit quality or attractiveness as an <strong>in</strong>vestment.<br />

12/31/2010 1 to 5 years Over 5 years Total<br />

(€ thousands)<br />

12/31/2010 Nom<strong>in</strong>al Interest Nom<strong>in</strong>al Interest Nom<strong>in</strong>al Interest Nom<strong>in</strong>al Interest<br />

Bonds - - - - - - - - -<br />

Bank borrow<strong>in</strong>gs 444,922 976 8,154 426,009 59,265 17,937 1,288 444,922 68,607<br />

F<strong>in</strong>ance lease payables 7,528 1,130 263 6,398 450 - - 7,528 713<br />

Payables to banks - - - - - - - - -<br />

Derivative fi nancial<br />

<strong>in</strong>struments<br />

29,546 - 12,724 - 19,575 - 6 - 32,305<br />

Total fi nancial liabilities 481,996 2,106 21,141 432,407 79,290 17,937 1294 452,450 101,725<br />

The table <strong>in</strong> Note 3 annexed to <strong>the</strong> Company’s consolidated<br />

fi nancial statements shows debt maturities at <strong>the</strong> end of <strong>the</strong> period.<br />

In terms of liquid assets, <strong>ANF</strong> takes steps to ensure that <strong>the</strong> amount<br />

of rental <strong>in</strong>come it receives is always suffi cient to cover its operat<strong>in</strong>g<br />

expenses and <strong>in</strong>terest payments.<br />

<strong>ANF</strong>’s liquid assets management policy <strong>in</strong>volves monitor<strong>in</strong>g its loan<br />

duration and available l<strong>in</strong>es of credit, as well as <strong>the</strong> diversifi cation of<br />

its sources of fi nanc<strong>in</strong>g.<br />

3.4 Company-specifi c risks<br />

Risks related to <strong>the</strong> Company’s shareholder<br />

structure<br />

As of <strong>the</strong> date of fi l<strong>in</strong>g of this Registration Document, <strong>ANF</strong>’s majority<br />

shareholder <strong>in</strong> terms of shares and vot<strong>in</strong>g rights is Eurazeo through<br />

its 99.9%-owned subsidiary, Immobilière B<strong>in</strong>gen. Eurazeo <strong>the</strong>refore<br />

�<br />

Contents<br />

Some of <strong>ANF</strong>’s loans conta<strong>in</strong> <strong>the</strong> usual covenants and clauses<br />

govern<strong>in</strong>g early repayment and fi nancial commitments (“covenants”),<br />

which are described <strong>in</strong> Section 5.3.1 “F<strong>in</strong>anc<strong>in</strong>g contracts” on<br />

pages 175-176, Part VI of <strong>the</strong> Registration Document and <strong>in</strong><br />

Note 10 on pages 119 and 120 of <strong>the</strong> annex to <strong>the</strong> consolidated<br />

fi nancial statements for <strong>the</strong> fi scal year ended December 31, <strong>2009</strong>.<br />

The company has carried out a specifi c review of its liquidity risk<br />

and considers that it is able to meet its future obligations.<br />

has signifi cant <strong>in</strong>fl uence over <strong>ANF</strong> and <strong>the</strong> way it carries out its<br />

bus<strong>in</strong>ess. For <strong>in</strong>stance, Eurazeo can make important decisions<br />

regard<strong>in</strong>g <strong>the</strong> composition of <strong>the</strong> Executive and Supervisory Boards,<br />

approval of <strong>the</strong> fi nancial statements, dividend payouts, share capital<br />

and <strong>the</strong> Articles of Association.<br />

OTHER GENERAL INFORMATION PRO FORMA FINANCIAL INFORMATION ANNUAL FINANCIAL STATEMENTS CONSOLIDATED FINANCIAL STATEMENTS INFORMATION ABOUT <strong>ANF</strong> DESCRIPTION OF THE BUSINESS