Tulsa, OklahomaPortland, OregonContact<strong>NAI</strong> <strong>Commercial</strong>Properties+1 918 745 1133Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold Income916,457944,580492,642$64,106$48,239The Tulsa market, with extensive oil and energy baseemployment, remained cautiously stable during the firstthree quarters of 2009 while now experiencing real impactand slowdown from the national economic downturn that isaffecting other markets. However, the increase in commercialvacancies for Tulsa is still among the lowest of the country’slargest metro areas.The office market is holding tight to its 2008 vacancy levelsas demand and relocations have tapered off. The vacancyrate for the CBD, at 23.7%, remains the highest in themarket. The suburban market continues to remain thestrongest sector with majority of higher class buildingsaveraging $14-$18.35/SF. The office market has maintaineda 76.4% occupancy rate overall with approximately21,183,758 SF in 148 buildings. The overall vacancy for a15,912,250 SF retail market has slightly increased about1% to 15.09%, the highest in a decade. Rental rates haveactually risen since 2008 with $19.64/SF for Class A and$10.47/SF for Class B properties. However, retail feelingthe effects of thinning national tenants and larger bigboxes vacated, will see increased vacancies, reduced rentpressures and stiffer competition for the remainder of 2009.In comparison, the industrial market has fared better thanother sectors despite a 3.5% vacancy increase from 2008,or approximately 8% total, on an inventory of 60,000,000SF. Lease rates have softened for new leases and renewals,with current averages of $4.07/SF for bulk warehouse and$6.65/SF for service center spaces. Investment/land salesfor multi-family, hospitality and retail have virtually stoppedfrom late 2008 with the notable exception of a $38 millionHilton hotel/retail development in the CBD across from thenew BOK Arena.Given Tulsa’s energy dependence, the stabilization of oil andgas prices along with a dose of consumer confidence willensure that Tulsa can successfully navigate its mild storm.Contact<strong>NAI</strong> Norris, Beggs& Simpson+1 503 223 7181Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold Income2,248,5542,428,9481,093,050$72,032$59,248Portland was named the #1 “Greenest City in America” byPopular Science last year, and sustainable industries likesolar and wind power and green buildings are a significantand growing presence in the area’s economy. Software andactivewear companies (Columbia Sportswear and Nikeare headquartered in Portland) are also important sectors.Portland’s employment climate was challenging in 2009,but the city’s green reputation, cultural offerings and outdoorofferings continue to attract new businesses and residents.Office vacancy increased considerably during 2009, butClass A space in the CBD remained tight, around 6%. Nonew CBD projects will deliver until summer <strong>2010</strong>. Shorenstein’sFirst & Main and Park Avenue West were put on holddue to a lack of financing. Vacancy in the suburban marketsrose to around 20%, as Kruse Way and other submarketswhere many financial firms were located suffered highervacancy rates.The industrial market softened, with vacancy rising to 15%.Though construction was down, work continued on FedExGround’s facility in Tigard, which should deliver in summer<strong>2010</strong> and employ about 650. One ofthe largest transactionsof the year was SEH America’s $55 million purchase ofHewlett-Packard’s Vancouver, Washington, campus.Retail vacancy rose to around 8%, and the Portland marketsaw some big-box spaces coming back on the market. Thebankruptcy/liquidation of Joe’s Sports, which had 14 Oregonstores, left considerable vacant space, but Dick’s SportingGoods leased six metro locations of around 50,000 SF each.Multifamily vacancy hovered around 5%; fewer tenants wereactive, as some doubled up or moved in with family to savemoney. Others took advantage of the $8,000 first-time homebuyer tax credit. Nearly 1,000 high-end units delivered inthe downtown area in the first half of the year, and it willtake time for those units to be absorbed.Though 2009 was a challenging year, Portland has solidcommercial property fundamentals, and the metro area iswell-positioned for economic recovery in <strong>2010</strong>. The Portlandmetro area is expected to add more than 76,000 jobs inthe next four years, and environmental services and the hightechindustry should continue to be key areas of job growth.Total PopulationMedian Age37Total PopulationMedian Age37Tulsa At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$$$$$$$$NA14.0011.0019.0013.5011.003.252.503.75N/A6.0010.0018.00$$$$$$$$NA19.0015.0021.0021.1416.00$4.75$4.00$6.00N/A13.0018.0026.00$$$$$$$$$$$NA6.8913.8419.5016.0013.504.073.005.25N/A10.5014.2722.00NA9.1%17.4%N/A14.5%18.0%29.3%7.0%4.6%N/A15.1%14.4%3.5%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-park$$$N/A260,000.0033,000.0030,000.00$$$N/A785,000.00217,800.00239,580.00Retail/<strong>Commercial</strong> Land$ 237,400.00 $ 1,220,000.00Residential$ 15,000.00 $ 52,000.00Portland At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$$$$$$$$$$29.0023.0015.5025.0012.0011.004.975.145.8412.006.0013.6414.26$$$$$$$$$$$$$39.0035.0030.0032.0033.5037.4016.0416.1317.2995.0035.0030.9534.00$$$$$$$$$1$$$$132.7529.0022.7528.7529.2515.856.116.690.4928.5020.0017.879.25N/A6.7%17.8%N/A22.6%18.9%14.3%18.9%15.7%9.8%9.3%9.2%3.3%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-park$$$150.00385,000.00N/A200,000.00$$$355.00975,000.00N/A450,000.00Retail/<strong>Commercial</strong> LandResidential$ 310,000.00N/A$ 1,050,000.00N/A<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 117

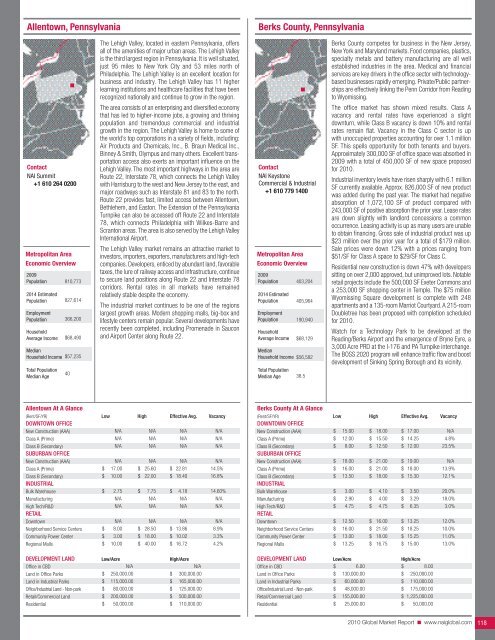

Allentown, PennsylvaniaBerks County, PennsylvaniaContact<strong>NAI</strong> Summit+1 610 264 0200Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold IncomeTotal PopulationMedian Age810,773827,614366,200$68,490$57,23540The Lehigh Valley, located in eastern Pennsylvania, offersall of the amenities of major urban areas. The Lehigh Valleyis the third largest region in Pennsylvania. It is well situated,just 95 miles to New York City and 53 miles north ofPhiladelphia. The Lehigh Valley is an excellent location forbusiness and industry. The Lehigh Valley has 11 higherlearning institutions and healthcare facilities that have beenrecognized nationally and continue to grow in the region.The area consists of an enterprising and diversified economythat has led to higher-income jobs, a growing and thrivingpopulation and tremendous commercial and industrialgrowth in the region. The Lehigh Valley is home to some ofthe world’s top corporations in a variety of fields, including:Air Products and Chemicals, Inc., B. Braun Medical Inc.,Binney & Smith, Olympus and many others. Excellent transportationaccess also exerts an important influence on theLehigh Valley. The most important highways in the area areRoute 22, Interstate 78, which connects the Lehigh Valleywith Harrisburg to the west and New Jersey to the east, andmajor roadways such as Interstate 81 and 83 to the north.Route 22 provides fast, limited access between Allentown,Bethlehem, and Easton. The Extension of the PennsylvaniaTurnpike can also be accessed off Route 22 and Interstate78, which connects Philadelphia with Wilkes-Barre andScranton areas. The area is also served by the Lehigh ValleyInternational Airport.The Lehigh Valley market remains an attractive market toinvestors, importers, exporters, manufacturers and high-techcompanies. Developers, enticed by abundant land, favorabletaxes, the lure of railway access and infrastructure, continueto secure land positions along Route 22 and Interstate 78corridors. Rental rates in all markets have remainedrelatively stable despite the economy.The industrial market continues to be one of the regionslargest growth areas. Modern shopping malls, big-box andlifestyle centers remain popular. Several developments haverecently been completed, including Promenade in Sauconand Airport Center along Route 22.Contact<strong>NAI</strong> Keystone<strong>Commercial</strong> & Industrial+1 610 779 1400Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold IncomeTotal PopulationMedian Age403,204405,964190,940$68,129$56,58238.5Berks County competes for business in the New Jersey,New York and Maryland markets. Food companies, plastics,specialty metals and battery manufacturing are all wellestablished industries in the area. Medical and financialservices are key drivers in the office sector with technologybasedbusinesses rapidly emerging. Private/Public partnershipsare effectively linking the Penn Corridor from Readingto Wyomissing.The office market has shown mixed results. Class Avacancy and rental rates have experienced a slightdownturn, while Class B vacancy is down 10% and rentalrates remain flat. Vacancy in the Class C sector is upwith unoccupied properties accounting for over 1.1 millionSF. This spells opportunity for both tenants and buyers.Approximately 300,000 SF of office space was absorbed in2009 with a total of 450,000 SF of new space proposedfor <strong>2010</strong>.Industrial inventory levels have risen sharply with 6.1 millionSF currently available. Approx. 826,000 SF of new productwas added during the past year. The market had negativeabsorption of 1,072,100 SF of product compared with243,000 SF of positive absorption the prior year. Lease ratesare down slightly with landlord concessions a commonoccurrence. Leasing activity is up as many users are unableto obtain financing. Gross sale of industrial product was up$23 million over the prior year for a total of $179 million.Sale prices were down 12% with a prices ranging from$51/SF for Class A space to $29/SF for Class C.Residential new construction is down 47% with developerssitting on over 2,000 approved, but unimproved lots. Notableretail projects include the 500,000 SF Exeter Commons anda 253,000 SF shopping center in Temple. The $75 millionWyomissing Square development is complete with 248apartments and a 135-room Marriot Courtyard. A 215-roomDoubletree has been proposed with completion scheduledfor <strong>2010</strong>.Watch for a Technology Park to be developed at theReading/Berks Airport and the emergence of Bryne Eyre, a3,000 Acre PRD at the I-176 and PA Turnpike interchange.The BOSS 2020 program will enhance traffic flow and boostdevelopment of Sinking Spring Borough and its vicinity.Allentown At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIAL$$N/AN/AN/AN/A17.0010.00$$N/AN/AN/AN/A25.6022.00N/AN/AN/AN/A$ 22.81$ 18.40N/AN/AN/AN/A14.5%16.8%Bulk WarehouseManufacturingHigh Tech/R&DRETAILDowntown$ 2.75N/AN/AN/A$ 7.75N/AN/AN/A$ 4.18N/AN/AN/A14.60%N/AN/AN/ANeighborhood Service CentersCommunity Power CenterRegional Malls$$$8.003.0010.00$$$28.5018.0040.00$ 13.86$ 10.02$ 16.728.9%3.3%4.2%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$$$$$N/A250,000.00115,000.0080,000.00200,000.0050,000.00$$$$$N/A300,000.00165,000.00125,000.00500,000.00110,000.00Berks County At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIAL$$$$$$15.0012.008.0018.0016.0013.50$$$$$$18.0015.5012.5021.0021.0018.00$ 17.00$ 14.25$ 12.00$ 19.00$ 18.00$ 15.30N/A4.8%23.5%N/A13.9%12.1%Bulk WarehouseManufacturingHigh Tech/R&DRETAIL$$$3.002.904.75$$$4.104.004.75$$$3.503.296.3520.0%18.0%3.0%DowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$12.5016.0013.0013.25$$$$16.0021.5018.0016.75$ 13.25$ 18.25$ 15.25$ 15.0012.0%10.0%11.0%13.0%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBD$ 6.00 $ 8.00Land in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-park$$$130,000.0060,000.0048,000.00$$$250,000.00110,000.00175,000.00Retail/<strong>Commercial</strong> Land$ 155,000.00 $ 1,225,000.00Residential$ 25,000.00 $ 50,000.00<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 118

- Page 1 and 2:

CommercialCommercial Real Estate Se

- Page 3 and 4:

■ ■ ■ Table of ContentsGENERA

- Page 5 and 6:

Global OutlookCommercial real estat

- Page 7 and 8:

38.3% in November 2009. At the same

- Page 9 and 10:

quality than the Census properties.

- Page 11 and 12:

SaskatchewanSaskatchewan is a small

- Page 13 and 14:

As 2009 draws to a close, there is

- Page 15 and 16:

Global investment interest largely

- Page 18 and 19:

ChinaChina continued to post large

- Page 20 and 21:

MalaysiaWith Malaysia’s dependenc

- Page 22 and 23:

■ US Highlights - Northeast Regio

- Page 24 and 25:

■ US Highlights - Midwest Region

- Page 26 and 27:

■ US Highlights - West Region■

- Page 28 and 29:

Melbourne, AustraliaBeijing, ChinaC

- Page 30 and 31:

Shanghai, ChinaXiamen, ChinaContact

- Page 32 and 33:

Delhi, Gurgaon, IndiaHyderabad, Pra

- Page 34 and 35:

Punjab, IndiaTokyo, JapanContactNAI

- Page 36 and 37:

Seoul, South KoreaTaipei, TaiwanCon

- Page 38 and 39:

Calgary, Alberta, CanadaEdmonton, A

- Page 40 and 41:

Halifax, Nova Scotia, CanadaOttawa,

- Page 42 and 43:

Regina, Saskatchewan, CanadaContact

- Page 44 and 45:

Vienna, AustriaThe Baltics (Latvia/

- Page 46 and 47:

Copenhagen, DenmarkFinlandContactNA

- Page 48 and 49:

Athens, GreeceReykjavik IcelandCont

- Page 50 and 51:

KuwaitOslo, NorwayContactNAI Kuwait

- Page 52 and 53:

Moscow, Russian FederationSt. Peter

- Page 54 and 55:

Madrid, SpainStockholm, SwedenConta

- Page 56 and 57:

Istanbul, TurkeyKiev, UkraineContac

- Page 58 and 59:

Latin AmericaSECTION CONTENTSBuenos

- Page 60 and 61:

Campinas, BrazilCuritiba, BrazilCon

- Page 62 and 63:

Sao Paulo, BrazilSantiago, ChileCon

- Page 64 and 65:

Ciudad Juarez, Chihuahua, MexicoGua

- Page 66 and 67:

Matamoros, Tamaulipas, MexicoMexica

- Page 68 and 69: Reynosa, MexicoSaltillo, Coahuila,

- Page 70 and 71: Torreon, Coahulia, MexicoCaracas, V

- Page 72 and 73: Birmingham, AlabamaHuntsville, Deca

- Page 74 and 75: Jonesboro, ArkansasLittle Rock, Ark

- Page 76 and 77: Marin County, CaliforniaMonterey, C

- Page 78 and 79: Sacramento, CaliforniaSan Diego, Ca

- Page 80 and 81: Santa Clara County (Silicon Valley)

- Page 82 and 83: Colorado Springs, ColoradoDenver, C

- Page 84 and 85: Fort Lauderdale, FloridaFt. Myers/N

- Page 86 and 87: Miami, FloridaOrlando, FloridaConta

- Page 88 and 89: Atlanta, GeorgiaHonolulu, HawaiiCon

- Page 90 and 91: Chicago, IllinoisSpringfield, Illin

- Page 92 and 93: Cedar Rapids, Iowa City, IowaDavenp

- Page 94 and 95: Wichita, KansasLexington, KentuckyC

- Page 96 and 97: Monroe, LouisianaNew Orleans, Louis

- Page 98 and 99: Suburban MarylandBoston, Massachuse

- Page 100 and 101: Grand Rapids, MichiganLansing, Mich

- Page 102 and 103: St. Louis, MissouriBozeman, Montana

- Page 104 and 105: Omaha, NebraskaLas Vegas, NevadaCon

- Page 106 and 107: Portsmouth, New HampshireAtlantic C

- Page 108 and 109: Ocean/Monmouth Counties (“Shore M

- Page 110 and 111: Las Cruces, New MexicoAlbany, New Y

- Page 112 and 113: Asheville, North CarolinaCharlotte,

- Page 114 and 115: Fargo, North DakotaAkron, OhioConta

- Page 116 and 117: Cleveland, OhioColumbus, OhioContac

- Page 120 and 121: Bucks County, PennsylvaniaHarrisbur

- Page 122 and 123: Pittsburgh, PennsylvaniaSchuylkill

- Page 124 and 125: Greenville/Spartanburg/Anderson Cou

- Page 126 and 127: Knoxville, TennesseeMemphis, Tennes

- Page 128 and 129: Beaumont, TexasCorpus Christi, Texa

- Page 130 and 131: Fort Worth, TexasHouston, TexasCont

- Page 132 and 133: Texarkana (Bowie County, Texas/Mill

- Page 134 and 135: Northern VirginiaSeattle/Puget Soun

- Page 136 and 137: Madison, WisconsinMilwaukee, Wiscon

- Page 138 and 139: Jackson Hole, WyomingContactNAI Jac

- Page 140: Build on the power of our network.N