2010 Global Market Report - NAI Commercial Real Estate

2010 Global Market Report - NAI Commercial Real Estate

2010 Global Market Report - NAI Commercial Real Estate

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

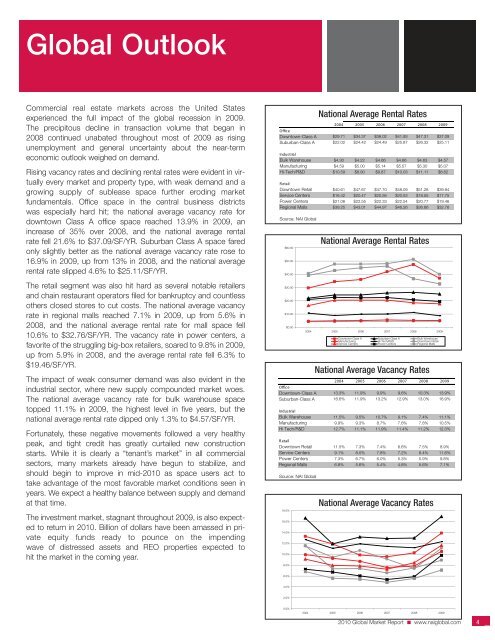

<strong>Global</strong> Outlook<strong>Commercial</strong> real estate markets across the United Statesexperienced the full impact of the global recession in 2009.The precipitous decline in transaction volume that began in2008 continued unabated throughout most of 2009 as risingunemployment and general uncertainty about the near-termeconomic outlook weighed on demand.Rising vacancy rates and declining rental rates were evident in virtuallyevery market and property type, with weak demand and agrowing supply of sublease space further eroding marketfundamentals. Office space in the central business districtswas especially hard hit; the national average vacancy rate fordowntown Class A office space reached 13.9% in 2009, anincrease of 35% over 2008, and the national average rentalrate fell 21.6% to $37.09/SF/YR. Suburban Class A space faredonly slightly better as the national average vacancy rate rose to16.9% in 2009, up from 13% in 2008, and the national averagerental rate slipped 4.6% to $25.11/SF/YR.The retail segment was also hit hard as several notable retailersand chain restaurant operators filed for bankruptcy and countlessothers closed stores to cut costs. The national average vacancyrate in regional malls reached 7.1% in 2009, up from 5.6% in2008, and the national average rental rate for mall space fell10.6% to $32.76/SF/YR. The vacancy rate in power centers, afavorite of the struggling big-box retailers, soared to 9.8% in 2009,up from 5.9% in 2008, and the average rental rate fell 6.3% to$19.46/SF/YR.The impact of weak consumer demand was also evident in theindustrial sector, where new supply compounded market woes.The national average vacancy rate for bulk warehouse spacetopped 11.1% in 2009, the highest level in five years, but thenational average rental rate dipped only 1.3% to $4.57/SF/YR.Fortunately, these negative movements followed a very healthypeak, and tight credit has greatly curtailed new constructionstarts. While it is clearly a “tenant’s market” in all commercialsectors, many markets already have begun to stabilize, andshould begin to improve in mid-<strong>2010</strong> as space users act totake advantage of the most favorable market conditions seen inyears. We expect a healthy balance between supply and demandat that time.The investment market, stagnant throughout 2009, is also expectedto return in <strong>2010</strong>. Billion of dollars have been amassed in privateequity funds ready to pounce on the impendingwave of distressed assets and REO properties expected tohit the market in the coming year.National Average Rental RatesNational Average Rental RatesNational Average Vacancy RatesNational Average Vacancy Rates<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com4