Suburban MarylandBoston, MassachusettsContact<strong>NAI</strong> Michael+1 301 459 4400Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold Income5,331,7755,398,3122,934,389$109,029$81,001Suburban Maryland includes two primary counties and threesecondary counties. Both Prince George’s and Montgomerycounties border Washington, DC, and have the largestpopulations. Calvert, Charles and Frederick Counties furtheroutside of Washington, DC, and have smaller populations;however, these areas are continuing to grow due to jobsmarkets in both Washington, DC, and Baltimore, Maryland.In southwestern Prince George’s County, the name ofAndrews Air Force Base has been changed to Joint BaseAndrews–Naval Air Facility Washington. This change comesas currently the base is having over $1 billion in renovationsand construction, and is expected to grow even more in thenear future. Andrews is still the second largest employer inthe State of Maryland, next to the University System, whichhas recently opened its UMUC Campus in Largo. In northernPrince George’s, a limited industrial land supply is expectedto remain robust and keep this market strong.The office sector is expected to grow in the near future asthe Federal Government takes aim at the county’s undevelopedland, which is unmatched in the Washington, DC,metropolitan area for built-to-suit projects. MontgomeryCounty has extensive infrastructure in place due to the largeamount of science and technology firms located in the areaalong the I-270 corridor. This area hosts over 200 biotechcompanies, employs over 100,000 advanced technologyworkers and has attracted the highest concentration of PhDsin the nation. The new Inter County Connector (ICC) willconnect I-270 with I-95, allowing a 12-minute travel timebetween these two counties, thereby alleviating traffic onI-495 the Capital Beltway and allowing the growth of boththe Industrial and Office markets.This market has several moving parts. It hosts an areadeveloped and steadily thriving in Montgomery, an up-andcomingarea with major developments in Prince George’s,as well as areas unaffected now but poised for future developmentin Charles, Calvert and Frederick.Contact<strong>NAI</strong> Hunneman+1 617 457 3400Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold Income4,536,2614,669,9752,741,072$91,065$68,969While the Massachusetts economy is still in a downturn, therate of deterioration has slowed considerably. According toMassBenchmarks, economic activity in Massachusettsdeclined at a 1.1% annualized rate in Q3 2009, comparedto 4.2% in February 2009. The state’s education, healthservices, professional services and information sectors haveremained relatively stable despite strong recessionarypressures from the financial services sector.Asking rates for office space continued to fall in 2009, but areleveling off. With vacancy rates climbing to 9.5% in the CBDand 16.5% in the suburbs, there is no shortage of supply,allowing tenants with solid financials to take advantage oftenant-favorable conditions. Significant transactions includeVerizon’s 200,000 SF lease at 185 Franklin Street in DowntownBoston and 3Com Corporation’s 130,000 SF lease at350 Campus Drive in Marlborough.The industrial market continues to trudge along as askingrates have dropped to an average of $6/SF NNN. Vacancyrates have hit their highest level since Q1 2005. Onesignificant transaction is Best Buy’s build-to-suit lease of anew distribution facility at 140 Depot Street in Bellingham,totaling 238,370 SF.Lack of liquidity continued to plague the investment marketin 2009. A majority of investment sales have been limitedto smaller deals that can be locally funded. Themultifamily market remains relatively active; one of thelargest deals in 2009 was the sale of a 90 unit multifamilyportfolio in Arlington for $12 million. Capitalization rateshave increased to 7.5% for multifamily sales, 9% for officeproperty sales and 9.5% for retail property sales.The retail market has also felt the impact of the economicturmoil with lower rental rates and significantly highervacancy in the downtown. Super H-Mart’s 51,000 SF leaseat 3 Old Concord Road in Burlington is one of the few dealsthat was completed in 2009.Although the Boston market continues to slide, the rate ofdecline is showing significant signs of deceleration. If thistrend of decelerating decline continues, we can anticipatethe beginnings of a stabilizing market in <strong>2010</strong>, with moresustainable growth trends returning in 2011.Total PopulationMedian Age37Total PopulationMedian Age39Suburban Maryland At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIAL$$$N/AN/AN/A25.5017.0011.00$$$N/AN/AN/A49.0045.7539.00N/AN/AN/A$ 40.36$ 28.45$ 24.20N/AN/AN/A73.0%15.0%12.0%Bulk WarehouseManufacturing$$4.955.00$$14.0011.25$$5.956.4212.5%8.7%High Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$6.95N/A12.0013.0022.10$$$$16.00N/A55.0044.0040.00$ 11.42N/A$ 25.22$ 24.12$ 23.127.8%N/A7.9%2.4%3.4%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$$$$$N/A118,000.00140,000.0040,000.00160,000.0025,000.00$$$$$N/A550,000.00625,000.00240,000.00700,000.0050,000.00Boston At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICEPremium (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAIL$$$$$$$$$45.0035.0025.0032.0025.0016.004.504.757.00$$$$$$$$$55.0052.0035.0042.0035.0025.007.008.0018.00$$$$$$$$$50.0042.5030.0037.0030.0022.505.756.0010.0017.0%9.5%11.3%40.0%16.5%15.0%11.0%13.5%15.0%Downtown$ 20.00 $ 120.00 $ 70.00 15.0%Neighborhood Service CentersCommunity Power CenterRegional Malls$$$10.0010.0015.00$$$17.5017.5080.00$$$13.2513.2547.007.5%7.5%7.5%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-park$$$$100.00225,000.0080,000.0075,000.00$$$$150.00750,000.00225,000.00150,000.00Retail/<strong>Commercial</strong> Land$ 280,000.00 $ 1,400,000.00Residential$ 100,000.00 $ 500,000.00<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 97

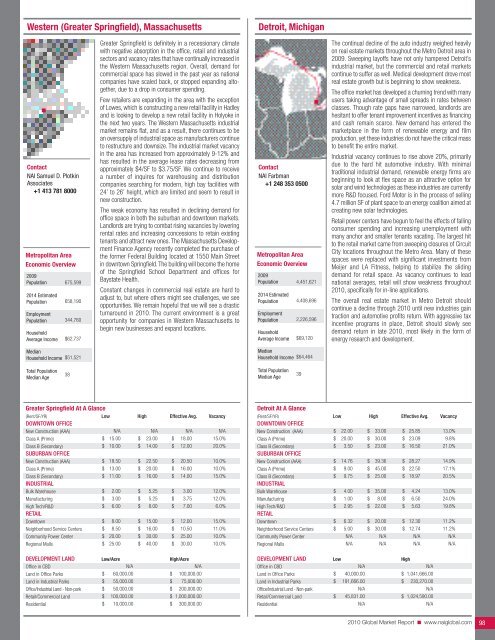

Western (Greater Springfield), MassachusettsDetroit, MichiganContact<strong>NAI</strong> Samuel D. PlotkinAssociates+1 413 781 8000Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage Income675,599658,190344,760$62,737Greater Springfield is definitely in a recessionary climatewith negative absorption in the office, retail and industrialsectors and vacancy rates that have continually increased inthe Western Massachusetts region. Overall, demand forcommercial space has slowed in the past year as nationalcompanies have scaled back, or stopped expanding altogether,due to a drop in consumer spending.Few retailers are expanding in the area with the exceptionof Lowes, which is constructing a new retail facility in Hadleyand is looking to develop a new retail facility in Holyoke inthe next two years. The Western Massachusetts industrialmarket remains flat, and as a result, there continues to bean oversupply of industrial space as manufacturers continueto restructure and downsize. The industrial market vacancyin the area has increased from approximately 9-12% andhas resulted in the average lease rates decreasing fromapproximately $4/SF to $3.75/SF. We continue to receivea number of inquires for warehousing and distributioncompanies searching for modern, high bay facilities with24’ to 26’ height, which are limited and seem to result innew construction.The weak economy has resulted in declining demand foroffice space in both the suburban and downtown markets.Landlords are trying to combat rising vacancies by loweringrental rates and increasing concessions to retain existingtenants and attract new ones. The Massachusetts DevelopmentFinance Agency recently completed the purchase ofthe former Federal Building located at 1550 Main Streetin downtown Springfield. The building will become the homeof the Springfield School Department and offices forBaystate Health.Constant changes in commercial real estate are hard toadjust to, but where others might see challenges, we seeopportunities. We remain hopeful that we will see a drasticturnaround in <strong>2010</strong>. The current environment is a greatopportunity for companies in Western Massachusetts tobegin new businesses and expand locations.Contact<strong>NAI</strong> Farbman+1 248 353 0500Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage Income4,451,6214,408,6962,226,596$69,120The continual decline of the auto industry weighed heavilyon real estate markets throughout the Metro Detroit area in2009. Sweeping layoffs have not only hampered Detroit’sindustrial market, but the commercial and retail marketscontinue to suffer as well. Medical development drove mostreal estate growth but is beginning to show weakness.The office market has developed a churning trend with manyusers taking advantage of small spreads in rates betweenclasses. Though rate gaps have narrowed, landlords arehesitant to offer tenant improvement incentives as financingand cash remain scarce. New demand has entered themarketplace in the form of renewable energy and filmproduction, yet these industries do not have the critical massto benefit the entire market.Industrial vacancy continues to rise above 20%, primarilydue to the hard hit automotive industry. With minimaltraditional industrial demand, renewable energy firms arebeginning to look at flex space as an attractive option forsolar and wind technologies as these industries are currentlymore R&D focused. Ford Motor is in the process of selling4.7 million SF of plant space to an energy coalition aimed atcreating new solar technologies.Retail power centers have begun to feel the effects of fallingconsumer spending and increasing unemployment withmany anchor and smaller tenants vacating. The largest hitto the retail market came from sweeping closures of CircuitCity locations throughout the Metro Area. Many of thesespaces were replaced with significant investments fromMeijer and LA Fitness, helping to stabilize the slidingdemand for retail space. As vacancy continues to leadnational averages, retail will show weakness throughout<strong>2010</strong>, specifically for in-line applications.The overall real estate market in Metro Detroit shouldcontinue a decline through <strong>2010</strong> until new industries gaintraction and automotive profits return. With aggressive taxincentive programs in place, Detroit should slowly seedemand return in late <strong>2010</strong>, most likely in the form ofenergy research and development.MedianHousehold Income$51,521MedianHousehold Income$64,464Total PopulationMedian Age38Total PopulationMedian Age39Greater Springfield At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$$$$$$$$$N/A15.0010.0018.5013.0011.002.003.006.008.008.5020.0025.00$$$$$$$$$$$$N/A23.0014.0022.5020.0016.005.255.258.0015.0016.0030.0040.00$$$$$$$$$$$$N/A18.0012.0020.5016.0014.003.003.757.0012.0010.5025.0030.00N/A15.0%20.0%10.0%10.0%15.0%12.0%12.0%6.0%15.0%11.0%10.0%10.0%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-park$$$N/A60,000.0055,000.0050,000.00$$$N/A100,000.0075,000.00200,000.00Retail/<strong>Commercial</strong> Land$ 100,000.00 $ 1,000,000.00Residential$ 10,000.00 $ 300,000.00Detroit At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$$$$$$$$22.0020.003.5014.769.009.754.001.002.956.325.00N/AN/A$$$$$$$$$$$33.0030.0023.0039.3645.0025.0035.008.0022.0020.0030.00N/AN/A$$$$$$$$$$$25.8523.0916.5028.2722.5018.974.246.505.6312.3012.74N/AN/A13.0%9.8%21.0%14.9%17.1%20.5%13.0%24.0%19.8%11.2%11.2%N/AN/ADEVELOPMENT LAND Low HighOffice in CBDLand in Office Parks$N/A40,000.00N/A$ 1,041,666.00Land in Industrial ParksOffice/Industrial Land - Non-park$ 191,666.00N/A$ 230,270.00N/ARetail/<strong>Commercial</strong> LandResidential$ 45,831.00N/A$ 1,024,590.00N/A<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 98

- Page 1 and 2:

CommercialCommercial Real Estate Se

- Page 3 and 4:

■ ■ ■ Table of ContentsGENERA

- Page 5 and 6:

Global OutlookCommercial real estat

- Page 7 and 8:

38.3% in November 2009. At the same

- Page 9 and 10:

quality than the Census properties.

- Page 11 and 12:

SaskatchewanSaskatchewan is a small

- Page 13 and 14:

As 2009 draws to a close, there is

- Page 15 and 16:

Global investment interest largely

- Page 18 and 19:

ChinaChina continued to post large

- Page 20 and 21:

MalaysiaWith Malaysia’s dependenc

- Page 22 and 23:

■ US Highlights - Northeast Regio

- Page 24 and 25:

■ US Highlights - Midwest Region

- Page 26 and 27:

■ US Highlights - West Region■

- Page 28 and 29:

Melbourne, AustraliaBeijing, ChinaC

- Page 30 and 31:

Shanghai, ChinaXiamen, ChinaContact

- Page 32 and 33:

Delhi, Gurgaon, IndiaHyderabad, Pra

- Page 34 and 35:

Punjab, IndiaTokyo, JapanContactNAI

- Page 36 and 37:

Seoul, South KoreaTaipei, TaiwanCon

- Page 38 and 39:

Calgary, Alberta, CanadaEdmonton, A

- Page 40 and 41:

Halifax, Nova Scotia, CanadaOttawa,

- Page 42 and 43:

Regina, Saskatchewan, CanadaContact

- Page 44 and 45:

Vienna, AustriaThe Baltics (Latvia/

- Page 46 and 47:

Copenhagen, DenmarkFinlandContactNA

- Page 48 and 49: Athens, GreeceReykjavik IcelandCont

- Page 50 and 51: KuwaitOslo, NorwayContactNAI Kuwait

- Page 52 and 53: Moscow, Russian FederationSt. Peter

- Page 54 and 55: Madrid, SpainStockholm, SwedenConta

- Page 56 and 57: Istanbul, TurkeyKiev, UkraineContac

- Page 58 and 59: Latin AmericaSECTION CONTENTSBuenos

- Page 60 and 61: Campinas, BrazilCuritiba, BrazilCon

- Page 62 and 63: Sao Paulo, BrazilSantiago, ChileCon

- Page 64 and 65: Ciudad Juarez, Chihuahua, MexicoGua

- Page 66 and 67: Matamoros, Tamaulipas, MexicoMexica

- Page 68 and 69: Reynosa, MexicoSaltillo, Coahuila,

- Page 70 and 71: Torreon, Coahulia, MexicoCaracas, V

- Page 72 and 73: Birmingham, AlabamaHuntsville, Deca

- Page 74 and 75: Jonesboro, ArkansasLittle Rock, Ark

- Page 76 and 77: Marin County, CaliforniaMonterey, C

- Page 78 and 79: Sacramento, CaliforniaSan Diego, Ca

- Page 80 and 81: Santa Clara County (Silicon Valley)

- Page 82 and 83: Colorado Springs, ColoradoDenver, C

- Page 84 and 85: Fort Lauderdale, FloridaFt. Myers/N

- Page 86 and 87: Miami, FloridaOrlando, FloridaConta

- Page 88 and 89: Atlanta, GeorgiaHonolulu, HawaiiCon

- Page 90 and 91: Chicago, IllinoisSpringfield, Illin

- Page 92 and 93: Cedar Rapids, Iowa City, IowaDavenp

- Page 94 and 95: Wichita, KansasLexington, KentuckyC

- Page 96 and 97: Monroe, LouisianaNew Orleans, Louis

- Page 100 and 101: Grand Rapids, MichiganLansing, Mich

- Page 102 and 103: St. Louis, MissouriBozeman, Montana

- Page 104 and 105: Omaha, NebraskaLas Vegas, NevadaCon

- Page 106 and 107: Portsmouth, New HampshireAtlantic C

- Page 108 and 109: Ocean/Monmouth Counties (“Shore M

- Page 110 and 111: Las Cruces, New MexicoAlbany, New Y

- Page 112 and 113: Asheville, North CarolinaCharlotte,

- Page 114 and 115: Fargo, North DakotaAkron, OhioConta

- Page 116 and 117: Cleveland, OhioColumbus, OhioContac

- Page 118 and 119: Tulsa, OklahomaPortland, OregonCont

- Page 120 and 121: Bucks County, PennsylvaniaHarrisbur

- Page 122 and 123: Pittsburgh, PennsylvaniaSchuylkill

- Page 124 and 125: Greenville/Spartanburg/Anderson Cou

- Page 126 and 127: Knoxville, TennesseeMemphis, Tennes

- Page 128 and 129: Beaumont, TexasCorpus Christi, Texa

- Page 130 and 131: Fort Worth, TexasHouston, TexasCont

- Page 132 and 133: Texarkana (Bowie County, Texas/Mill

- Page 134 and 135: Northern VirginiaSeattle/Puget Soun

- Page 136 and 137: Madison, WisconsinMilwaukee, Wiscon

- Page 138 and 139: Jackson Hole, WyomingContactNAI Jac

- Page 140: Build on the power of our network.N