Miami, FloridaOrlando, FloridaContact<strong>NAI</strong> Miami+1 305 938 4000Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold IncomeTotal PopulationMedian Age5,305,1825,051,5132,792,167$71,345$51,04440Experts in the market report that events leading into 2009caused an unprecedented decline in all facets of commercialand residential real estate. Activity quickly skidded to a haltand stayed at a virtual standstill during the first half of 2009.Foreclosures, short sales and loan restructurings were mostcommon. Predictions are that a bottom in the market wasreached and growth will resume in <strong>2010</strong>, albeit at ananemic pace. It may be difficult to differentiate the growthfrom the stagnation.Investment activity is at a standstill due to a lack of financing,rising vacancy rates, lower rent rates and investorsdemanding increasing yields. Development activity is nonexistentas declining rents combine with rising vacancy andcapitalization rates to make development nonviable for up tothree years. Land prices are down by 50%.Office vacancy rates rose while rents dropped by more than10%. Certain submarkets, most notably the CBD & Brickell,are hardest hit as approximately 2 million SF are scheduledto be delivered in <strong>2010</strong> and 2011.Miami’s industrial sector suffered from the recession astransshipping slowed and smaller tenants failed. Vacanciesincreased weekly. Bankruptcies in the automotive andconstruction industries intensified problems. Rents andresale prices have dropped. Prospects for <strong>2010</strong> are grim asstagnation does not foster tenant growth.Retail demand has been hard hit. Consumer demand hasstopped, resetting to 2004 levels. Retailers are reevaluatingstore spacing and product offerings. Rents dropped andvacancies increased. Exceptions are local, well-capitalizedretailers. After waiting out the exuberance, they are selectivelyexpanding, negotiating favorable leases.Residential prices dropped 20-50% because of a lack ofend-user financing. Most multifamily projects are in a loanrestructuring, foreclosure, bankruptcy, short sale or someother workout. Some lenders sold their notes at a 50-80%discount. Others financed end-users, permitting lowerprices. It appears the bottom was reached in 2008; stayedflat in 2009 and will slowly increase in <strong>2010</strong>.<strong>2010</strong> will be a major transition year in most marketsegments as the final problems will be addressed and themarkets stabilize. If population and job growth resume, theMiami markets will accelerate at a pace faster than mostexperts predict.Contact<strong>NAI</strong> <strong>Real</strong>vest+1 407 875 9989Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold IncomeTotal PopulationMedian Age2,124,2702,354,3811,121,730$68,690$53,35737The overall Orlando office vacancy rate stands at 15.1%,up from 12.3% one year ago. Average lease rates are downby 3.3%. Net absorption has been negative in four of thelast five quarters. Vacancies are highest in Class A propertieswhere average rents have declined by 6% over the past year.Vacant sublease space has increased in all submarkets.Built-to-suit headquarters have dominated new officeconstruction.The overall Orlando industrial vacancy rate stands at 13.2%,up from 8.3% one year ago. Average industrial lease rateshave dropped by more than 10.5% over the past year inresponse to four consecutive quarters of negative absorption.Vacancy rates are highest for flex product at 17.6%. Tenantsin every industry that supports industrial real estate arereluctant to commit to new leases and take advantage ofaggressive concessions, resulting in stagnant deal volume.Construction of new industrial space has halted throughoutthe market.Increasing unemployment and a decline in tourism haveimpacted the retail sector over the past year. Asking andeffective rents have dropped, while concessions increasedto more than 10% of asking rents. The market-wide retailvacancy rate is 8.3%, up from 5.7% one year ago. Newdeliveries have been dominated by single-tenant supercenters. Investors are waiting on the sidelines for distressedopportunities, though few have surfaced.Orlando is one of only two communities worldwide where anew medical city is being developed. The cluster of life sciencecompanies emerging here include a new University ofCentral Florida College of Medicine, East Coast headquartersof Burnham Institute for Medical Research, Nemours Children’sHospital, University of Florida Research Center, M.D.Anderson Cancer Research Institute, and Orlando VA MedicalCenter.The $600 million VA facility, due to open in 2013, will bethe first VA hospital built in the United States since 1995.Within 10 years, the cluster is expected to create 30,000jobs and generate $7.6 billion in economic impact.Miami At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$$$$$$$$$43.0033.3126.5131.5926.9419.215.53N/A9.7425.8314.7513.0014.00$$$$$$$$$$$$49.5043.7331.5734.0938.0336.1210.83N/A19.3343.9245.1745.0053.72$$$$$$$$$$$$44.2738.2328.7332.2733.2527.227.41N/A13.1131.8624.4821.3731.1992.0%14.5%23.4%85.0%22.3%15.6%10.1%N/A9.3%4.7%7.0%6.8%2.3%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBD$ 3,250,000.00 $ 5,445,000.00Land in Office Parks$ 653,400.00 $ 1,089,000.00Land in Industrial Parks$ 348,480.00 $ 653,400.00Office/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$$$435,600.00653,400.0087,120.00$ 1,089,000.00$ 3,267,000.00$ 5,445,000.00Orlando At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$$$$$$$$$$24.0016.0015.0018.0011.0012.003.953.508.5018.0012.0018.0014.00$$$$$$$$$$$$$29.0032.0028.5040.0040.0028.007.008.0030.0035.0030.0030.0040.00$$$$$$$$$$$$$27.0024.5021.7024.0023.0021.005.654.7026.5028.0016.6015.7023.8036.0%20.0%17.0%49.0%17.3%14.6%12.3%12.5%6.2%10.4%11.6%10.6%4.6%DEVELOPMENT LAND Low/Acre $ 45.00 High/Acre $ 90.00Office in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$$$$$218,000.00130,000.0065,500.00218,000.0050,000.00$$$$$350,000.00260,000.00217,800.00653,000.00109,000.00<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 85

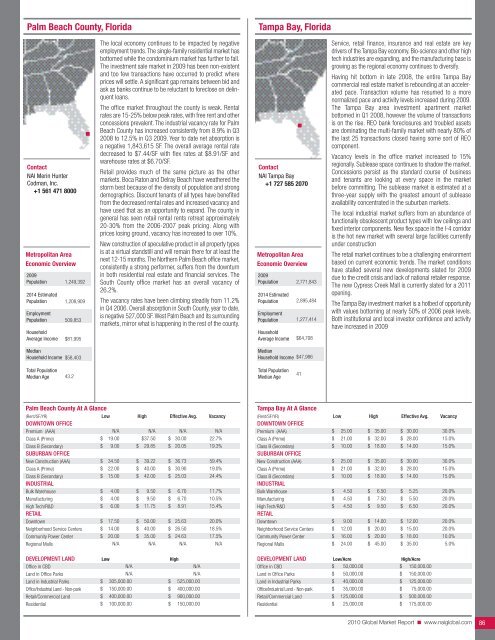

Palm Beach County, FloridaTampa Bay, FloridaContact<strong>NAI</strong> Merin HunterCodman, Inc.+1 561 471 8000Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage Income1,249,3921,208,909509,853$81,995The local economy continues to be impacted by negativeemployment trends. The single-family residential market hasbottomed while the condominium market has further to fall.The investment sale market in 2009 has been non-existentand too few transactions have occurred to predict whereprices will settle. A significant gap remains between bid andask as banks continue to be reluctant to foreclose on delinquentloans.The office market throughout the county is weak. Rentalrates are 15-25% below peak rates, with free rent and otherconcessions prevalent. The industrial vacancy rate for PalmBeach County has increased consistently from 8.9% in Q32008 to 12.5% in Q3 2009. Year to date net absorption isa negative 1,843,615 SF. The overall average rental ratedecreased to $7.44/SF with flex rates at $8.91/SF andwarehouse rates at $6.70/SF.Retail provides much of the same picture as the othermarkets. Boca Raton and Delray Beach have weathered thestorm best because of the density of population and strongdemographics. Discount tenants of all types have benefitedfrom the decreased rental rates and increased vacancy andhave used that as an opportunity to expand. The county ingeneral has seen retail rental rents retreat approximately20-30% from the 2006-2007 peak pricing. Along withprices losing ground, vacancy has increased to over 10%.New construction of speculative product in all property typesis at a virtual standstill and will remain there for at least thenext 12-15 months. The Northern Palm Beach office market,consistently a strong performer, suffers from the downturnin both residential real estate and financial services. TheSouth County office market has an overall vacancy of26.2%.The vacancy rates have been climbing steadily from 11.2%in Q4 2006. Overall absorption in South County, year to date,is negative 527,000 SF. West Palm Beach and its surroundingmarkets, mirror what is happening in the rest of the county.Contact<strong>NAI</strong> Tampa Bay+1 727 585 2070Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage Income2,771,8432,895,4841,277,414$64,708Service, retail finance, insurance and real estate are keydrivers of the Tampa Bay economy. Bio-science and other hightech industries are expanding, and the manufacturing base isgrowing as the regional economy continues to diversify.Having hit bottom in late 2008, the entire Tampa Baycommercial real estate market is rebounding at an acceleratedpace. Transaction volume has resumed to a morenormalized pace and activity levels increased during 2009.The Tampa Bay area investment apartment marketbottomed in Q1 2008, however the volume of transactionsis on the rise. REO bank foreclosures and troubled assetsare dominating the multi-family market with nearly 80% ofthe last 25 transactions closed having some sort of REOcomponent.Vacancy levels in the office market increased to 15%regionally. Sublease space continues to shadow the market.Concessions persist as the standard course of businessand tenants are looking at every space in the marketbefore committing. The sublease market is estimated at athree-year supply with the greatest amount of subleaseavailability concentrated in the suburban markets.The local industrial market suffers from an abundance offunctionally obsolescent product types with low ceilings andfixed interior components. New flex space in the I-4 corridoris the hot new market with several large facilities currentlyunder constructionThe retail market continues to be a challenging environmentbased on current economic trends. The market conditionshave stalled several new developments slated for 2009due to the credit crisis and lack of national retailer response.The new Cypress Creek Mall is currently slated for a 2011opening.The Tampa Bay investment market is a hotbed of opportunitywith values bottoming at nearly 50% of 2006 peak levels.Both institutional and local investor confidence and activityhave increased in 2009MedianHousehold Income$58,403MedianHousehold Income$47,986Total PopulationMedian Age43.2Total PopulationMedian Age41Palm Beach County At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICEPremium (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$$$$$$$$N/A19.009.0034.5022.0015.004.004.006.0017.5014.0020.00N/A$$$$$$$$$$N/A$37.5029.8539.2240.0042.009.509.5011.7550.0040.0035.00N/A$$$$$$$$$$$N/A30.0020.0536.7330.9025.036.706.708.9125.6326.5024.63N/AN/A22.7%19.3%59.4%19.0%24.4%11.7%10.5%15.4%20.0%18.5%17.5%N/ADEVELOPMENT LAND Low HighOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$$$$N/AN/A305,000.00150,000.00400,000.00100,000.00$$$$N/AN/A525,000.00400,000.00900,000.00150,000.00Tampa Bay At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICEPremium (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIAL$$$$$$25.0021.0010.0025.0021.0010.00$$$$$$35.0032.0018.0035.0032.0018.00$ 30.00$ 28.00$ 14.00$ 30.00$ 28.00$ 14.0030.0%15.0%15.0%30.0%15.0%15.0%Bulk WarehouseManufacturingHigh Tech/R&DRETAIL$$$4.504.504.50$$$6.507.509.50$$$5.255.506.5020.0%20.0%20.0%DowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$9.0012.0016.0024.00$$$$14.0020.0020.0045.00$ 12.00$ 15.00$ 18.00$ 35.0020.0%20.0%10.0%5.0%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$$$$$$50,000.0050,000.0040,000.0035,000.00125,000.0025,000.00$$$$$$150,000.00150,000.00125,000.0075,000.00500,000.00175,000.00<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 86

- Page 1 and 2:

CommercialCommercial Real Estate Se

- Page 3 and 4:

■ ■ ■ Table of ContentsGENERA

- Page 5 and 6:

Global OutlookCommercial real estat

- Page 7 and 8:

38.3% in November 2009. At the same

- Page 9 and 10:

quality than the Census properties.

- Page 11 and 12:

SaskatchewanSaskatchewan is a small

- Page 13 and 14:

As 2009 draws to a close, there is

- Page 15 and 16:

Global investment interest largely

- Page 18 and 19:

ChinaChina continued to post large

- Page 20 and 21:

MalaysiaWith Malaysia’s dependenc

- Page 22 and 23:

■ US Highlights - Northeast Regio

- Page 24 and 25:

■ US Highlights - Midwest Region

- Page 26 and 27:

■ US Highlights - West Region■

- Page 28 and 29:

Melbourne, AustraliaBeijing, ChinaC

- Page 30 and 31:

Shanghai, ChinaXiamen, ChinaContact

- Page 32 and 33:

Delhi, Gurgaon, IndiaHyderabad, Pra

- Page 34 and 35:

Punjab, IndiaTokyo, JapanContactNAI

- Page 36 and 37: Seoul, South KoreaTaipei, TaiwanCon

- Page 38 and 39: Calgary, Alberta, CanadaEdmonton, A

- Page 40 and 41: Halifax, Nova Scotia, CanadaOttawa,

- Page 42 and 43: Regina, Saskatchewan, CanadaContact

- Page 44 and 45: Vienna, AustriaThe Baltics (Latvia/

- Page 46 and 47: Copenhagen, DenmarkFinlandContactNA

- Page 48 and 49: Athens, GreeceReykjavik IcelandCont

- Page 50 and 51: KuwaitOslo, NorwayContactNAI Kuwait

- Page 52 and 53: Moscow, Russian FederationSt. Peter

- Page 54 and 55: Madrid, SpainStockholm, SwedenConta

- Page 56 and 57: Istanbul, TurkeyKiev, UkraineContac

- Page 58 and 59: Latin AmericaSECTION CONTENTSBuenos

- Page 60 and 61: Campinas, BrazilCuritiba, BrazilCon

- Page 62 and 63: Sao Paulo, BrazilSantiago, ChileCon

- Page 64 and 65: Ciudad Juarez, Chihuahua, MexicoGua

- Page 66 and 67: Matamoros, Tamaulipas, MexicoMexica

- Page 68 and 69: Reynosa, MexicoSaltillo, Coahuila,

- Page 70 and 71: Torreon, Coahulia, MexicoCaracas, V

- Page 72 and 73: Birmingham, AlabamaHuntsville, Deca

- Page 74 and 75: Jonesboro, ArkansasLittle Rock, Ark

- Page 76 and 77: Marin County, CaliforniaMonterey, C

- Page 78 and 79: Sacramento, CaliforniaSan Diego, Ca

- Page 80 and 81: Santa Clara County (Silicon Valley)

- Page 82 and 83: Colorado Springs, ColoradoDenver, C

- Page 84 and 85: Fort Lauderdale, FloridaFt. Myers/N

- Page 88 and 89: Atlanta, GeorgiaHonolulu, HawaiiCon

- Page 90 and 91: Chicago, IllinoisSpringfield, Illin

- Page 92 and 93: Cedar Rapids, Iowa City, IowaDavenp

- Page 94 and 95: Wichita, KansasLexington, KentuckyC

- Page 96 and 97: Monroe, LouisianaNew Orleans, Louis

- Page 98 and 99: Suburban MarylandBoston, Massachuse

- Page 100 and 101: Grand Rapids, MichiganLansing, Mich

- Page 102 and 103: St. Louis, MissouriBozeman, Montana

- Page 104 and 105: Omaha, NebraskaLas Vegas, NevadaCon

- Page 106 and 107: Portsmouth, New HampshireAtlantic C

- Page 108 and 109: Ocean/Monmouth Counties (“Shore M

- Page 110 and 111: Las Cruces, New MexicoAlbany, New Y

- Page 112 and 113: Asheville, North CarolinaCharlotte,

- Page 114 and 115: Fargo, North DakotaAkron, OhioConta

- Page 116 and 117: Cleveland, OhioColumbus, OhioContac

- Page 118 and 119: Tulsa, OklahomaPortland, OregonCont

- Page 120 and 121: Bucks County, PennsylvaniaHarrisbur

- Page 122 and 123: Pittsburgh, PennsylvaniaSchuylkill

- Page 124 and 125: Greenville/Spartanburg/Anderson Cou

- Page 126 and 127: Knoxville, TennesseeMemphis, Tennes

- Page 128 and 129: Beaumont, TexasCorpus Christi, Texa

- Page 130 and 131: Fort Worth, TexasHouston, TexasCont

- Page 132 and 133: Texarkana (Bowie County, Texas/Mill

- Page 134 and 135: Northern VirginiaSeattle/Puget Soun

- Page 136 and 137:

Madison, WisconsinMilwaukee, Wiscon

- Page 138 and 139:

Jackson Hole, WyomingContactNAI Jac

- Page 140:

Build on the power of our network.N