2010 Global Market Report - NAI Commercial Real Estate

2010 Global Market Report - NAI Commercial Real Estate

2010 Global Market Report - NAI Commercial Real Estate

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

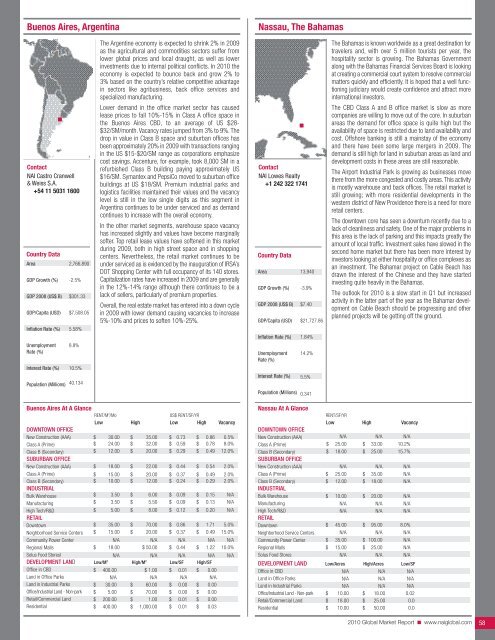

Buenos Aires, ArgentinaNassau, The BahamasContact<strong>NAI</strong> Castro Cranwell& Weiss S.A.+54 11 5031 1600Country DataAreaGDP Growth (%)GDP 2008 (US$ B)GDP/Capita (USD)Inflation Rate (%)UnemploymentRate (%)Interest Rate (%)2,766,890-2.5%$301.33$7,508.055.58%8.8%10.5%Population (Millions) 40.134The Argentine economy is expected to shrink 2% in 2009as the agricultural and commodities sectors suffer fromlower global prices and local draught, as well as lowerinvestments due to internal political conflicts. In <strong>2010</strong> theeconomy is expected to bounce back and grow 2% to3% based on the country’s relative competitive advantagein sectors like agribusiness, back office services andspecialized manufacturing.Lower demand in the office market sector has causedlease prices to fall 10%-15% in Class A office space inthe Buenos Aires CBD, to an average of US $28-$32/SM/month. Vacancy rates jumped from 3% to 9%. Thedrop in value in Class B space and suburban offices hasbeen approximately 20% in 2009 with transactions rangingin the US $15-$20/SM range as corporations emphasizecost savings. Accenture, for example, took 8,000 SM in arefurbished Class B building paying approximately US$16/SM. Symantex and PepsiCo moved to suburban officebuildings at US $18/SM. Premium industrial parks andlogistics facilities maintained their values and the vacancylevel is still in the low single digits as this segment inArgentina continues to be under serviced and as demandcontinues to increase with the overall economy.In the other market segments, warehouse space vacancyhas increased slightly and values have become marginallysofter. Top retail lease values have softened in this marketduring 2009, both in high street space and in shoppingcenters. Nevertheless, the retail market continues to beunder serviced as is evidenced by the inauguration of IRSA’sDOT Shopping Center with full occupancy of its 140 stores.Capitalization rates have increased in 2009 and are generallyin the 12%-14% range although there continues to be alack of sellers, particularly of premium properties.Overall, the real estate market has entered into a down cyclein 2009 with lower demand causing vacancies to increase5%-10% and prices to soften 10%-25%.Contact<strong>NAI</strong> Lowes <strong>Real</strong>ty+1 242 322 1741Country DataAreaGDP Growth (%)GDP 2008 (US$ B)GDP/Capita (USD)Inflation Rate (%)UnemploymentRate (%)Interest Rate (%)13,940-3.9%$7.40$21,727.861.84%14.2%5.5%Population (Millions) 0.341The Bahamas is known worldwide as a great destination fortravelers and, with over 5 million tourists per year, thehospitality sector is growing. The Bahamas Governmentalong with the Bahamas Financial Services Board is lookingat creating a commercial court system to resolve commercialmatters quickly and efficiently. It is hoped that a well functioningjudiciary would create confidence and attract moreinternational investors.The CBD Class A and B office market is slow as morecompanies are willing to move out of the core. In suburbanareas the demand for office space is quite high but theavailability of space is restricted due to land availability andcost. Offshore banking is still a mainstay of the economyand there have been some large mergers in 2009. Thedemand is still high for land in suburban areas as land anddevelopment costs in these areas are still reasonable.The Airport Industrial Park is growing as businesses movethere from the more congested and costly areas. This activityis mostly warehouse and back offices. The retail market isstill growing; with more residential developments in thewestern district of New Providence there is a need for moreretail centers.The downtown core has seen a downturn recently due to alack of cleanliness and safety. One of the major problems inthis area is the lack of parking and this impacts greatly theamount of local traffic. Investment sales have slowed in thesecond home market but there has been more interest byinvestors looking at either hospitality or office complexes asan investment. The Bahamar project on Cable Beach hasdrawn the interest of the Chinese and they have startedinvesting quite heavily in the Bahamas.The outlook for <strong>2010</strong> is a slow start in Q1 but increasedactivity in the latter part of the year as the Bahamar developmenton Cable Beach should be progressing and otherplanned projects will be getting off the ground.Buenos Aires At A GlanceRENT/M 2 /MoUS$ RENT/SF/YRLow High Low High VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional MallsSolus Food Storesl$$$$$$$$$$$$30.0024.0012.0018.0015.0010.003.503.505.0035.0015.00N/A18.00N/A$$$$$$$$$$$35.0032.0020.0022.0020.0012.006.005.508.0070.0020.00N/A$ 50.00N/A$$$$$$$$$$$$0.730.590.290.440.370.240.090.090.120.860.37N/A0.44N/A$$$$$$$$$$$$0.860.780.490.540.490.290.150.130.201.710.49N/A1.22N/A0.5%8.0%12.0%2.0%2.0%2.0%N/AN/AN/A5.0%15.0%N/A10.0%N/ADEVELOPMENT LAND Low/M 2 High/M 2 Low/SF High/SFOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$ 400.00 $ 1.00 $ 0.01 $ 0.00N/A N/A N/A N/A$ 30.00 $ 60.00 $ 0.00 $ 0.00$ 5.00 $ 70.00 $ 0.00 $ 0.00$ 200.00 $ 1.00 $ 0.01 $ 0.00$ 400.00 $ 1,000.00 $ 0.01 $ 0.03Nassau At A GlanceDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional MallsSolus Food StoresRENT/SF/YRLow High VacancyN/A N/A N/A$ 25.00 $ 33.00 10.2%$ 18.00 $ 25.00 15.7%N/A N/A N/A$ 25.00 $ 35.00 N/A$ 12.00 $ 18.00 N/A$ 10.00 $ 20.00 N/AN/A N/A N/AN/A N/A N/A$ 45.00 $ 95.00 8.0%N/A N/A N/A$ 35.00 $ 100.00 N/A$ 15.00 $ 25.00 N/AN/A N/A N/ADEVELOPMENT LAND Low/Acres High/Acres Low/SFOffice in CBDLand in Office ParksLand in Industrial ParksN/AN/AN/AN/AN/AN/AN/AN/AN/AOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$$$10.0018.0010.00$$$18.0025.0050.000.020.00.0<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 58