Athens, GreeceReykjavik IcelandContact<strong>NAI</strong> Ktimatiki+30 210 3628559Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)UnemploymentRate (%)Interest Rate(%)1334.3-0.75%$338.25$30,304.751.13%9.50%1.00%Population (Millions) 11.162Greece weathered the economic crisis fairly well despite a15.8% drop in building permits. The market is looking to thenew government for a way out from Ministry decisions concerningmatters of semi-sheltered spaces. Property taxationis another major issue for <strong>2010</strong>. The market awaiting governmentprovided incentives to boost construction throughcheaper loans, radical changes in urban planning laws andefforts towards tying up loose ends that deter foreign investorsfrom investing. Further, the market is eagerly awaitingresolution of major projects Votanikos, Galatsi andMesogeia malls.The office market in Athens is estimated at over 2 million SMwith the vast majority being under 500 SM floor plates. RecentClass A buildings tend to be from 800 SM to 1,000SM. Older buildings have limited or no parking. Current existinginventory is estimated between 50,000 SM to 75,000SM with less than 25,000 SM under construction. Vacancyrates are estimated at 7-8% for all classes, mainly due tocorporate consolidations. Demand for over 2,000 SM to8,000 SM is high, however, supply is limited. Yields increasedfrom their low of 6% to reach 7-7.5%.Property prices on prime locations in Thessaloniki highstreetshave dropped by an estimated 5-10%, while in otherlocations prices have dropped by over 15% in some cases.On Tsimiski Street, ground retail spaces are leased for €100-€150/SM and sale prices reach €30,000 to €35,000/SM,while the same numbers for Mitropoleos Street are €50/SMand €8,000 to €10,000/SM, respectively.Retail investments in Thessaloniki seem undeterred by thecrisis. Louis Vuitton leased a further 100 SM for its store,while Inditex signed deals for four city center stores, includingan €8.2 million leasing deal for its Pull & Bear brand.Eurobank Properties REIC purchased three retail stores totaling33,000 SM leased to Praktiker Hellas, a subsidiary ofGerman Praktiker AG. The deal closed at a reported price of€46 million, which is an estimated 9.5% reduction from a2006 reported value. The yield is at 8.3%.Tourism income fell 10.7% and shipping income dropped38.7% in August 2009 compared to the same period in2008, while current account balance remained unchangedat €425 million. Travel expenditure from non-locals dropped10.7% over August 2008, while locals increased spending9.7%. Transportation gross receipts (mostly shipping)dropped 38.7%, while income account deficit dropped by€56 million.Contact<strong>NAI</strong> Reykjavik+ 354 5331122Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)UnemploymentRate (%)Interest Rate(%)1334.3-8.51%$11.78$36,873.4311.67%8.62%12.00%Population (Millions) 0.319The economic situation in Iceland has been uncertainthroughout 2009 because of the collapse of 80% of thebanking system in October 2008. The property market hasbeen extremely slow. The number of commercial real estatesales is only about 10-20% of the volume recorded in 2007.The economy is export driven with fish and aluminumthe primary exports, and the domestic tourist business isbooming because of the low value of the Icelandic krona.The property market in Iceland has been slow or almostfrozen throughout 2009. Most deals that occur involvesmaller units where buyers are using the opportunity tobuy into a good location now at a lower price than in thelast few years. Many of the Icelandic real estate holdingcompanies have gone or are going bankrupt, so the ownershipof a large part of the leased out real estate base ischanging hands, mostly to the new government-ownedbanks. It is not yet known if or when these properties will besold in the market.The fundamentals in the Icelandic economy are the exportof fish and aluminum, which have been enjoying the veryweak Icelandic krona. Also the tourism in Iceland has beenbooming, which again has resulted in increasing demandfor hotel rooms. Banks have been more willing to lend intohotel development projects than any other type of projects.Many office, retail and residential development projects havebeen delayed or cancelled, and in the immediate future suchnew projects are not likely to be started. The Icelandicgovernment has applied for Iceland to become a member ofthe EU. Some investors may see that as an opportunity toinvest in Iceland.The value of the Icelandic krona is very low now. Prices ofproperties have come down. Iceland may join the EU withinthe next two years and adopting the Euro within five years.Athens At A GlanceConversion .793 EUR = 1 US$ RENT/M2/MONTH US$ RENT/SF/YEARLow High Low High VacancyCENTER CITY OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power Center (Big Box)Regional MallsSolus Food Stores€ 16.00 € 22.00 $ 26.62 $ 36.61 10.0%€ 15.00 € 21.00 $ 24.96 $ 34.94 10.0%€ 9.00 € 12.00 $ 14.98 $ 19.97 15.0%€ 16.00 € 21.00 $ 26.62 $ 34.94 10.0%€ 14.00 € 20.00 $ 23.29 $ 33.28 10.0%€ 10.00 € 13.00 $ 16.64 $ 21.63 15.0%€ 4.50 € 7.50 $ 7.49 $ 12.48 5.0%€ 6.00 € 8.00 $ 9.98 $ 13.31 N/A€ 7.00 € 8.50 $ 11.65 $ 14.14 N/A€ 35.00 € 290.00 $ 58.24 $ 482.54 15.0%€ 20.00 € 40.00 $ 33.28 $ 66.56 15.0%€ 11.00 € 18.00 $ 18.30 $ 29.95 N/A€ 20.00 € 150.00 $ 33.28 $ 249.59 N/A€ 9.00 € 14.00 $ 14.98 $ 23.29 N/ADEVELOPMENT LAND Low/M 2 High/M 2 Low/SF High/SFOffice in CBD€ 5,000.00 € 12,000.00 $ 7,462.69 $ 17,910.45Land in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-park€€N/A120.00150.00€€N/A245.00300.00$$N/A179.10 $223.88 $N/A365.67447.76Retail/<strong>Commercial</strong> LandResidential€ 1,600.00€ 1,000.00€€2,700.003,000.00$ 2,388.06 $$ 1,492.54 $4,029.854,477.61Reykjavik At A GlanceConversion: 122 ISK = 1 US$ RENT/M 2 /MO US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILCity CenterNeighborhood Service CentersCommunity Power Center (Big Box)Regional Shopping Centers/MallsSolus Food StoresDEVELOPMENT LANDISK 1,322.00ISK 1,322.00ISK 1,133.00ISK 850.00ISK 850.00ISK 708.00ISK 708.00ISK 708.00ISK 850.00ISK 1,417.00ISK 1,133.00ISK 1,133.00ISK 1,606.00ISK 1,417.00Low/M 2 ISK 1,983.00ISK 1,983.00ISK 1,416.00ISK 1,133.00ISK 1,133.00ISK 945.00ISK 1,039.00ISK 1,039.00ISK 1,322.00ISK 2,834.00ISK 1,700.00ISK 1,606.00ISK 2,361.00ISK 1,983.00High/M 2 $$$$$$$$$$$$$$12.0812.0810.357.777.776.476.476.477.7712.9510.3510.3514.6812.95Low/SF$$$$$$$$$$$$$$18.1218.1212.9410.3510.358.649.499.4912.0825.9015.5314.6821.5718.12High/SFN/AN/AN/AN/AN/AN/AN/AN/AN/AN/AN/AN/AN/AN/AOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidentialISK 6,100,000 ISK 9,760,000 $ 4,645.11 $ 7,432.18ISK 1,220,000 ISK 3,660,000 $ 929.02 $ 2,787.07ISK 1,220,000 ISK 3,660,000 $ 929.02 $ 2,787.07ISK 1,220,000 ISK 3,660,000 $ 929.02 $ 2,787.07ISK 1,220,000 ISK 3,660,000 $ 929.02 $ 2,787.07ISK 2,440,000 ISK 9,760,000 $ 1,858.05 $ 7,432.18<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 47

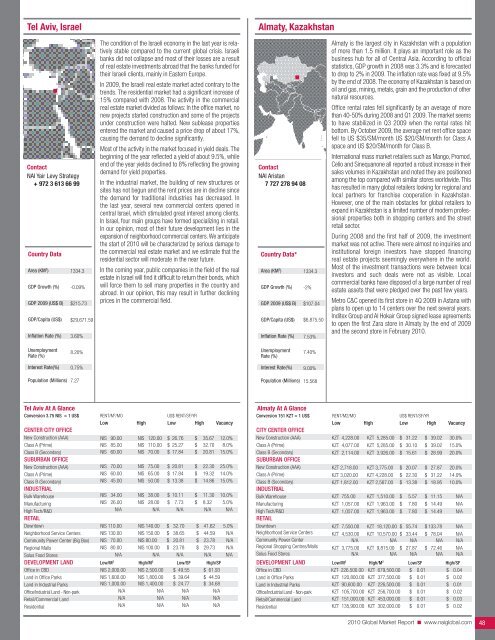

Tel Aviv, IsraelAlmaty, KazakhstanContact<strong>NAI</strong> Yair Levy Strategy+ 972 3 613 66 99Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)1334.3-0.09%$215.73$29,671.593.60%The condition of the Israeli economy in the last year is relativelystable compared to the current global crisis. Israelibanks did not collapse and most of their losses are a resultof real estate investments abroad that the banks funded fortheir Israeli clients, mainly in Eastern Europe.In 2009, the Israeli real estate market acted contrary to thetrends. The residential market had a significant increase of15% compared with 2008. The activity in the commercialreal estate market divided as follows: In the office market, nonew projects started construction and some of the projectsunder construction were halted. New sublease propertiesentered the market and caused a price drop of about 17%,causing the demand to decline significantly.Most of the activity in the market focused in yield deals. Thebeginning of the year reflected a yield of about 9.5%, whileend of the year yields declined to 8% reflecting the growingdemand for yield properties.In the industrial market, the building of new structures orsites has not begun and the rent prices are in decline sincethe demand for traditional industries has decreased. Inthe last year, several new commercial centers opened incentral Israel, which stimulated great interest among clients.In Israel, four main groups have formed specializing in retail.In our opinion, most of their future development lies in theexpansion of neighborhood commercial centers. We anticipatethe start of <strong>2010</strong> will be characterized by serious damage tothe commercial real estate market and we estimate that theresidential sector will moderate in the near future.In the coming year, public companies in the field of the realestate in Israel will find it difficult to return their bonds, whichwill force them to sell many properties in the country andabroad. In our opinion, this may result in further decliningprices in the commercial field.Contact<strong>NAI</strong> Aristan7 727 278 94 08Country Data*Area (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)1334.3-2%$107.04$6,875.507.53%Almaty is the largest city in Kazakhstan with a populationof more than 1.5 million. It plays an important role as thebusiness hub for all of Central Asia. According to officialstatistics, GDP growth in 2008 was 3.3% and is forecastedto drop to 2% in 2009. The inflation rate was fixed at 9.5%by the end of 2008. The economy of Kazakhstan is based onoil and gas, mining, metals, grain and the production of othernatural resources.Office rental rates fell significantly by an average of morethan 40-50% during 2008 and Q1 2009. The market seemsto have stabilized in Q3 2009 when the rental rates hitbottom. By October 2009, the average net rent office spacefell to US $35/SM/month US $20/SM/month for Class Aspace and US $20/SM/month for Class B.International mass market retailers such as Mango, Promod,Celio and Sinequanone all reported a robust increase in theirsales volumes in Kazakhstan and noted they are positionedamong the top compared with similar stores worldwide. Thishas resulted in many global retailers looking for regional andlocal partners for franchise cooperation in Kazakhstan.However, one of the main obstacles for global retailers toexpand in Kazakhstan is a limited number of modern professionalproperties both in shopping centers and the streetretail sector.During 2008 and the first half of 2009, the investmentmarket was not active. There were almost no inquiries andinstitutional foreign investors have stopped financingreal estate projects seemingly everywhere in the world.Most of the investment transactions were between localinvestors and such deals were not as visible. Localcommercial banks have disposed of a large number of realestate assets that were pledged over the past few years.Metro C&C opened its first store in 4Q 2009 in Astana withplans to open up to 14 centers over the next several years.Inditex Group and Al Hokair Group signed lease agreementsto open the first Zara store in Almaty by the end of 2009and the second store in February <strong>2010</strong>.UnemploymentRate (%)8.20%UnemploymentRate (%)7.40%Interest Rate(%)0.75%Interest Rate(%)9.00%Population (Millions)7.27Population (Millions) 15.568Tel Aviv At A GlanceConversion 3.75 NIS = 1 US$ RENT/M 2 /MO US$ RENT/SF/YRLow High Low High VacancyCENTER CITY OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseNISNISNISNISNISNISNIS90.0085.0060.0070.0060.0045.0034.00NIS 120.00NIS 110.00NIS 70.00NIS 75.00NIS 65.00NIS 50.00NIS 38.00$ 26.76$ 25.27$ 17.84$ 20.81$ 17.84$ 13.38$ 10.11$$$$$$$35.6732.7020.8122.3019.3214.8611.3012.0%8.0%15.0%25.0%14.0%15.0%10.0%ManufacturingHigh Tech/R&DRETAILNIS 26.00N/ANIS 28.00N/A$ 7.73N/A$ 8.32N/A5.0%N/ADowntownNeighborhood Service CentersCommunity Power Center (Big Box)Regional MallsSolus Food StoresDEVELOPMENT LANDNIS 110.00NIS 130.00NIS 70.00NIS 80.00N/ALow/M 2 NIS 140.00NIS 150.00NIS 80.00NIS 100.00N/AHigh/M 2 $$$$32.7038.6520.8123.78N/ALow/SF$$$$41.6244.5923.7829.73N/AHigh/SF5.0%N/AN/AN/AN/AOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidentialNIS 2,000.00 NIS 2,500.00 $ 49.55 $ 61.93NIS 1,600.00 NIS 1,800.00 $ 39.64 $ 44.59NIS 1,000.00 NIS 1,400.00 $ 24.77 $ 34.68N/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AAlmaty At A GlanceConversion 151 KZT = 1 US$ RENT/M2/MO US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Shopping Centres/MallsSolus Food StoresKZT 4,228.00 KZT 5,285.00 $ 31.22 $ 39.02 30.0%KZT 4,077.00 KZT 5,285.00 $ 30.10 $ 39.02 15.0%KZT 2,114.00 KZT 3,926.00 $ 15.61 $ 28.99 20.0%KZT 2,718.00 KZT 3,775.00 $ 20.07 $ 27.87 20.0%KZT 3,020.00 KZT 4,228.00 $ 22.30 $ 31.22 14.0%KZT 1,812.00 KZT 2,567.00 $ 13.38 $ 18.95 10.0%KZT 755.00 KZT 1,510.00 $ 5.57 $ 11.15 N/AKZT 1,057.00 KZT 1,963.00 $ 7.80 $ 14.49 N/AKZT 1,057.00 KZT 1,963.00 $ 7.80 $ 14.49 N/AKZT 7,550.00 KZT 18,120.00 $ 55.74 $ 133.78 N/AKZT 4,530.00 KZT 10,570.00 $ 33.44 $ 78.04 N/AN/A N/A N/A N/A N/AKZT 3,775.00 KZT 9,815.00 $ 27.87 $ 72.46 N/AN/A N/A N/A N/A N/ADEVELOPMENT LAND Low/M 2 High/M 2 Low/SF High/SFOffice in CBDKZT 226,500.00 KZT 679,500.00 $ 0.01 $ 0.04Land in Office ParksKZT 120,800.00 KZT 377,500.00 $ 0.01 $ 0.02Land in Industrial ParksKZT 90,600.00 KZT 226,500.00 $ 0.01 $ 0.01Office/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidentialKZT 105,700.00 KZT 256,700.00KZT 151,000.00 KZT 453,000.00KZT 135,900.00 KZT 302,000.00$$$0.010.010.01$$$0.020.030.02<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 48

- Page 1 and 2: CommercialCommercial Real Estate Se

- Page 3 and 4: ■ ■ ■ Table of ContentsGENERA

- Page 5 and 6: Global OutlookCommercial real estat

- Page 7 and 8: 38.3% in November 2009. At the same

- Page 9 and 10: quality than the Census properties.

- Page 11 and 12: SaskatchewanSaskatchewan is a small

- Page 13 and 14: As 2009 draws to a close, there is

- Page 15 and 16: Global investment interest largely

- Page 18 and 19: ChinaChina continued to post large

- Page 20 and 21: MalaysiaWith Malaysia’s dependenc

- Page 22 and 23: ■ US Highlights - Northeast Regio

- Page 24 and 25: ■ US Highlights - Midwest Region

- Page 26 and 27: ■ US Highlights - West Region■

- Page 28 and 29: Melbourne, AustraliaBeijing, ChinaC

- Page 30 and 31: Shanghai, ChinaXiamen, ChinaContact

- Page 32 and 33: Delhi, Gurgaon, IndiaHyderabad, Pra

- Page 34 and 35: Punjab, IndiaTokyo, JapanContactNAI

- Page 36 and 37: Seoul, South KoreaTaipei, TaiwanCon

- Page 38 and 39: Calgary, Alberta, CanadaEdmonton, A

- Page 40 and 41: Halifax, Nova Scotia, CanadaOttawa,

- Page 42 and 43: Regina, Saskatchewan, CanadaContact

- Page 44 and 45: Vienna, AustriaThe Baltics (Latvia/

- Page 46 and 47: Copenhagen, DenmarkFinlandContactNA

- Page 50 and 51: KuwaitOslo, NorwayContactNAI Kuwait

- Page 52 and 53: Moscow, Russian FederationSt. Peter

- Page 54 and 55: Madrid, SpainStockholm, SwedenConta

- Page 56 and 57: Istanbul, TurkeyKiev, UkraineContac

- Page 58 and 59: Latin AmericaSECTION CONTENTSBuenos

- Page 60 and 61: Campinas, BrazilCuritiba, BrazilCon

- Page 62 and 63: Sao Paulo, BrazilSantiago, ChileCon

- Page 64 and 65: Ciudad Juarez, Chihuahua, MexicoGua

- Page 66 and 67: Matamoros, Tamaulipas, MexicoMexica

- Page 68 and 69: Reynosa, MexicoSaltillo, Coahuila,

- Page 70 and 71: Torreon, Coahulia, MexicoCaracas, V

- Page 72 and 73: Birmingham, AlabamaHuntsville, Deca

- Page 74 and 75: Jonesboro, ArkansasLittle Rock, Ark

- Page 76 and 77: Marin County, CaliforniaMonterey, C

- Page 78 and 79: Sacramento, CaliforniaSan Diego, Ca

- Page 80 and 81: Santa Clara County (Silicon Valley)

- Page 82 and 83: Colorado Springs, ColoradoDenver, C

- Page 84 and 85: Fort Lauderdale, FloridaFt. Myers/N

- Page 86 and 87: Miami, FloridaOrlando, FloridaConta

- Page 88 and 89: Atlanta, GeorgiaHonolulu, HawaiiCon

- Page 90 and 91: Chicago, IllinoisSpringfield, Illin

- Page 92 and 93: Cedar Rapids, Iowa City, IowaDavenp

- Page 94 and 95: Wichita, KansasLexington, KentuckyC

- Page 96 and 97: Monroe, LouisianaNew Orleans, Louis

- Page 98 and 99:

Suburban MarylandBoston, Massachuse

- Page 100 and 101:

Grand Rapids, MichiganLansing, Mich

- Page 102 and 103:

St. Louis, MissouriBozeman, Montana

- Page 104 and 105:

Omaha, NebraskaLas Vegas, NevadaCon

- Page 106 and 107:

Portsmouth, New HampshireAtlantic C

- Page 108 and 109:

Ocean/Monmouth Counties (“Shore M

- Page 110 and 111:

Las Cruces, New MexicoAlbany, New Y

- Page 112 and 113:

Asheville, North CarolinaCharlotte,

- Page 114 and 115:

Fargo, North DakotaAkron, OhioConta

- Page 116 and 117:

Cleveland, OhioColumbus, OhioContac

- Page 118 and 119:

Tulsa, OklahomaPortland, OregonCont

- Page 120 and 121:

Bucks County, PennsylvaniaHarrisbur

- Page 122 and 123:

Pittsburgh, PennsylvaniaSchuylkill

- Page 124 and 125:

Greenville/Spartanburg/Anderson Cou

- Page 126 and 127:

Knoxville, TennesseeMemphis, Tennes

- Page 128 and 129:

Beaumont, TexasCorpus Christi, Texa

- Page 130 and 131:

Fort Worth, TexasHouston, TexasCont

- Page 132 and 133:

Texarkana (Bowie County, Texas/Mill

- Page 134 and 135:

Northern VirginiaSeattle/Puget Soun

- Page 136 and 137:

Madison, WisconsinMilwaukee, Wiscon

- Page 138 and 139:

Jackson Hole, WyomingContactNAI Jac

- Page 140:

Build on the power of our network.N