Istanbul, TurkeyKiev, UkraineContact<strong>NAI</strong> Treas+90 216 481 47 00Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)1334.3-6.50%$593.53$8,427.116.20%Turkey’s economy shows the impact of the global recessionin 2009. The inflation rate reached 5.39% in May, which isslightly higher than the lowest level of 5.24% in the past 39years. Turkey’s currency has depreciated 20% compared tothe first half of 2008. Construction activity declined 7.6%in2009, and the steel industry declined about 15%. Turkey’smajor export manufacturing sectors such as textile andautomotive have also been impacted negatively.Occupancy rates in CBD routes like Levent and Zincirlikuyuare still high, while Umraniye and Kozyatagi in the Asian Partof Istanbul kept their popularity to become new districts foroffices. One of the biggest office projects is the 90,000 SMAkkom office project, which will be built by Eroglu Holdingin Umraniye. In addition, Emaar Properties has purchaseda 74,000 SM land parcel in the Asian Side of Istanbul forapproximately $400 million from Toprak Holding. There willbe residence blocks as well as a 120,000 SM shoppingcenter, a five-star hotel and office buildings.The retail market, which registered fast growth in recentyears, showed signs of slowing in the first nine months of2009. By September 2009, retail supply had reached 6.06million SM in 276 retail centers. Istanbul accounts for 2.2million SM of this total in 88 shopping centers. Thereare 135 shopping centers under construction and in theplanning stage in Turkey, of which 67 are in Istanbul. Therehas been an increase in the number of warehouses dueto increased demand for industrial real estate in Turkey.Logiturk B2B <strong>Real</strong> <strong>Estate</strong> Solutions Company is planningto complete a 126,000 SM warehouse park in Istanbul.Total international direct investment in 2008 reached$17.96 billion in Turkey, where $2.94 billion of this amountwas invested in real estate. The amount of internationaldirect investment in July 2009 totaled $4.938 billion, downsignificantly from $9.735 billion in July 2008.Contact<strong>NAI</strong> Pickard+380 44 278 00 02Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)1334.3-14.00%$115.71$2,537.8016.28%In Q2 of 2009 Ukraine’s real GDP dropped 17.8 %. Howeverthe speed of decline has decreased. The construction sectorhas decreased more than others (-47%). Its part of GDPstructure makes up 2.8%. Agriculture is the only sector thatdemonstrated growth (+2.3%). The processing industry,which is the basis of country’s GDP, had fallen 33% throughQ2 2009.Demand for professional office space has decreased considerably.In Kiev, the vacancy rate is about 15%. The fall in rentalrates from their 2008 peak is roughly 60%. Prime rents arenow about US $30-35/SM/month. Despite the decline, newoffice buildings continue to be commissioned in Kiev. Duringthe first half of 2009 three new centers were commissioned,accounting for 20,500 SM growth.From the beginning of 2009, prime rents for modern warehousefacilities within a 30km zone from Kiev dropped by30% to US $6.00-$7.00/SM/month excluding operatingexpenses. Vacancy rates are currently 35%-40%. Most warehousingdevelopments are now on hold and their delivery isrescheduled to <strong>2010</strong>-2011. Only 70,000-80,000 SM is likelyto be delivered onto the market by the end of 2009.The occupancy rate for shopping centers in Kiev hasdecreased but it is still rather high; only about 3.5% of totalretail spaces are vacant. Yet a decrease of consumer demandand devaluation of the Hrivna led to a substantial declinein rental rates, dropping 60% since 2008. The averagerental rates today are about US $45-50/SM/month. Growthof retail space in shopping centers in the first half of 2009is at 14.3% (66,900 SM).Ukraine is still desperately short of hotels especially in thegenuine three-star category. The authorities are offering tofast track approvals but money remains tight.FDI is virtually non-existent this year and will probablyremain flat until after the presidential elections slated forJanuary <strong>2010</strong>. However sales on yields of 20% on currentlow rental levels are possible. The opportunity for rentalgrowth and consequent capital growth is still strong.UnemploymentRate (%)12.80%UnemploymentRate (%)9.00%Interest Rate(%)6.75%Interest Rate(%)10.25%Population (Millions) 70.431Population (Millions)45.593Istanbul At A GlanceConversion: 1.49 = 1 US$ RENT/M 2 /YR US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILCity CenterNeighborhood Service CentersCommunity Power Center (Big Box)Regional Shopping Centers/MallsSolus Food Stores$$$$$$$$$$$$$$204.00126.00108.00114.0078.0054.0048.0048.0072.00432.00264.00216.00216.00162.00$$$$$$$$$$$$$$360.00306.00138.00138.00120.00120.0084.0072.0096.001,560.00768.00576.00768.00240.00$$$$$$$$$$$$$$18.9511.7110.0310.597.255.024.464.466.6940.1324.5320.0720.0715.05$$$$$$$$$$$$$$33.4428.4312.8212.8211.1511.157.806.698.92144.9371.3553.5171.3522.30N/A15.0%N/AN/A20.0%N/AN/AN/AN/A20.0%N/AN/A18.0%N/ADEVELOPMENT LAND Low/M 2 High/M 2 Low/SF High/SFOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$ 850.00 $ 4,015.00 $ 78.97 $ 373.00N/A N/A N/A N/A$ 265.00 $ 825.00 $ 24.62 $ 76.64$ 210.00 $ 1,950.00 $ 19.51 $ 181.16$ 425.00 $ 3,010.00 $ 39.48 $ 279.64$ 45.00 $ 3,010.00 $ 4.18 $ 279.64Kiev At A GlanceConversion: 7,64 UAH = 1 US$ RENT/M 2 /MO US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew ConstructionClass A (Prime)Class B (Secondary)SUBURBAN OFFICENew ConstructionClass A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILN/AUAH 360.00UAH 216.00N/AN/AN/AUAH 70.00N/AN/AN/AUAH 420.00UAH 264.00N/AN/AN/AUAH 85.00N/AN/AN/A$ 52.53$ 31.52N/AN/AN/A$ 10.21N/AN/A$$$N/A61.2938.52N/AN/AN/A12.40N/AN/AN/A17.0%14.0%N/AN/AN/A35.0%N/AN/ACity CenterUAH 490.00 UAH 720.00 $ 71.50 $ 105.06 6.2%Neighborhood Service CentersCommunity Power Center (Big Box)Regional Shopping Centers/MallsSolus Food StoresDEVELOPMENT LANDUAH 360.00UAH 480.00UAH 480.00N/ALow/M 2 UAH 600.00UAH 660.00UAH 720.00N/AHigh/M 2 $ 52.53$ 70.04$ 70.04N/ALow/SF$$$87.5596.3196.31N/AHigh/SFN/A2.0%2.0%N/AOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidentialN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/A<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 55

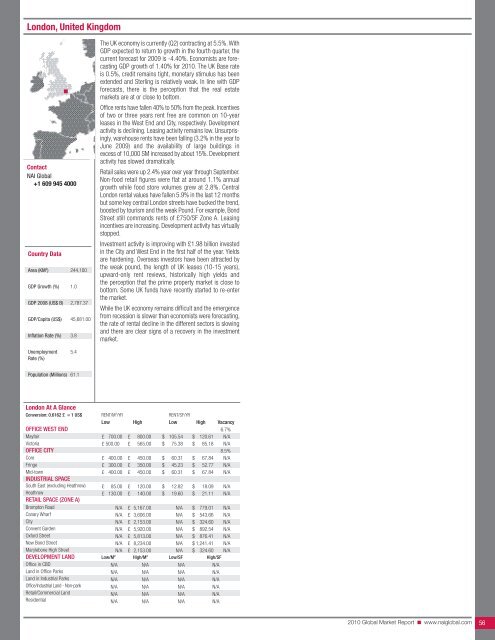

London, United KingdomContact<strong>NAI</strong> <strong>Global</strong>+1 609 945 4000Country DataArea (KM 2 )GDP Growth (%)GDP 2008 (US$ B)GDP/Capita (US$)Inflation Rate (%)244,1001.02,787.3745,681.003.8The UK economy is currently (Q2) contracting at 5.5%. WithGDP expected to return to growth in the fourth quarter, thecurrent forecast for 2009 is -4.40%. Economists are forecastingGDP growth of 1.40% for <strong>2010</strong>. The UK Base rateis 0.5%, credit remains tight, monetary stimulus has beenextended and Sterling is relatively weak. In line with GDPforecasts, there is the perception that the real estatemarkets are at or close to bottom.Office rents have fallen 40% to 50% from the peak. Incentivesof two or three years rent free are common on 10-yearleases in the West End and City, respectively. Developmentactivity is declining. Leasing activity remains low. Unsurprisingly,warehouse rents have been falling (3.2% in the year toJune 2009) and the availability of large buildings inexcess of 10,000 SM increased by about 15%. Developmentactivity has slowed dramatically.Retail sales were up 2.4% year over year through September.Non-food retail figures were flat at around 1.1% annualgrowth while food store volumes grew at 2.8%. CentralLondon rental values have fallen 5.9% in the last 12 monthsbut some key central London streets have bucked the trend,boosted by tourism and the weak Pound. For example, BondStreet still commands rents of £750/SF Zone A. Leasingincentives are increasing. Development activity has virtuallystopped.Investment activity is improving with £1.98 billion investedin the City and West End in the first half of the year. Yieldsare hardening. Overseas investors have been attracted bythe weak pound, the length of UK leases (10-15 years),upward-only rent reviews, historically high yields andthe perception that the prime property market is close tobottom. Some UK funds have recently started to re-enterthe market.While the UK economy remains difficult and the emergencefrom recession is slower than economists were forecasting,the rate of rental decline in the different sectors is slowingand there are clear signs of a recovery in the investmentmarket.UnemploymentRate (%)5.4Population (Millions)61.1London At A GlanceConversion: 0.6162 £ = 1 US$ RENT/M 2 /YR RENT/SF/YRLow High Low High VacancyOFFICE WEST ENDMayfair£ 700.00 £ 800.00 $ 105.54 $ 120.616.7%N/AVictoriaOFFICE CITYCoreFringeMid-townINDUSTRIAL SPACE£ 500.00£ 400.00£ 300.00£ 400.00££££565.00450.00350.00450.00$$$$75.3860.3145.2360.31$$$$85.1867.8452.7767.84N/A8.5%N/AN/AN/ASouth East (excluding Heathrow) £ 85.00 £ 120.00 $ 12.82 $ 18.09 N/AHeathrowRETAIL SPACE (ZONE A)£ 130.00 £ 140.00 $ 19.60 $ 21.11 N/ABrompton RoadCanary WharfCityConvent GardenOxford StreetN/AN/AN/AN/AN/A£ 5,167.00£ 3,606.00£ 2,153.00£ 5,920.00£ 5,813.00N/AN/AN/AN/AN/A$$$$$779.01543.66324.60892.54876.41N/AN/AN/AN/AN/ANew Bond StreetN/A £ 8,234.00 N/A $ 1,241.41 N/AMarylebone High StreetDEVELOPMENT LANDN/ALow/M 2 £ 2,153.00High/M 2 N/ALow/SF$ 324.60High/SFN/AOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidentialN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/A<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 56

- Page 1 and 2:

CommercialCommercial Real Estate Se

- Page 3 and 4:

■ ■ ■ Table of ContentsGENERA

- Page 5 and 6: Global OutlookCommercial real estat

- Page 7 and 8: 38.3% in November 2009. At the same

- Page 9 and 10: quality than the Census properties.

- Page 11 and 12: SaskatchewanSaskatchewan is a small

- Page 13 and 14: As 2009 draws to a close, there is

- Page 15 and 16: Global investment interest largely

- Page 18 and 19: ChinaChina continued to post large

- Page 20 and 21: MalaysiaWith Malaysia’s dependenc

- Page 22 and 23: ■ US Highlights - Northeast Regio

- Page 24 and 25: ■ US Highlights - Midwest Region

- Page 26 and 27: ■ US Highlights - West Region■

- Page 28 and 29: Melbourne, AustraliaBeijing, ChinaC

- Page 30 and 31: Shanghai, ChinaXiamen, ChinaContact

- Page 32 and 33: Delhi, Gurgaon, IndiaHyderabad, Pra

- Page 34 and 35: Punjab, IndiaTokyo, JapanContactNAI

- Page 36 and 37: Seoul, South KoreaTaipei, TaiwanCon

- Page 38 and 39: Calgary, Alberta, CanadaEdmonton, A

- Page 40 and 41: Halifax, Nova Scotia, CanadaOttawa,

- Page 42 and 43: Regina, Saskatchewan, CanadaContact

- Page 44 and 45: Vienna, AustriaThe Baltics (Latvia/

- Page 46 and 47: Copenhagen, DenmarkFinlandContactNA

- Page 48 and 49: Athens, GreeceReykjavik IcelandCont

- Page 50 and 51: KuwaitOslo, NorwayContactNAI Kuwait

- Page 52 and 53: Moscow, Russian FederationSt. Peter

- Page 54 and 55: Madrid, SpainStockholm, SwedenConta

- Page 58 and 59: Latin AmericaSECTION CONTENTSBuenos

- Page 60 and 61: Campinas, BrazilCuritiba, BrazilCon

- Page 62 and 63: Sao Paulo, BrazilSantiago, ChileCon

- Page 64 and 65: Ciudad Juarez, Chihuahua, MexicoGua

- Page 66 and 67: Matamoros, Tamaulipas, MexicoMexica

- Page 68 and 69: Reynosa, MexicoSaltillo, Coahuila,

- Page 70 and 71: Torreon, Coahulia, MexicoCaracas, V

- Page 72 and 73: Birmingham, AlabamaHuntsville, Deca

- Page 74 and 75: Jonesboro, ArkansasLittle Rock, Ark

- Page 76 and 77: Marin County, CaliforniaMonterey, C

- Page 78 and 79: Sacramento, CaliforniaSan Diego, Ca

- Page 80 and 81: Santa Clara County (Silicon Valley)

- Page 82 and 83: Colorado Springs, ColoradoDenver, C

- Page 84 and 85: Fort Lauderdale, FloridaFt. Myers/N

- Page 86 and 87: Miami, FloridaOrlando, FloridaConta

- Page 88 and 89: Atlanta, GeorgiaHonolulu, HawaiiCon

- Page 90 and 91: Chicago, IllinoisSpringfield, Illin

- Page 92 and 93: Cedar Rapids, Iowa City, IowaDavenp

- Page 94 and 95: Wichita, KansasLexington, KentuckyC

- Page 96 and 97: Monroe, LouisianaNew Orleans, Louis

- Page 98 and 99: Suburban MarylandBoston, Massachuse

- Page 100 and 101: Grand Rapids, MichiganLansing, Mich

- Page 102 and 103: St. Louis, MissouriBozeman, Montana

- Page 104 and 105: Omaha, NebraskaLas Vegas, NevadaCon

- Page 106 and 107:

Portsmouth, New HampshireAtlantic C

- Page 108 and 109:

Ocean/Monmouth Counties (“Shore M

- Page 110 and 111:

Las Cruces, New MexicoAlbany, New Y

- Page 112 and 113:

Asheville, North CarolinaCharlotte,

- Page 114 and 115:

Fargo, North DakotaAkron, OhioConta

- Page 116 and 117:

Cleveland, OhioColumbus, OhioContac

- Page 118 and 119:

Tulsa, OklahomaPortland, OregonCont

- Page 120 and 121:

Bucks County, PennsylvaniaHarrisbur

- Page 122 and 123:

Pittsburgh, PennsylvaniaSchuylkill

- Page 124 and 125:

Greenville/Spartanburg/Anderson Cou

- Page 126 and 127:

Knoxville, TennesseeMemphis, Tennes

- Page 128 and 129:

Beaumont, TexasCorpus Christi, Texa

- Page 130 and 131:

Fort Worth, TexasHouston, TexasCont

- Page 132 and 133:

Texarkana (Bowie County, Texas/Mill

- Page 134 and 135:

Northern VirginiaSeattle/Puget Soun

- Page 136 and 137:

Madison, WisconsinMilwaukee, Wiscon

- Page 138 and 139:

Jackson Hole, WyomingContactNAI Jac

- Page 140:

Build on the power of our network.N