2010 Global Market Report - NAI Commercial Real Estate

2010 Global Market Report - NAI Commercial Real Estate

2010 Global Market Report - NAI Commercial Real Estate

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

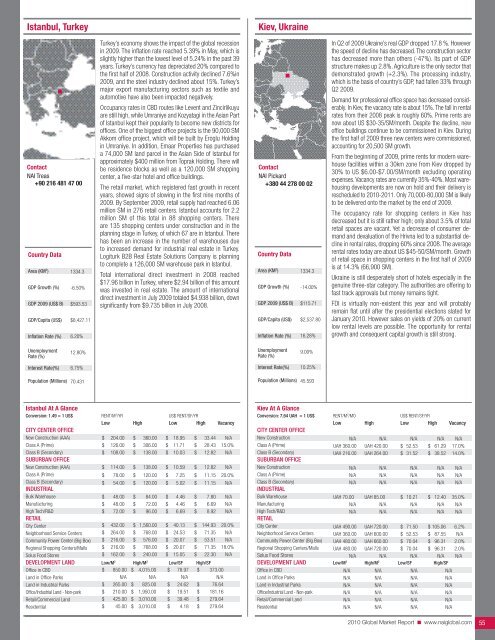

Istanbul, TurkeyKiev, UkraineContact<strong>NAI</strong> Treas+90 216 481 47 00Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)1334.3-6.50%$593.53$8,427.116.20%Turkey’s economy shows the impact of the global recessionin 2009. The inflation rate reached 5.39% in May, which isslightly higher than the lowest level of 5.24% in the past 39years. Turkey’s currency has depreciated 20% compared tothe first half of 2008. Construction activity declined 7.6%in2009, and the steel industry declined about 15%. Turkey’smajor export manufacturing sectors such as textile andautomotive have also been impacted negatively.Occupancy rates in CBD routes like Levent and Zincirlikuyuare still high, while Umraniye and Kozyatagi in the Asian Partof Istanbul kept their popularity to become new districts foroffices. One of the biggest office projects is the 90,000 SMAkkom office project, which will be built by Eroglu Holdingin Umraniye. In addition, Emaar Properties has purchaseda 74,000 SM land parcel in the Asian Side of Istanbul forapproximately $400 million from Toprak Holding. There willbe residence blocks as well as a 120,000 SM shoppingcenter, a five-star hotel and office buildings.The retail market, which registered fast growth in recentyears, showed signs of slowing in the first nine months of2009. By September 2009, retail supply had reached 6.06million SM in 276 retail centers. Istanbul accounts for 2.2million SM of this total in 88 shopping centers. Thereare 135 shopping centers under construction and in theplanning stage in Turkey, of which 67 are in Istanbul. Therehas been an increase in the number of warehouses dueto increased demand for industrial real estate in Turkey.Logiturk B2B <strong>Real</strong> <strong>Estate</strong> Solutions Company is planningto complete a 126,000 SM warehouse park in Istanbul.Total international direct investment in 2008 reached$17.96 billion in Turkey, where $2.94 billion of this amountwas invested in real estate. The amount of internationaldirect investment in July 2009 totaled $4.938 billion, downsignificantly from $9.735 billion in July 2008.Contact<strong>NAI</strong> Pickard+380 44 278 00 02Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)1334.3-14.00%$115.71$2,537.8016.28%In Q2 of 2009 Ukraine’s real GDP dropped 17.8 %. Howeverthe speed of decline has decreased. The construction sectorhas decreased more than others (-47%). Its part of GDPstructure makes up 2.8%. Agriculture is the only sector thatdemonstrated growth (+2.3%). The processing industry,which is the basis of country’s GDP, had fallen 33% throughQ2 2009.Demand for professional office space has decreased considerably.In Kiev, the vacancy rate is about 15%. The fall in rentalrates from their 2008 peak is roughly 60%. Prime rents arenow about US $30-35/SM/month. Despite the decline, newoffice buildings continue to be commissioned in Kiev. Duringthe first half of 2009 three new centers were commissioned,accounting for 20,500 SM growth.From the beginning of 2009, prime rents for modern warehousefacilities within a 30km zone from Kiev dropped by30% to US $6.00-$7.00/SM/month excluding operatingexpenses. Vacancy rates are currently 35%-40%. Most warehousingdevelopments are now on hold and their delivery isrescheduled to <strong>2010</strong>-2011. Only 70,000-80,000 SM is likelyto be delivered onto the market by the end of 2009.The occupancy rate for shopping centers in Kiev hasdecreased but it is still rather high; only about 3.5% of totalretail spaces are vacant. Yet a decrease of consumer demandand devaluation of the Hrivna led to a substantial declinein rental rates, dropping 60% since 2008. The averagerental rates today are about US $45-50/SM/month. Growthof retail space in shopping centers in the first half of 2009is at 14.3% (66,900 SM).Ukraine is still desperately short of hotels especially in thegenuine three-star category. The authorities are offering tofast track approvals but money remains tight.FDI is virtually non-existent this year and will probablyremain flat until after the presidential elections slated forJanuary <strong>2010</strong>. However sales on yields of 20% on currentlow rental levels are possible. The opportunity for rentalgrowth and consequent capital growth is still strong.UnemploymentRate (%)12.80%UnemploymentRate (%)9.00%Interest Rate(%)6.75%Interest Rate(%)10.25%Population (Millions) 70.431Population (Millions)45.593Istanbul At A GlanceConversion: 1.49 = 1 US$ RENT/M 2 /YR US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILCity CenterNeighborhood Service CentersCommunity Power Center (Big Box)Regional Shopping Centers/MallsSolus Food Stores$$$$$$$$$$$$$$204.00126.00108.00114.0078.0054.0048.0048.0072.00432.00264.00216.00216.00162.00$$$$$$$$$$$$$$360.00306.00138.00138.00120.00120.0084.0072.0096.001,560.00768.00576.00768.00240.00$$$$$$$$$$$$$$18.9511.7110.0310.597.255.024.464.466.6940.1324.5320.0720.0715.05$$$$$$$$$$$$$$33.4428.4312.8212.8211.1511.157.806.698.92144.9371.3553.5171.3522.30N/A15.0%N/AN/A20.0%N/AN/AN/AN/A20.0%N/AN/A18.0%N/ADEVELOPMENT LAND Low/M 2 High/M 2 Low/SF High/SFOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$ 850.00 $ 4,015.00 $ 78.97 $ 373.00N/A N/A N/A N/A$ 265.00 $ 825.00 $ 24.62 $ 76.64$ 210.00 $ 1,950.00 $ 19.51 $ 181.16$ 425.00 $ 3,010.00 $ 39.48 $ 279.64$ 45.00 $ 3,010.00 $ 4.18 $ 279.64Kiev At A GlanceConversion: 7,64 UAH = 1 US$ RENT/M 2 /MO US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew ConstructionClass A (Prime)Class B (Secondary)SUBURBAN OFFICENew ConstructionClass A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILN/AUAH 360.00UAH 216.00N/AN/AN/AUAH 70.00N/AN/AN/AUAH 420.00UAH 264.00N/AN/AN/AUAH 85.00N/AN/AN/A$ 52.53$ 31.52N/AN/AN/A$ 10.21N/AN/A$$$N/A61.2938.52N/AN/AN/A12.40N/AN/AN/A17.0%14.0%N/AN/AN/A35.0%N/AN/ACity CenterUAH 490.00 UAH 720.00 $ 71.50 $ 105.06 6.2%Neighborhood Service CentersCommunity Power Center (Big Box)Regional Shopping Centers/MallsSolus Food StoresDEVELOPMENT LANDUAH 360.00UAH 480.00UAH 480.00N/ALow/M 2 UAH 600.00UAH 660.00UAH 720.00N/AHigh/M 2 $ 52.53$ 70.04$ 70.04N/ALow/SF$$$87.5596.3196.31N/AHigh/SFN/A2.0%2.0%N/AOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidentialN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/A<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 55