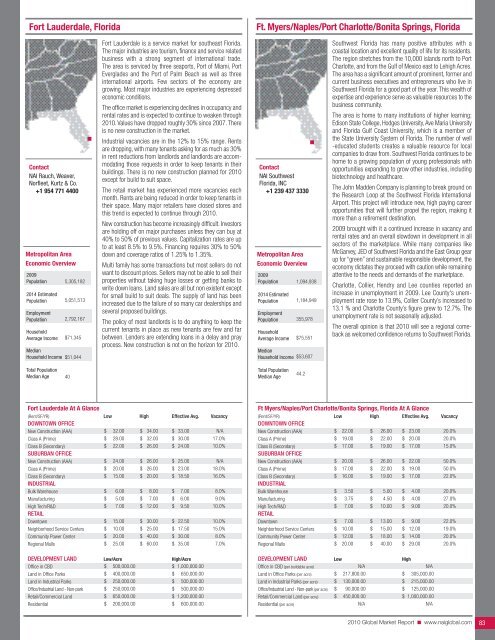

Fort Lauderdale, FloridaFt. Myers/Naples/Port Charlotte/Bonita Springs, FloridaContact<strong>NAI</strong> Rauch, Weaver,Norfleet, Kurtz & Co.+1 954 771 4400Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold Income5,305,1825,051,5132,792,167$71,345$51,044Fort Lauderdale is a service market for southeast Florida.The major industries are tourism, finance and service relatedbusiness with a strong segment of international trade.The area is serviced by three seaports, Port of Miami, PortEverglades and the Port of Palm Beach as well as threeinternational airports. Few sectors of the economy aregrowing. Most major industries are experiencing depressedeconomic conditions.The office market is experiencing declines in occupancy andrental rates and is expected to continue to weaken through<strong>2010</strong>. Values have dropped roughly 30% since 2007. Thereis no new construction in the market.Industrial vacancies are in the 12% to 15% range. Rentsare dropping, with many tenants asking for as much as 30%in rent reductions from landlords and landlords are accommodatingthose requests in order to keep tenants in theirbuildings. There is no new construction planned for <strong>2010</strong>except for build to suit space.The retail market has experienced more vacancies eachmonth. Rents are being reduced in order to keep tenants intheir space. Many major retailers have closed stores andthis trend is expected to continue through <strong>2010</strong>.New construction has become increasingly difficult. Investorsare holding off on major purchases unless they can buy at40% to 50% of previous values. Capitalization rates are upto at least 8.5% to 9.5%. Financing requires 30% to 50%down and coverage ratios of 1.25% to 1.35%.Multi family has some transactions but most sellers do notwant to discount prices. Sellers may not be able to sell theirproperties without taking huge losses or getting banks towrite down loans. Land sales are all but non existent exceptfor small build to suit deals. The supply of land has beenincreased due to the failure of so many car dealerships andseveral proposed buildings.The policy of most landlords is to do anything to keep thecurrent tenants in place as new tenants are few and farbetween. Lenders are extending loans in a delay and prayprocess. New construction is not on the horizon for <strong>2010</strong>.Contact<strong>NAI</strong> SouthwestFlorida, INC+1 239 437 3330Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold Income1,094,9381,184,949355,978$75,551$53,607Southwest Florida has many positive attributes with acoastal location and excellent quality of life for its residents.The region stretches from the 10,000 islands north to PortCharlotte, and from the Gulf of Mexico east to Lehigh Acres.The area has a significant amount of prominent, former andcurrent business executives and entrepreneurs who live inSouthwest Florida for a good part of the year. This wealth ofexpertise and experience serve as valuable resources to thebusiness community.The area is home to many institutions of higher learning;Edison State College, Hodges University, Ave Maria Universityand Florida Gulf Coast University, which is a member ofthe State University System of Florida. The number of well-educated students creates a valuable resource for localcompanies to draw from. Southwest Florida continues to behome to a growing population of young professionals withopportunities expanding to grow other industries, includingbiotechnology and healthcare.The John Madden Company is planning to break ground onthe Research Loop at the Southwest Florida InternationalAirport. This project will introduce new, high paying careeropportunities that will further propel the region, making itmore than a retirement destination.2009 brought with it a continued increase in vacancy andrental rates and an overall slowdown in development in allsectors of the marketplace. While many companies likeMcGarvey, JED of Southwest Florida and the East Group gearup for “green” and sustainable responsible development, theeconomy dictates they proceed with caution while remainingattentive to the needs and demands of the marketplace.Charlotte, Collier, Hendry and Lee counties reported anincrease in unemployment in 2009. Lee County's unemploymentrate rose to 13.9%, Collier County’s increased to13.1 % and Charlotte County’s figure grew to 12.7%. Theunemployment rate is not seasonally adjusted.The overall opinion is that <strong>2010</strong> will see a regional comebackas welcomed confidence returns to Southwest Florida.Total PopulationMedian Age40Total PopulationMedian Age44.2Fort Lauderdale At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIAL$$$$$$32.0028.0022.0024.0020.0015.00$$$$$$34.0032.0026.0026.0026.0020.00$ 33.00$ 30.00$ 24.00$ 25.00$ 23.00$ 18.50N/A17.0%10.0%N/A18.0%16.0%Bulk WarehouseManufacturingHigh Tech/R&DRETAIL$$$6.005.007.00$$$8.007.0012.00$$$7.006.009.508.0%9.0%10.0%DowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$15.0010.0020.0025.00$$$$30.0025.0040.0060.00$ 22.50$ 17.50$ 30.00$ 35.0010.0%15.0%8.0%7.0%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBD$ 500,000.00 $ 1,000,000.00Land in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-park$$$400,000.00250,000.00250,000.00$$$650,000.00500,000.00500,000.00Retail/<strong>Commercial</strong> Land$ 650,000.00 $ 1,200,000.00Residential$ 200,000.00 $ 600,000.00Ft Myers/Naples/Port Charlotte/Bonita Springs, Florida At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$$$$$$$$$$22.0019.0017.0020.0017.0016.003.503.757.007.0010.0012.0020.00$$$$$$$$$$$$$26.0022.0019.0026.0022.0019.005.004.5010.0013.0015.0018.0040.00$$$$$$$$$$$$$23.0020.0017.0022.0019.0017.004.004.009.009.0012.0014.0029.0020.0%20.0%15.0%50.0%50.0%22.0%20.0%27.0%20.0%22.0%19.0%20.0%20.0%DEVELOPMENT LAND Low HighOffice in CBD (per buildable acre)Land in Office Parks (per acre)Land in Industrial Parks (per acre)Office/Industrial Land - Non-park (per acre)$$$N/A217,800.00130,000.0090,000.00$$$N/A305,000.00215,000.00125,000.00Retail/<strong>Commercial</strong> Land (per acre)Residential (per acre)$ 450,000.00N/A$ 1,000,000.00N/A<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 83

Jacksonville, FloridaMartin & St. Lucie Counties, FloridaContact<strong>NAI</strong> <strong>Commercial</strong>Jacksonville.+1 904 358 2717Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold IncomeTotal PopulationMedian Age1,344,5041,454,531663,969$68,792$54,95138Jacksonville's diverse economy makes it an ideal choice forrelocating and expanding businesses and its healthcaresector is emerging as a major medical player in the southeast.However, in 2009 demand in all markets was, at best,sluggish. Unemployment rates soared to 11.3% andconsolidations in the financial services sector produced aglut of sublease availabilities. With more than 40,000 peopleemployed in distribution/warehousing-related occupations,even Jacksonville's robust logistics sector contracted slightlyin 2009.Negative net absorption of 1,192,680 SF pushedJacksonville's 2009 office vacancy rate to 15.8%. Averagerental rates declined from 2008 levels to $18.53/SF, but asJacksonville’s hospitals grow in national and regionalstature, the need for additional medical office space shouldhelp reduce vacancies and spur an increase in rental ratesin late <strong>2010</strong> and beyond.Over $14.8 million in federal stimulus funds is earmarkedfor infrastructure improvements at The Port of Jacksonvilleand additional funds are awaiting approval. Even so, productdelivered to the Port waned in 2009, as did distributioncompanies' expansion plans. As a result, industrial constructionthat commenced and completed in 2008 and 2009was left temporarily vacant at a rate of 10.3%.Jacksonville's retail market behaved in accordance withdepressed national market standards in 2009. Eleven retailsales transactions with a total volume of $22.8 millionand an average price of $78.17/SF closed in 2009.In 2008, the market posted 15 transactions with a totalvolume of $59.2 million and a price per SF averaging$161.83. After 2008's record expansion of the multifamilymarket and the demise of the condominium conversionmarket, demand for apartments plummeted in 2009. Thefallout from non-existent home sales and decline in Floridain-migration forced Jacksonville's 2009 apartment vacancyrate to 13.7%, more than double 2008’s rate of 6.3%.One of Jacksonville's largest 2009 office transactions wasthe lease of 43,008 SF for the new corporate headquartersof Xorail, Inc. brokered by <strong>NAI</strong> <strong>Commercial</strong> Jacksonville. Thecompany also represented D&H Distributors in the lease of79,652 SF of industrial space to Invacare Corporation.Contact<strong>NAI</strong> South Coast+1 772 286 6292Metropolitan AreaEconomic Overview2009Population2014 EstimatedPopulationEmploymentPopulationHouseholdAverage IncomeMedianHousehold IncomeTotal PopulationMedian Age415,435453,891135,521$69,787$49,89142.4The overall economy for Martin and St. Lucie counties hascontinued to contract as unemployment has reached 11.2%in Martin County and 14.7% in St. Lucie County. This hashad a negative impact on all sectors of commercial realestate. The area unemployment has also had a significantimpact on multi-family properties. The market for officespace remains slow as many companies with headquartersin larger metropolitan areas seek to close satellite offices insmaller markets.In the office market, the majority of leasing activity has beenin the form of tenants making a move from more expensivespace to less expensive space. Rents are in the range of$10/SF to $15/SF net for Class A and good Class B buildingsand occupancy has dipped to approximately 85%.The industrial market has been the hardest hit. There remainsapproximately 750,000 SF of vacant flex space and rentshave been reduced to the range of $5-$7/SF gross from$10-$12/SF in the boom years. Vacancy in the industrialsector is at nearly 50% for all property types.The retail market remains the most attractive. Small neighborhoodtenant spaces range from $12/SF net to $18/SFnet with the better positioned end caps and prime spacesexperiencing a higher rate. Several big box facilities remainvacant. Occupancy in the retail sector is approximately 85%.The bid/ask in Martin and St. Lucie counties for investmentproperties remains wide spread and financing investmentproperties remains a challenge.Land prices are at 20-50% of their value from the 2004-2006 period. Foreclosed, aggressively priced, bank-ownedland is predominant in the market. In the multifamily market,finished residential lots have shown stronger appeal in2009. Several transactions have closed in the $25,000-$50,000/lot range for lot packages ranging from 15-30 ormore lots.The overall outlook is better than at the beginning of 2009.Most investors and businesses feel there is genuine opportunitybut remain cautious in their outlook. It is expectedthat in <strong>2010</strong> foreclosures will continue to spread into thecommercial markets but there will be opportunities for thosein a position to take advantage of them.Jacksonville At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICEPremium (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILDowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$$$$$$$$$$$17.5017.009.9217.5017.0014.503.743.007.7010.318.8912.6414.69$$$$$$$$$$$$$19.7221.2318.9121.5021.5019.508.526.2214.9119.0421.6013.3936.21$$$$$$$$$$$$$17.8320.4117.8219.1020.6218.024.364.289.8914.3114.2913.0124.5116.2%16.1%12.4%12.2%13.8%17.2%10.1%12.8%13.3%8.2%10.3%12.9%7.4%DEVELOPMENT LAND Low/Acre High/AcreOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-park$$$$250,000.00125,000.00130,000.0085,000.00$$$$600,000.00425,000.00350,000.00550,000.00Retail/<strong>Commercial</strong> Land$ 125,000.00 $ 1,000,000.00Residential$ 8,500.00 $ 450,000.00Martin & St. Lucie Counties At A Glance(Rent/SF/YR) Low High Effective Avg. VacancyDOWNTOWN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)$$$$$12.0012.007.0010.008.00$$$$$20.0016.0012.0015.0013.00$ 16.00$ 14.00$ 10.00$ 12.50$ 10.0015.0%15.0%25.0%20.0%20.0%Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAIL$$$6.005.004.00N/A$$$10.007.006.00N/A$$$7.506.005.00N/A25.0%50.0%50.0%N/ADowntownNeighborhood Service CentersCommunity Power CenterRegional Malls$$$15.0012.0015.00N/A$$$20.0018.0020.00N/A$ 17.50$ 15.00$ 17.50N/A15.0%20.0%18.0%N/ADEVELOPMENT LAND Low/Acre High/AcreOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential$$$$$$450,000.00200,000.0075,000.00100,000.00500,000.0020,000.00$$$$$$650,000.00400,000.00150,000.00200,000.00875,000.0050,000.00<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 84

- Page 1 and 2:

CommercialCommercial Real Estate Se

- Page 3 and 4:

■ ■ ■ Table of ContentsGENERA

- Page 5 and 6:

Global OutlookCommercial real estat

- Page 7 and 8:

38.3% in November 2009. At the same

- Page 9 and 10:

quality than the Census properties.

- Page 11 and 12:

SaskatchewanSaskatchewan is a small

- Page 13 and 14:

As 2009 draws to a close, there is

- Page 15 and 16:

Global investment interest largely

- Page 18 and 19:

ChinaChina continued to post large

- Page 20 and 21:

MalaysiaWith Malaysia’s dependenc

- Page 22 and 23:

■ US Highlights - Northeast Regio

- Page 24 and 25:

■ US Highlights - Midwest Region

- Page 26 and 27:

■ US Highlights - West Region■

- Page 28 and 29:

Melbourne, AustraliaBeijing, ChinaC

- Page 30 and 31:

Shanghai, ChinaXiamen, ChinaContact

- Page 32 and 33:

Delhi, Gurgaon, IndiaHyderabad, Pra

- Page 34 and 35: Punjab, IndiaTokyo, JapanContactNAI

- Page 36 and 37: Seoul, South KoreaTaipei, TaiwanCon

- Page 38 and 39: Calgary, Alberta, CanadaEdmonton, A

- Page 40 and 41: Halifax, Nova Scotia, CanadaOttawa,

- Page 42 and 43: Regina, Saskatchewan, CanadaContact

- Page 44 and 45: Vienna, AustriaThe Baltics (Latvia/

- Page 46 and 47: Copenhagen, DenmarkFinlandContactNA

- Page 48 and 49: Athens, GreeceReykjavik IcelandCont

- Page 50 and 51: KuwaitOslo, NorwayContactNAI Kuwait

- Page 52 and 53: Moscow, Russian FederationSt. Peter

- Page 54 and 55: Madrid, SpainStockholm, SwedenConta

- Page 56 and 57: Istanbul, TurkeyKiev, UkraineContac

- Page 58 and 59: Latin AmericaSECTION CONTENTSBuenos

- Page 60 and 61: Campinas, BrazilCuritiba, BrazilCon

- Page 62 and 63: Sao Paulo, BrazilSantiago, ChileCon

- Page 64 and 65: Ciudad Juarez, Chihuahua, MexicoGua

- Page 66 and 67: Matamoros, Tamaulipas, MexicoMexica

- Page 68 and 69: Reynosa, MexicoSaltillo, Coahuila,

- Page 70 and 71: Torreon, Coahulia, MexicoCaracas, V

- Page 72 and 73: Birmingham, AlabamaHuntsville, Deca

- Page 74 and 75: Jonesboro, ArkansasLittle Rock, Ark

- Page 76 and 77: Marin County, CaliforniaMonterey, C

- Page 78 and 79: Sacramento, CaliforniaSan Diego, Ca

- Page 80 and 81: Santa Clara County (Silicon Valley)

- Page 82 and 83: Colorado Springs, ColoradoDenver, C

- Page 86 and 87: Miami, FloridaOrlando, FloridaConta

- Page 88 and 89: Atlanta, GeorgiaHonolulu, HawaiiCon

- Page 90 and 91: Chicago, IllinoisSpringfield, Illin

- Page 92 and 93: Cedar Rapids, Iowa City, IowaDavenp

- Page 94 and 95: Wichita, KansasLexington, KentuckyC

- Page 96 and 97: Monroe, LouisianaNew Orleans, Louis

- Page 98 and 99: Suburban MarylandBoston, Massachuse

- Page 100 and 101: Grand Rapids, MichiganLansing, Mich

- Page 102 and 103: St. Louis, MissouriBozeman, Montana

- Page 104 and 105: Omaha, NebraskaLas Vegas, NevadaCon

- Page 106 and 107: Portsmouth, New HampshireAtlantic C

- Page 108 and 109: Ocean/Monmouth Counties (“Shore M

- Page 110 and 111: Las Cruces, New MexicoAlbany, New Y

- Page 112 and 113: Asheville, North CarolinaCharlotte,

- Page 114 and 115: Fargo, North DakotaAkron, OhioConta

- Page 116 and 117: Cleveland, OhioColumbus, OhioContac

- Page 118 and 119: Tulsa, OklahomaPortland, OregonCont

- Page 120 and 121: Bucks County, PennsylvaniaHarrisbur

- Page 122 and 123: Pittsburgh, PennsylvaniaSchuylkill

- Page 124 and 125: Greenville/Spartanburg/Anderson Cou

- Page 126 and 127: Knoxville, TennesseeMemphis, Tennes

- Page 128 and 129: Beaumont, TexasCorpus Christi, Texa

- Page 130 and 131: Fort Worth, TexasHouston, TexasCont

- Page 132 and 133: Texarkana (Bowie County, Texas/Mill

- Page 134 and 135:

Northern VirginiaSeattle/Puget Soun

- Page 136 and 137:

Madison, WisconsinMilwaukee, Wiscon

- Page 138 and 139:

Jackson Hole, WyomingContactNAI Jac

- Page 140:

Build on the power of our network.N