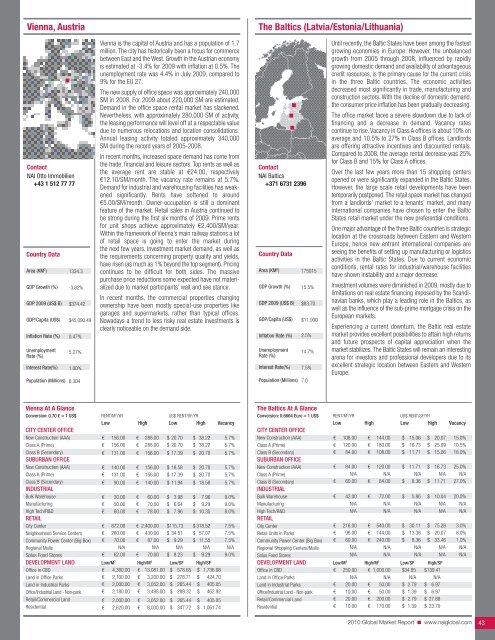

Vienna, AustriaThe Baltics (Latvia/Estonia/Lithuania)Contact<strong>NAI</strong> Otto Immobilien+43 1 512 77 77Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)UnemploymentRate (%)Interest Rate(%)1334.3-3.82%$374.42$45,090.490.47%5.27%1.00%Population (Millions) 8.304Vienna is the capital of Austria and has a population of 1.7million. The city has historically been a focus for commercebetween East and the West. Growth in the Austrian economyis estimated at -3.4% for 2009 with inflation at 0.5%. Theunemployment rate was 4.4% in July 2009, compared to9% for the EU 27.The new supply of office space was approximately 240,000SM in 2008. For 2009 about 220,000 SM are estimated.Demand in the office space rental market has slackened.Nevertheless, with approximately 280,000 SM of activity,the leasing performance will level off at a respectable valuedue to numerous relocations and location consolidations.Annual leasing activity totaled approximately 340,000SM during the record years of 2005-2008.In recent months, increased space demand has come fromthe trade, financial and leisure sectors. Top rents as well asthe average rent are stable at €24.00, respectively€12.10/SM/month. The vacancy rate remains at 5.7%.Demand for industrial and warehousing facilities has weakenedsignificantly. Rents have softened to around€5.00/SM/month. Owner-occupation is still a dominantfeature of the market. Retail sales in Austria continued tobe strong during the first six months of 2009. Prime rentsfor unit shops achieve approximately €2,400/SM/year.Within the framework of Vienna’s main railway stations a lotof retail space is going to enter the market duringthe next few years. Investment market demand, as well asthe requirements concerning property quality and yields,have risen (as much as 1% beyond the top segment). Pricingcontinues to be difficult for both sides. The massivepurchase price reductions some expected have not materializeddue to market participants’ wait and see stance.In recent months, the commercial properties changingownership have been mostly special-use properties likegarages and supermarkets, rather than typical offices.Nowadays a trend to less risky real estate investments isclearly noticeable on the demand side.Contact<strong>NAI</strong> Baltics+371 6731 2396Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)UnemploymentRate (%)Interest Rate(%)17501515.5%$83.70$11,9002.5%14.7%7.5%Population (Millions) 7.0Until recently, the Baltic States have been among the fastestgrowing economies in Europe. However, the unbalancedgrowth from 2005 through 2008, influenced by rapidlygrowing domestic demand and availability of advantageouscredit resources, is the primary cause for the current crisisin the three Baltic countries. The economic activitiesdecreased most significantly in trade, manufacturing andconstruction sectors. With the decline of domestic demand,the consumer price inflation has been gradually decreasing.The office market faces a severe slowdown due to lack offinancing and a decrease in demand. Vacancy ratescontinue to rise. Vacancy in Class A offices is about 10% onaverage and 10.5% to 27% in Class B offices. Landlordsare offering attractive incentives and discounted rentals.Compared to 2008, the average rental decrease was 25%for Class B and 15% for Class A offices.Over the last few years more than 15 shopping centersopened or were significantly expanded in the Baltic States.However, the large scale retail developments have beentemporarily postponed. The retail space market has changedfrom a landlords’ market to a tenants’ market, and manyinternational companies have chosen to enter the BalticStates retail market under the new preferential conditions.One major advantage of the three Baltic countries is strategiclocation at the crossroads between Eastern and WesternEurope, hence new entrant international companies areseeing the benefits of setting up manufacturing or logisticsactivities in the Baltic States. Due to current economicconditions, rental rates for industrial/warehouse facilitieshave shown instability and a major decrease.Investment volumes were diminished in 2009, mostly due tolimitations on real estate financing imposed by the Scandinavianbanks, which play a leading role in the Baltics, aswell as the influence of the sub-prime mortgage crisis on theEuropean markets.Experiencing a current downturn, the Baltic real estatemarket provides excellent possibilities to attain high returnsand future prospects of capital appreciation when themarket stabilizes. The Baltic States will remain an interestingarena for investors and professional developers due to itsexcellent strategic location between Eastern and WesternEurope.Vienna At A GlanceConversion: 0.70 € = 1 US$ RENT/M 2 /YR US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIAL€€€€€€156.00156.00131.00140.00131.0090.00€€€€€€288.00288.00156.00156.00156.00140.00$ 20.70$ 20.70$ 17.39$ 18.58$ 17.39$ 11.94$ 38.22$ 38.22$ 20.70$ 20.70$ 20.70$ 18.585.7%5.7%5.7%5.7%5.7%5.7%Bulk WarehouseManufacturing€€30.0050.00€€60.0070.00$$3.986.64$$7.969.299.0%9.0%High Tech/R&DRETAIL€ 60.00 € 78.00 $ 7.96 $ 10.35 8.0%City Center€ 872.00 € 2,400.00 $115.73 $ 318.52 7.5%Neighborhood Service Centers € 260.00 € 430.00 $ 34.51 $ 57.07 7.5%Community Power Center (Big Box)Regional Malls€ 70.00N/A€ 87.00N/A$ 9.29N/A$ 11.55N/A7.5%N/ASolus Food Stores€ 62.00 € 70.00 $ 8.23 $ 9.29 9.0%DEVELOPMENT LAND Low/M 2 High/M 2 Low/SF High/SFOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential€ 4,360.00 € 13,081.00 $ 578.65 $ 1,736.08€ 2,100.00 € 3,200.00 $ 278.71 $ 424.70€ 2,000.00 € 3,052.00 $ 265.44 $ 405.05€ 2,180.00 € 3,488.00 $ 289.32 $ 462.92€ 2,000.00 € 3,052.00 $ 265.44 $ 405.05€ 2,620.00 € 8,000.00 $ 347.72 $ 1,061.74The Baltics At A GlanceConversion: 0.6664 Euro = 1 US$ RENT/M 2 /YR US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAILCity CenterRetail Units in ParksCommunity Power Center (Big Box)Regional Shopping Centers/MallsSolus Food Stores€€€€€€€€€108.00120.0084.0084.00N/A60.0042.00N/AN/A216.0096.0060.00N/AN/A€€€€€€€€€144.00180.00108.00120.00N/A84.0072.00N/AN/A540.00144.00240.00N/AN/A$$$$$$$$$15.0616.7311.7111.71N/A8.365.86N/AN/A30.1113.388.36N/AN/A$$$$$$$$$20.0725.0915.0616.73N/A11.7110.04N/AN/A75.2820.0733.46N/AN/A15.0%10.5%18.0%25.0%N/A27.0%20.0%N/AN/A3.0%8.0%1.0%N/AN/ADEVELOPMENT LAND Low/M 2 High/M 2 Low/SF High/SFOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential€ 250.00 € 1,000.00 $34.85 $139.41N/A N/A N/A N/A€ 20.00 € 50.00 $ 2.79 $ 6.97€ 10.00 € 50.00 $ 1.39 $ 6.97€ 20.00 € 200.00 $ 2.79 $ 27.88€ 10.00 € 170.00 $ 1.39 $ 23.70<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 43

Sofia, BulgariaPrague, Czech RepublicContact<strong>NAI</strong> ProCon+359 2 943 43 75Country DataArea (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)UnemploymentRate (%)1334.3-6.50%$44.78$5,916.220.61%8.23%The downturn was first felt in October 2008. Deterioratingdomestic demand has led to a contraction of Bulgaria’seconomy by 5.8-7.1% in Q2 2009. The country's economydeteriorated significantly throughout 2009. Investment volumeis off 60% compared to 2008. Most commercial developmentplans have either been stopped or are on hold.The market was characterized by weakened domesticdemand in comparison to the previous year. Rising exportswill help offset that weakened demand, but expectations arefor continued negative GDP. Mostly because the adjustmentprocess is still going on and because the currency is fixed,most of this adjustment takes place at a slower pace. Recentdata indicates that inflation is heading to a negative territorywhich, in turn, is also hurting the GDP growth. Bulgariareported a monthly deflation of non-EU harmonizedconsumer prices for July, for a third month in a row. We areseeing a further deterioration in domestic demand, which isthe key factor for the deepening erosion of GDP. At the sametime, net exports should be contributing positively but thatwill not be enough to offset the slump of the domesticdemand component.Plans to start development of nine industrial parks are onhold. Most of the transactions are done by local players. Theonly property transactions that are continuing are the seasonaland holiday properties along the Black Sea coast, buteven those are moving along at a much slower pace. Bankshave gradually started to open up for credit but at muchhigher interest rates than a year ago.The office market has remained the most developedcommercial property sector in Bulgaria, primarily concentratedin Sofia. Vacancy rates are in the range of 13.5% withvacancy rates of 19.6% in the suburban areas. Four newshopping malls opened and reached 220,000 SM. The firstCarrefour hypermarket opened n Burgas.Contact<strong>NAI</strong> MIPA+420 224 818 677Country Data*Area (KM 2 )GDP Growth (%)GDP 2009 (US$ B)GDP/Capita (US$)Inflation Rate (%)UnemploymentRate (%)1334.3-4.32%$189.67$18,193.651.04%7.93%With a global economic downturn and GDP in negativeterritory, the Czech Republic has witnessed a slowdown indevelopment and investment throughout all of 2009. Newoffice, retail and industrial development has significantlydiminished due to a lack of financing and reduced tenantdemand. This also applies to shopping centre development,which has almost come to a halt.Prague has 2.6 million SM of modern office space composedof 50% inner city, 30% outer city and 20% city centre with70% new buildings and 30% refurbished. Vacancy is around13%. Prague will see about 130,000 SM of new space in2009, a year over year drop of 60%. Pankrac Budejovicka’soffice hub continued to be the preferred location. Significantprojects include Prague Marina, Factory Futurama andPrague 8. Only 85,000 SM of modern office space will comeon the Prague market in <strong>2010</strong>. This will ease thedemand/supply situation and help to maintain rents.The Czech Republic has 240 SM of shopping centre spaceper 1,000 inhabitants. Of this, 1.9 million is in shoppingcentres and 600,000 SM in retail parks. Openingsinclude Forum Liberec (20,000 SM), Liberec Plaza (19,500SM), Skodovka Klatovy (16,000 SM), Forum Usti nad labem(26,400 SM), Olympia Brno (25,000 SM), Area Bory PhaseII (15,000 SM), Atrium Hradec Kralove (7,300 SM) and retailPark Kladno (6,000 SM). There are currently two outletcenters. There is a total inventory of 3,277,000 SM of industrialspace in the region; 1,600,000 SM in Prague and1,680,000 SM in the rest of the Czech Republic. Vacancy isat 20%. Rent remains low at €3-€4.5/SM/month.The commercial real estate investment market is experiencinga surprisingly low level of activity and of the foursignificant office investments transacted in 2009, two wereagreements made from previous years. The most significanttransactions have been the purchase of JungmannovaPlaza Gemini and Prague 4 by Deka. Yields were 7% and7.5%, respectively.Financing of new developments remains key. Rates aredown but pre-leasing requirements are up. Since demandfor space is dramatically reduced, this has led to manydevelopment sites being put on hold.Interest Rate(%)1.00%Interest Rate(%)1.25%Population (Millions)7.569Population (Millions) 10.425Sofia At A GlanceConversion: 0.6681 € = 1 US$ RENT/M 2 /MO US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIALBulk WarehouseManufacturingHigh Tech/R&DRETAIL€€€€€€€€€25.0010.005.0015.008.005.003.002.004.00€€€€€€€€€35.0016.0010.0025.0012.007.005.004.006.00$$$$$$$$$41.7216.698.3425.0313.358.345.013.346.67$$$$$$$$$58.4026.7016.6941.7220.0211.688.346.6710.01N/AN/AN/AN/AN/AN/AN/AN/AN/ACity Center (High Street Shop) € 50.00 € 100.00 $ 83.43 $ 166.87 N/ANeighborhood Service CentersCommunity Power Center(Big Box)Regional Shopping Centers/MallSolus Food Stores€€€€20.006.0015.006.00€€€€40.008.0025.008.00$$$$33.3710.0125.0310.01$$$$66.7513.3541.7213.35N/AN/AN/AN/ADEVELOPMENT LAND Low/M 2 High/M 2 Low/SF High/SFOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidentialN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/AN/A N/A N/A N/APrague At A GlanceConversion: .793 EUR = 1 US$ RENT/M 2 /MO US$ RENT/SF/YRLow High Low High VacancyCITY CENTER OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)SUBURBAN OFFICENew Construction (AAA)Class A (Prime)Class B (Secondary)INDUSTRIAL€€€€€€220.00140.00130.00160.00140.00100.00€€€€€€240.00180.00160.00180.00160.00130.00$ 29.62$ 18.85$ 17.50$ 21.54$ 18.85$ 13.46$$$$$$32.3124.2421.5424.2421.5417.5013.0%13.5%14.0%13.0%11.0%10.0%Bulk WarehouseManufacturingHigh Tech/R&DRETAIL€€€66.0055.0040.00€€€72.0060.0050.00$$$8.897.415.39$$$9.698.086.733.0%3.0%3.0%City Center€ 1,320.00 € 1,800.00 $ 177.73 $ 242.35 2.0%Neighborhood Service CentersCommunity Power Center (Big Box)Regional Shopping Centers/MallsSolus Food Stores€€€€420.00100.00480.00120.00€€€€480.00140.00660.00140.00$ 56.55$ 13.46$ 64.63$ 16.16$$$$64.6318.8588.8618.855.0%3.0%5.0%N/ADEVELOPMENT LAND Low/M 2 High/M 2 Low/SF High/SFOffice in CBDLand in Office ParksLand in Industrial ParksOffice/Industrial Land - Non-parkRetail/<strong>Commercial</strong> LandResidential€ 300.00 € 1,000.00 $ 40.39 $ 134.64€ 116.00 € 166.00 $ 15.62 $ 22.35€ 30.00 € 60.00 $ 4.04 $ 8.08€ 16.00 € 33.00 $ 2.15 $ 4.44€ 40.00 € 70.00 $ 5.39 $ 9.42€ 30.00 € 90.00 $ 4.04 $ 12.12<strong>2010</strong> <strong>Global</strong> <strong>Market</strong> <strong>Report</strong> ■ www.naiglobal.com 44

- Page 1 and 2: CommercialCommercial Real Estate Se

- Page 3 and 4: ■ ■ ■ Table of ContentsGENERA

- Page 5 and 6: Global OutlookCommercial real estat

- Page 7 and 8: 38.3% in November 2009. At the same

- Page 9 and 10: quality than the Census properties.

- Page 11 and 12: SaskatchewanSaskatchewan is a small

- Page 13 and 14: As 2009 draws to a close, there is

- Page 15 and 16: Global investment interest largely

- Page 18 and 19: ChinaChina continued to post large

- Page 20 and 21: MalaysiaWith Malaysia’s dependenc

- Page 22 and 23: ■ US Highlights - Northeast Regio

- Page 24 and 25: ■ US Highlights - Midwest Region

- Page 26 and 27: ■ US Highlights - West Region■

- Page 28 and 29: Melbourne, AustraliaBeijing, ChinaC

- Page 30 and 31: Shanghai, ChinaXiamen, ChinaContact

- Page 32 and 33: Delhi, Gurgaon, IndiaHyderabad, Pra

- Page 34 and 35: Punjab, IndiaTokyo, JapanContactNAI

- Page 36 and 37: Seoul, South KoreaTaipei, TaiwanCon

- Page 38 and 39: Calgary, Alberta, CanadaEdmonton, A

- Page 40 and 41: Halifax, Nova Scotia, CanadaOttawa,

- Page 42 and 43: Regina, Saskatchewan, CanadaContact

- Page 46 and 47: Copenhagen, DenmarkFinlandContactNA

- Page 48 and 49: Athens, GreeceReykjavik IcelandCont

- Page 50 and 51: KuwaitOslo, NorwayContactNAI Kuwait

- Page 52 and 53: Moscow, Russian FederationSt. Peter

- Page 54 and 55: Madrid, SpainStockholm, SwedenConta

- Page 56 and 57: Istanbul, TurkeyKiev, UkraineContac

- Page 58 and 59: Latin AmericaSECTION CONTENTSBuenos

- Page 60 and 61: Campinas, BrazilCuritiba, BrazilCon

- Page 62 and 63: Sao Paulo, BrazilSantiago, ChileCon

- Page 64 and 65: Ciudad Juarez, Chihuahua, MexicoGua

- Page 66 and 67: Matamoros, Tamaulipas, MexicoMexica

- Page 68 and 69: Reynosa, MexicoSaltillo, Coahuila,

- Page 70 and 71: Torreon, Coahulia, MexicoCaracas, V

- Page 72 and 73: Birmingham, AlabamaHuntsville, Deca

- Page 74 and 75: Jonesboro, ArkansasLittle Rock, Ark

- Page 76 and 77: Marin County, CaliforniaMonterey, C

- Page 78 and 79: Sacramento, CaliforniaSan Diego, Ca

- Page 80 and 81: Santa Clara County (Silicon Valley)

- Page 82 and 83: Colorado Springs, ColoradoDenver, C

- Page 84 and 85: Fort Lauderdale, FloridaFt. Myers/N

- Page 86 and 87: Miami, FloridaOrlando, FloridaConta

- Page 88 and 89: Atlanta, GeorgiaHonolulu, HawaiiCon

- Page 90 and 91: Chicago, IllinoisSpringfield, Illin

- Page 92 and 93: Cedar Rapids, Iowa City, IowaDavenp

- Page 94 and 95:

Wichita, KansasLexington, KentuckyC

- Page 96 and 97:

Monroe, LouisianaNew Orleans, Louis

- Page 98 and 99:

Suburban MarylandBoston, Massachuse

- Page 100 and 101:

Grand Rapids, MichiganLansing, Mich

- Page 102 and 103:

St. Louis, MissouriBozeman, Montana

- Page 104 and 105:

Omaha, NebraskaLas Vegas, NevadaCon

- Page 106 and 107:

Portsmouth, New HampshireAtlantic C

- Page 108 and 109:

Ocean/Monmouth Counties (“Shore M

- Page 110 and 111:

Las Cruces, New MexicoAlbany, New Y

- Page 112 and 113:

Asheville, North CarolinaCharlotte,

- Page 114 and 115:

Fargo, North DakotaAkron, OhioConta

- Page 116 and 117:

Cleveland, OhioColumbus, OhioContac

- Page 118 and 119:

Tulsa, OklahomaPortland, OregonCont

- Page 120 and 121:

Bucks County, PennsylvaniaHarrisbur

- Page 122 and 123:

Pittsburgh, PennsylvaniaSchuylkill

- Page 124 and 125:

Greenville/Spartanburg/Anderson Cou

- Page 126 and 127:

Knoxville, TennesseeMemphis, Tennes

- Page 128 and 129:

Beaumont, TexasCorpus Christi, Texa

- Page 130 and 131:

Fort Worth, TexasHouston, TexasCont

- Page 132 and 133:

Texarkana (Bowie County, Texas/Mill

- Page 134 and 135:

Northern VirginiaSeattle/Puget Soun

- Page 136 and 137:

Madison, WisconsinMilwaukee, Wiscon

- Page 138 and 139:

Jackson Hole, WyomingContactNAI Jac

- Page 140:

Build on the power of our network.N