SACS Compliance Certification Report (PDF) - South Florida State ...

SACS Compliance Certification Report (PDF) - South Florida State ...

SACS Compliance Certification Report (PDF) - South Florida State ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

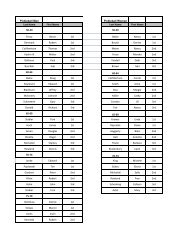

To further ensure financial stability and appropriate stewardship of resources, the college undergoes anannual, mid-year budget review at the end of January. All budget managers are asked to evaluate theirbudgets, needs and plans. Budget managers indicate if they have enough funds, need more funds, or ifthey have excess funds that can be re-distributed (See example of mid-year appeal to all budgetmanagers). The revised expenditure needs are compared to revised revenue projections based on the falland spring enrollments and presented to the VPAS and the President for consideration. Depending onthe availability of funds, strategic priorities for current and future years plans are revised accordingly tomeet what current financial resources are able to provide while maintaining a fund balance that exceeds5% of ending fund balance. For greater detail regarding the development and approval of the college'sbudget, see Core Requirement 2.11.1.Procurement and ExpendituresThe coordinator of purchasing is responsible for assuring that the college’s purchasing practices adhereto SFCC District Board of Trustees (DBOT) Policy 4.04 and SFCC Administrative Procedure4040, which outline responsibilities for purchases and competitive selections. Additionally, DBOTPolicy 4.18 and SFCC Administrative Procedure 4180 govern travel, and DBOT Policy 5.20 andSFCC Administrative Procedure 5200 govern consultant employment. Internal controls assure thatproper separation of duties are in place over college disbursements (see SFCC AdministrativeProcedure 2050). No single staff member has complete control over all aspects of any financialtransaction. The college uses the encumbrance method of accounting for purchases. Purchase requisitions(purchase orders) and invoices are approved by the appropriate personnel and submitted to the presidentor VPAS for final approval. All checks have the facsimile signatures of the DBOT Chair and the Presidentof the college.From a system's perspective, the college uses Sungard's Banner integrated administrative software forprocurement transactions, as well as all other financial activities (accounts payable, payroll, financialreporting, etc.) There is a defined approval structure that is maintained for requisitions' procurement, p-card transactions, and requests for funds (see SFCC Administrative Procedure 4040).Inventory and Asset ManagementThe college maintains control and has accurate and up-to-date records over its physical assets asprescribed by DBOT Policy 2.07 and SFCC Administrative Procedure 2074. Capital assets aretagged and physically inventoried annually by the college's staff. All exceptions identified during thephysical inventory process are investigated and resolved to the satisfaction of management. Collegeassets are also subject to verification by the college's independent auditors.To further reduce the risk of economic loss, the college maintains adequate insurance coverage on itsassets.Cash and InvestmentsThe college maintains centralized or pooled checking accounts at qualified public depositories (QPD). Allsuch deposits are insured by Federal depository insurance, up to specified limits, or collateralized withsecurities held in <strong>Florida</strong>'s multiple financial institution collateral pool as required by <strong>Florida</strong> Statute(FS) 280. Cash collections are deposited into authorized banking institutions on a daily basis inaccordance with SFCC Administrative Procedure 4090 . Any cash on hand is kept in a locked,fireproof file cabinet or a safe so that physical access to cash is restricted to authorized personnel.Surplus or excess daily funds earn interest equivalent to the federal funds rate in the college's mainchecking account. Additional investments of surplus cash are made into the Local GovernmentInvestment Pool (LGIP) that is managed by the <strong>Florida</strong> <strong>State</strong> Board of Administration and the SpecialPurpose Investment Account (SPIA) that is managed by the <strong>State</strong> of <strong>Florida</strong> Treasurer. All funds areinvested in accordance with SFCC's investment policy, DBOT Policy 4.15, and SFCC AdministrativeProcedure 4150.<strong>South</strong> <strong>Florida</strong> Community College Page 166 / 202