2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

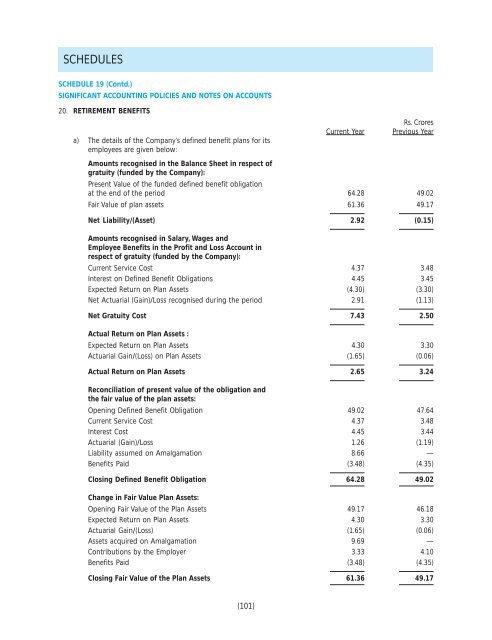

SCHEDULESSCHEDULE 19 (Contd.)SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTS20. RETIREMENT BENEFITSa) The details of the Company’s defined benefit plans for itsemployees are given below:Current YearRs. CroresPrevious YearAmounts recognised in the Balance Sheet in respect ofgratuity (funded by the Company):Present Value of the funded defined benefit obligationat the end of the period 64.28 49.02Fair Value of plan assets 61.36 49.17Net Liability/(Asset) 2.92 (0.15)Amounts recognised in Salary, Wages andEmployee Benefits in the Profit and Loss Account inrespect of gratuity (funded by the Company):Current Service Cost 4.37 3.48Interest on Defined Benefit Obligations 4.45 3.45Expected Return on Plan Assets (4.30) (3.30)Net Actuarial (Gain)/Loss recognised during the period 2.91 (1.13)Net Gratuity Cost 7.43 2.50Actual Return on Plan Assets :Expected Return on Plan Assets 4.30 3.30Actuarial Gain/(Loss) on Plan Assets (1.65) (0.06)Actual Return on Plan Assets 2.65 3.24Reconciliation of present value of the obligation andthe fair value of the plan assets:Opening Defined Benefit Obligation 49.02 47.64Current Service Cost 4.37 3.48Interest Cost 4.45 3.44Actuarial (Gain)/Loss 1.26 (1.19)Liability assumed on Amalgamation 8.66 —Benefits Paid (3.48) (4.35)Closing Defined Benefit Obligation 64.28 49.02Change in Fair Value Plan Assets:Opening Fair Value of the Plan Assets 49.17 46.18Expected Return on Plan Assets 4.30 3.30Actuarial Gain/(Loss) (1.65) (0.06)Assets acquired on Amalgamation 9.69 —Contributions by the Employer 3.33 4.10Benefits Paid (3.48) (4.35)Closing Fair Value of the Plan Assets 61.36 49.17(101)