2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

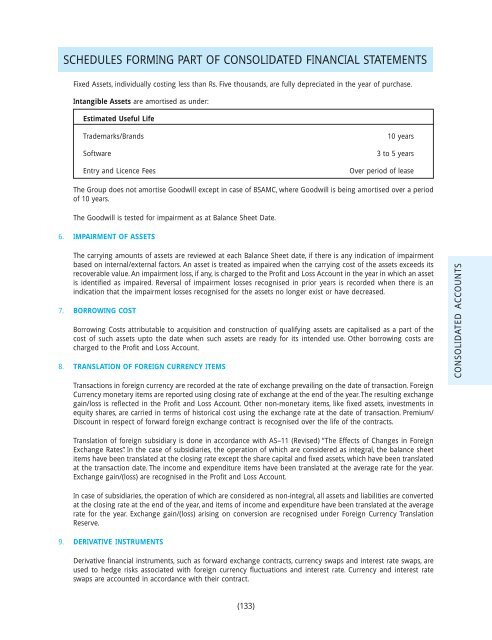

SCHEDULES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTSFixed Assets, individually costing less than Rs. Five thousands, are fully depreciated in the year of purchase.Intangible Assets are amortised as under:Estimated Useful LifeTrademarks/BrandsSoftwareEntry and Licence Fees10 years3 to 5 yearsOver period of leaseThe Group does not amortise Goodwill except in case of BSAMC, where Goodwill is being amortised over a periodof 10 years.The Goodwill is tested for impairment as at Balance Sheet Date.6. IMPAIRMENT OF ASSETSThe carrying amounts of assets are reviewed at each Balance Sheet date, if there is any indication of impairmentbased on internal/external factors. An asset is treated as impaired when the carrying cost of the assets exceeds itsrecoverable value. An impairment loss, if any, is charged to the Profit and Loss Account in the year in which an assetis identified as impaired. Reversal of impairment losses recognised in prior years is recorded when there is anindication that the impairment losses recognised for the assets no longer exist or have decreased.7. BORROWING COSTBorrowing Costs attributable to acquisition and construction of qualifying assets are capitalised as a part of thecost of such assets upto the date when such assets are ready for its intended use. Other borrowing costs arecharged to the Profit and Loss Account.8. TRANSLATION OF FOREIGN CURRENCY ITEMSTransactions in foreign currency are recorded at the rate of exchange prevailing on the date of transaction. ForeignCurrency monetary items are reported using closing rate of exchange at the end of the year. The resulting exchangegain/loss is reflected in the Profit and Loss Account. Other non-monetary items, like fixed assets, investments inequity shares, are carried in terms of historical cost using the exchange rate at the date of transaction. Premium/Discount in respect of forward foreign exchange contract is recognised over the life of the contracts.CONSOLIDATED ACCOUNTSTranslation of foreign subsidiary is done in accordance with AS–11 (Revised) “The Effects of Changes in ForeignExchange Rates”. In the case of subsidiaries, the operation of which are considered as integral, the balance sheetitems have been translated at the closing rate except the share capital and fixed assets, which have been translatedat the transaction date. The income and expenditure items have been translated at the average rate for the year.Exchange gain/(loss) are recognised in the Profit and Loss Account.In case of subsidiaries, the operation of which are considered as non-integral, all assets and liabilities are convertedat the closing rate at the end of the year, and items of income and expenditure have been translated at the averagerate for the year. Exchange gain/(loss) arising on conversion are recognised under Foreign Currency TranslationReserve.9. DERIVATIVE INSTRUMENTSDerivative financial instruments, such as forward exchange contracts, currency swaps and interest rate swaps, areused to hedge risks associated with foreign currency fluctuations and interest rate. Currency and interest rateswaps are accounted in accordance with their contract.(133)