2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

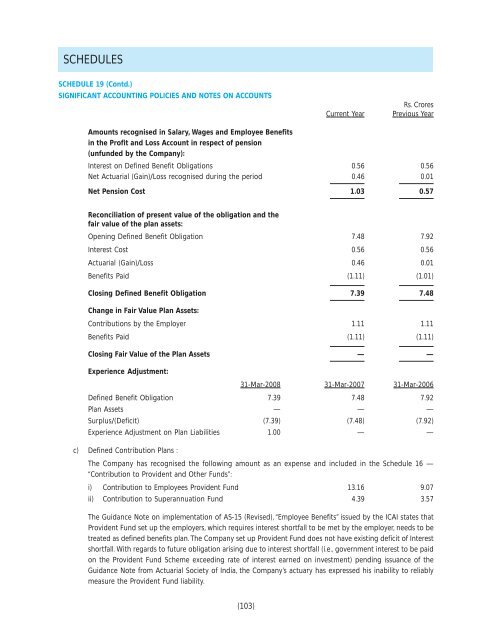

SCHEDULESSCHEDULE 19 (Contd.)SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTSCurrent YearRs. CroresPrevious YearAmounts recognised in Salary, Wages and Employee Benefitsin the Profit and Loss Account in respect of pension(unfunded by the Company):Interest on Defined Benefit Obligations 0.56 0.56Net Actuarial (Gain)/Loss recognised during the period 0.46 0.01Net Pension Cost 1.03 0.57Reconciliation of present value of the obligation and thefair value of the plan assets:Opening Defined Benefit Obligation 7.48 7.92Interest Cost 0.56 0.56Actuarial (Gain)/Loss 0.46 0.01Benefits Paid (1.11) (1.01)Closing Defined Benefit Obligation 7.39 7.48Change in Fair Value Plan Assets:Contributions by the Employer 1.11 1.11Benefits Paid (1.11) (1.11)Closing Fair Value of the Plan Assets — —Experience Adjustment:31-Mar-20<strong>08</strong> 31-Mar-<strong>2007</strong> 31-Mar-2006Defined Benefit Obligation 7.39 7.48 7.92Plan Assets — — —Surplus/(Deficit) (7.39) (7.48) (7.92)Experience Adjustment on Plan Liabilities 1.00 — —c) Defined Contribution Plans :The Company has recognised the following amount as an expense and included in the Schedule 16 —“Contribution to Provident and Other Funds”:i) Contribution to Employees Provident Fund 13.16 9.07ii) Contribution to Superannuation Fund 4.39 3.57The Guidance Note on implementation of AS-15 (Revised), “Employee Benefits” issued by the ICAI states thatProvident Fund set up the employers, which requires interest shortfall to be met by the employer, needs to betreated as defined benefits plan. The Company set up Provident Fund does not have existing deficit of Interestshortfall. With regards to future obligation arising due to interest shortfall (i.e., government interest to be paidon the Provident Fund Scheme exceeding rate of interest earned on investment) pending issuance of theGuidance Note from Actuarial Society of India, the Company’s actuary has expressed his inability to reliablymeasure the Provident Fund liability.(103)