2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

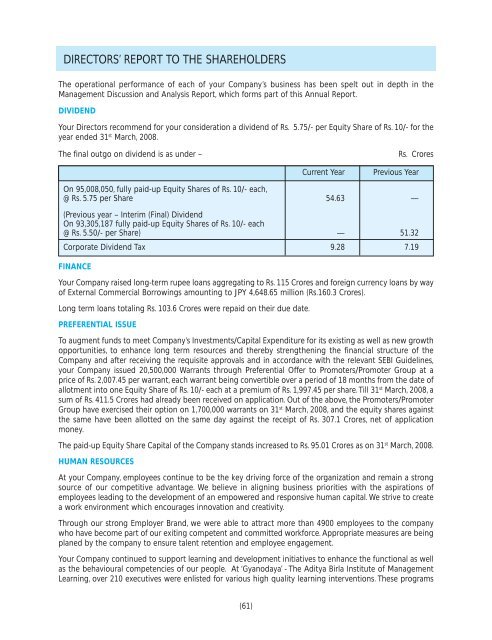

DIRECTORS’ REPORT TO THE SHAREHOLDERSThe operational performance of each of your Company’s business has been spelt out in depth in theManagement Discussion and Analysis Report, which forms part of this Annual Report.DIVIDENDYour Directors recommend for your consideration a dividend of Rs. 5.75/- per Equity Share of Rs. 10/- for theyear ended 31 st March, 20<strong>08</strong>.The final outgo on dividend is as under –Rs. CroresCurrent YearPrevious YearOn 95,0<strong>08</strong>,050, fully paid-up Equity Shares of Rs. 10/- each,@ Rs. 5.75 per Share 54.63 —(Previous year – Interim (Final) DividendOn 93,305,187 fully paid-up Equity Shares of Rs. 10/- each@ Rs. 5.50/- per Share) — 51.32Corporate Dividend Tax 9.28 7.19FINANCEYour Company raised long-term rupee loans aggregating to Rs. 115 Crores and foreign currency loans by wayof External Commercial Borrowings amounting to JPY 4,648.65 million (Rs.160.3 Crores).Long term loans totaling Rs. 103.6 Crores were repaid on their due date.PREFERENTIAL ISSUETo augment funds to meet Company’s Investments/Capital Expenditure for its existing as well as new growthopportunities, to enhance long term resources and thereby strengthening the financial structure of theCompany and after receiving the requisite approvals and in accordance with the relevant SEBI Guidelines,your Company issued 20,500,000 Warrants through Preferential Offer to Promoters/Promoter Group at aprice of Rs. 2,007.45 per warrant, each warrant being convertible over a period of 18 months from the date ofallotment into one Equity Share of Rs. 10/- each at a premium of Rs. 1,997.45 per share. Till 31 st March, 20<strong>08</strong>, asum of Rs. 411.5 Crores had already been received on application. Out of the above, the Promoters/PromoterGroup have exercised their option on 1,700,000 warrants on 31 st March, 20<strong>08</strong>, and the equity shares againstthe same have been allotted on the same day against the receipt of Rs. 307.1 Crores, net of applicationmoney.The paid-up Equity Share Capital of the Company stands increased to Rs. 95.01 Crores as on 31 st March, 20<strong>08</strong>.HUMAN RESOURCESAt your Company, employees continue to be the key driving force of the organization and remain a strongsource of our competitive advantage. We believe in aligning business priorities with the aspirations ofemployees leading to the development of an empowered and responsive human capital. We strive to createa work environment which encourages innovation and creativity.Through our strong Employer Brand, we were able to attract more than 4900 employees to the companywho have become part of our exiting competent and committed workforce. Appropriate measures are beingplaned by the company to ensure talent retention and employee engagement.Your Company continued to support learning and development initiatives to enhance the functional as wellas the behavioural competencies of our people. At ‘Gyanodaya’ - The <strong>Aditya</strong> <strong>Birla</strong> Institute of ManagementLearning, over 210 executives were enlisted for various high quality learning interventions. These programs(61)