2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

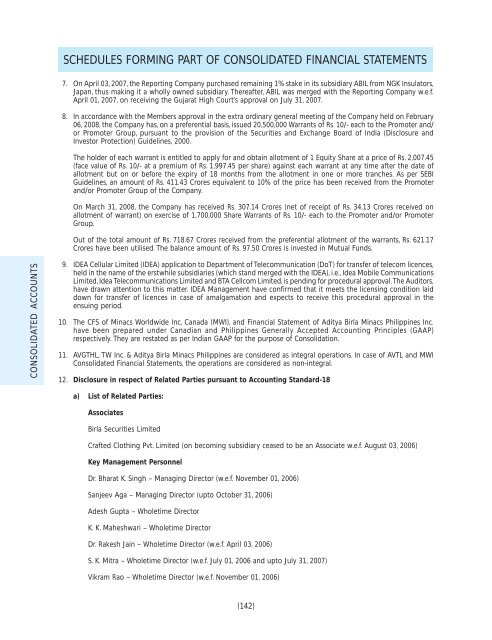

SCHEDULES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTS7. On April 03, <strong>2007</strong>, the Reporting Company purchased remaining 1% stake in its subsidiary ABIL from NGK Insulators,Japan, thus making it a wholly owned subsidiary. Thereafter, ABIL was merged with the Reporting Company w.e.f.April 01, <strong>2007</strong>, on receiving the Gujarat High Court’s approval on July 31, <strong>2007</strong>.8. In accordance with the Members approval in the extra ordinary general meeting of the Company held on February06, 20<strong>08</strong>, the Company has, on a preferential basis, issued 20,500,000 Warrants of Rs. 10/- each to the Promoter and/or Promoter Group, pursuant to the provision of the Securities and Exchange Board of India (Disclosure andInvestor Protection) Guidelines, 2000.The holder of each warrant is entitled to apply for and obtain allotment of 1 Equity Share at a price of Rs. 2,007.45(face value of Rs. 10/- at a premium of Rs. 1,997.45 per share) against each warrant at any time after the date ofallotment but on or before the expiry of 18 months from the allotment in one or more tranches. As per SEBIGuidelines, an amount of Rs. 411.43 Crores equivalent to 10% of the price has been received from the Promoterand/or Promoter Group of the Company.On March 31, 20<strong>08</strong>, the Company has received Rs. 307.14 Crores (net of receipt of Rs. 34.13 Crores received onallotment of warrant) on exercise of 1,700,000 Share Warrants of Rs. 10/- each to the Promoter and/or PromoterGroup.Out of the total amount of Rs. 718.67 Crores received from the preferential allotment of the warrants, Rs. 621.17Crores have been utilised. The balance amount of Rs. 97.50 Crores is invested in Mutual Funds.CONSOLIDATED ACCOUNTS9. IDEA Cellular Limited (IDEA) application to Department of Telecommunication (DoT) for transfer of telecom licences,held in the name of the erstwhile subsidiaries (which stand merged with the IDEA), i.e., Idea Mobile CommunicationsLimited, Idea Telecommunications Limited and BTA Cellcom Limited, is pending for procedural approval. The Auditors,have drawn attention to this matter. IDEA Management have confirmed that it meets the licensing condition laiddown for transfer of licences in case of amalgamation and expects to receive this procedural approval in theensuing period.10. The CFS of Minacs Worldwide Inc, Canada (MWI), and Financial Statement of <strong>Aditya</strong> <strong>Birla</strong> Minacs Philippines Inc.have been prepared under Canadian and Philippines Generally Accepted Accounting Principles (GAAP)respectively. They are restated as per Indian GAAP for the purpose of Consolidation.11. AVGTHL, TW Inc. & <strong>Aditya</strong> <strong>Birla</strong> Minacs Philippines are considered as integral operations. In case of AVTL and MWIConsolidated Financial Statements, the operations are considered as non-integral.12. Disclosure in respect of Related Parties pursuant to Accounting Standard-18a) List of Related Parties:Associates<strong>Birla</strong> Securities LimitedCrafted Clothing Pvt. Limited (on becoming subsidiary ceased to be an Associate w.e.f. August 03, 2006)Key Management PersonnelDr. Bharat K. Singh – Managing Director (w.e.f. November 01, 2006)Sanjeev Aga – Managing Director (upto October 31, 2006)Adesh Gupta – Wholetime DirectorK. K. Maheshwari – Wholetime DirectorDr. Rakesh Jain – Wholetime Director (w.e.f. April 03, 2006)S. K. Mitra – Wholetime Director (w.e.f. July 01, 2006 and upto July 31, <strong>2007</strong>)Vikram Rao – Wholetime Director (w.e.f. November 01, 2006)(142)