2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

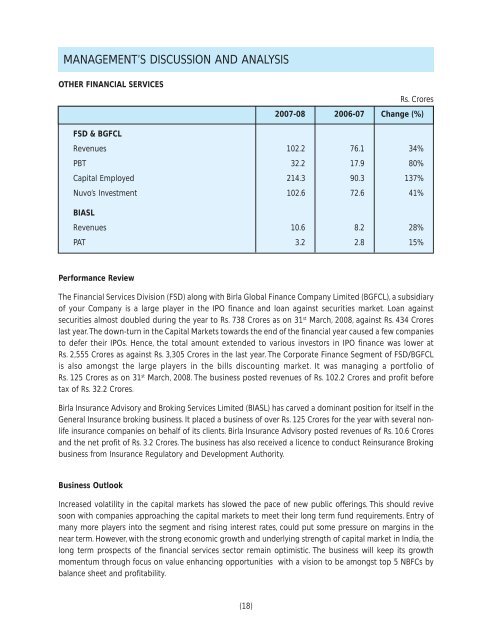

MANAGEMENT’S DISCUSSION AND ANALYSISOTHER FINANCIAL SERVICESRs. Crores<strong>2007</strong>-<strong>08</strong> 2006-07 Change (%)FSD & BGFCLRevenues 102.2 76.1 34%PBT 32.2 17.9 80%Capital Employed 214.3 90.3 137%<strong>Nuvo</strong>’s Investment 102.6 72.6 41%BIASLRevenues 10.6 8.2 28%PAT 3.2 2.8 15%Performance ReviewThe Financial Services Division (FSD) along with <strong>Birla</strong> Global Finance Company Limited (BGFCL), a subsidiaryof your Company is a large player in the IPO finance and loan against securities market. Loan againstsecurities almost doubled during the year to Rs. 738 Crores as on 31 st March, 20<strong>08</strong>, against Rs. 434 Croreslast year. The down-turn in the Capital Markets towards the end of the financial year caused a few companiesto defer their IPOs. Hence, the total amount extended to various investors in IPO finance was lower atRs. 2,555 Crores as against Rs. 3,305 Crores in the last year. The Corporate Finance Segment of FSD/BGFCLis also amongst the large players in the bills discounting market. It was managing a portfolio ofRs. 125 Crores as on 31 st March, 20<strong>08</strong>. The business posted revenues of Rs. 102.2 Crores and profit beforetax of Rs. 32.2 Crores.<strong>Birla</strong> Insurance Advisory and Broking Services Limited (BIASL) has carved a dominant position for itself in theGeneral Insurance broking business. It placed a business of over Rs. 125 Crores for the year with several nonlifeinsurance companies on behalf of its clients. <strong>Birla</strong> Insurance Advisory posted revenues of Rs. 10.6 Croresand the net profit of Rs. 3.2 Crores. The business has also received a licence to conduct Reinsurance Brokingbusiness from Insurance Regulatory and Development Authority.Business OutlookIncreased volatility in the capital markets has slowed the pace of new public offerings. This should revivesoon with companies approaching the capital markets to meet their long term fund requirements. Entry ofmany more players into the segment and rising interest rates, could put some pressure on margins in thenear term. However, with the strong economic growth and underlying strength of capital market in India, thelong term prospects of the financial services sector remain optimistic. The business will keep its growthmomentum through focus on value enhancing opportunities with a vision to be amongst top 5 NBFCs bybalance sheet and profitability.(18)