2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

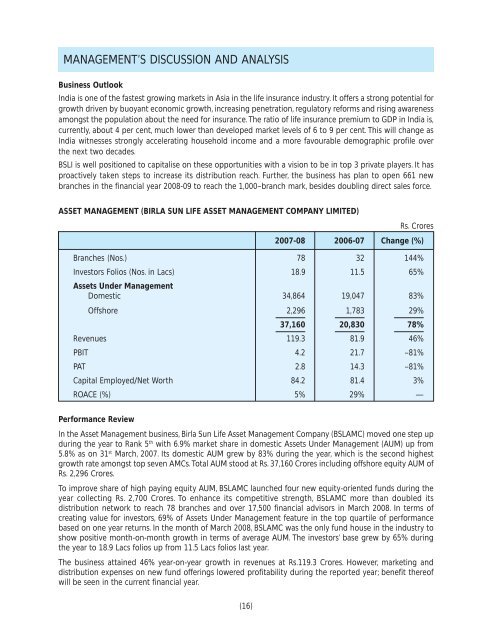

MANAGEMENT’S DISCUSSION AND ANALYSISBusiness OutlookIndia is one of the fastest growing markets in Asia in the life insurance industry. It offers a strong potential forgrowth driven by buoyant economic growth, increasing penetration, regulatory reforms and rising awarenessamongst the population about the need for insurance. The ratio of life insurance premium to GDP in India is,currently, about 4 per cent, much lower than developed market levels of 6 to 9 per cent. This will change asIndia witnesses strongly accelerating household income and a more favourable demographic profile overthe next two decades.BSLI is well positioned to capitalise on these opportunities with a vision to be in top 3 private players. It hasproactively taken steps to increase its distribution reach. Further, the business has plan to open 661 newbranches in the financial year 20<strong>08</strong>-09 to reach the 1,000–branch mark, besides doubling direct sales force.ASSET MANAGEMENT (BIRLA SUN LIFE ASSET MANAGEMENT COMPANY LIMITED)Rs. Crores<strong>2007</strong>-<strong>08</strong> 2006-07 Change (%)Branches (Nos.) 78 32 144%Investors Folios (Nos. in Lacs) 18.9 11.5 65%Assets Under ManagementDomestic 34,864 19,047 83%Offshore 2,296 1,783 29%37,160 20,830 78%Revenues 119.3 81.9 46%PBIT 4.2 21.7 –81%PAT 2.8 14.3 –81%Capital Employed/Net Worth 84.2 81.4 3%ROACE (%) 5% 29% —Performance ReviewIn the Asset Management business, <strong>Birla</strong> Sun Life Asset Management Company (BSLAMC) moved one step upduring the year to Rank 5 th with 6.9% market share in domestic Assets Under Management (AUM) up from5.8% as on 31 st March, <strong>2007</strong>. Its domestic AUM grew by 83% during the year, which is the second highestgrowth rate amongst top seven AMCs. Total AUM stood at Rs. 37,160 Crores including offshore equity AUM ofRs. 2,296 Crores.To improve share of high paying equity AUM, BSLAMC launched four new equity-oriented funds during theyear collecting Rs. 2,700 Crores. To enhance its competitive strength, BSLAMC more than doubled itsdistribution network to reach 78 branches and over 17,500 financial advisors in March 20<strong>08</strong>. In terms ofcreating value for investors, 69% of Assets Under Management feature in the top quartile of performancebased on one year returns. In the month of March 20<strong>08</strong>, BSLAMC was the only fund house in the industry toshow positive month-on-month growth in terms of average AUM. The investors’ base grew by 65% duringthe year to 18.9 Lacs folios up from 11.5 Lacs folios last year.The business attained 46% year-on-year growth in revenues at Rs.119.3 Crores. However, marketing anddistribution expenses on new fund offerings lowered profitability during the reported year; benefit thereofwill be seen in the current financial year.(16)