2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

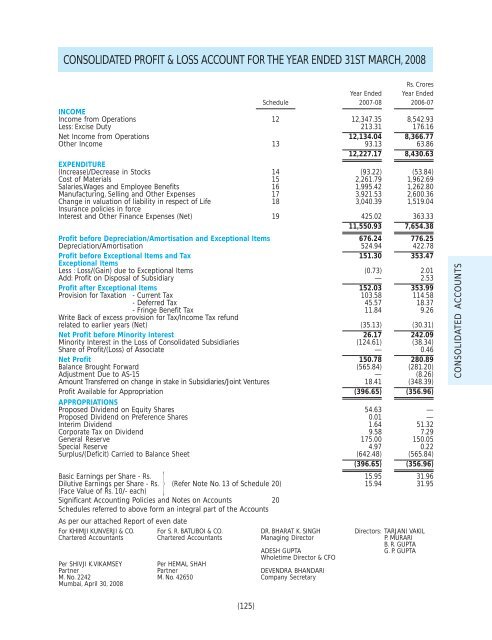

CONSOLIDATED PROFIT & LOSS ACCOUNT FOR THE YEAR ENDED 31ST MARCH, 20<strong>08</strong>Rs. CroresYear Ended Year EndedSchedule <strong>2007</strong>-<strong>08</strong> 2006-07INCOMEIncome from Operations 12 12,347.35 8,542.93Less: Excise Duty 213.31 176.16Net Income from Operations 12,134.04 8,366.77Other Income 13 93.13 63.8612,227.17 8,430.63EXPENDITURE(Increase)/Decrease in Stocks 14 (93.22) (53.84)Cost of Materials 15 2,261.79 1,962.69Salaries,Wages and Employee Benefits 16 1,995.42 1,262.80Manufacturing, Selling and Other Expenses 17 3,921.53 2,600.36Change in valuation of liability in respect of Life 18 3,040.39 1,519.04Insurance policies in forceInterest and Other Finance Expenses (Net) 19 425.02 363.3311,550.93 7,654.38Profit before Depreciation/Amortisation and Exceptional Items 676.24 776.25Depreciation/Amortisation 524.94 422.78Profit before Exceptional Items and Tax 151.30 353.47Exceptional ItemsLess : Loss/(Gain) due to Exceptional Items (0.73) 2.01Add: Profit on Disposal of Subsidiary — 2.53Profit after Exceptional Items 152.03 353.99Provision for Taxation - Current Tax 103.58 114.58- Deferred Tax 45.57 18.37- Fringe Benefit Tax 11.84 9.26Write Back of excess provision for Tax/Income Tax refundrelated to earlier years (Net) (35.13) (30.31)Net Profit before Minority Interest 26.17 242.09Minority Interest in the Loss of Consolidated Subsidiaries (124.61) (38.34)Share of Profit/(Loss) of Associate — 0.46Net Profit 150.78 280.89Balance Brought Forward (565.84) (281.20)Adjustment Due to AS-15 — (8.26)Amount Transferred on change in stake in Subsidiaries/Joint Ventures 18.41 (348.39)Profit Available for Appropriation (396.65) (356.96)APPROPRIATIONSProposed Dividend on Equity Shares 54.63 —Proposed Dividend on Preference Shares 0.01 —Interim Dividend 1.64 51.32Corporate Tax on Dividend 9.58 7.29General Reserve 175.00 150.05Special Reserve 4.97 0.22Surplus/(Deficit) Carried to Balance Sheet (642.48) (565.84)(396.65) (356.96)}Basic Earnings per Share - Rs. 15.95 31.96Dilutive Earnings per Share - Rs. (Refer Note No. 13 of Schedule 20) 15.94 31.95(Face Value of Rs. 10/- each)Significant Accounting Policies and Notes on Accounts 20Schedules referred to above form an integral part of the AccountsAs per our attached Report of even dateFor KHIMJI KUNVERJI & CO. For S. R. BATLIBOI & CO. DR. BHARAT K. SINGH Directors: TARJANI VAKILChartered Accountants Chartered Accountants Managing Director P. MURARIB. R. GUPTAADESH GUPTAG. P. GUPTAWholetime Director & CFOPer SHIVJI K.VIKAMSEYPer HEMAL SHAHPartner Partner DEVENDRA BHANDARIM. No. 2242 M. No. 42650 Company SecretaryMumbai, April 30, 20<strong>08</strong>CONSOLIDATED ACCOUNTS(125)