MANAGEMENT’S DISCUSSION AND ANALYSISPerformance ReviewIdea Cellular Limited has delivered a robust performance. About 10 million subscribers were added duringthe year to reach 24 million subscribers as on 31 st March, 20<strong>08</strong>, registering a 71% rise over last year’s subscriberbase. Its all India market share has improved to 9.4% from 8.6%. Revenues grew significantly by 54% toRs. 6,720 Crores from Rs. 4,366.4 Crores in the previous year. Net profit was more than doubled to Rs. 1,042.3Crores from Rs. 502.2 Crores.Idea is a leading cellular operator in India with 16.2% market share in 11 circles under commercial operations.During the year, Idea received licences for the remaining 9 circles, for which the requisite licence fee ofRs. 684.6 Crores was deposited on 10 th January, 20<strong>08</strong>, with the Department of Telecommunications. Idea hasnow licences to operate in all 22 circles. Idea was also allotted 4.4 MHz spectrum for the Mumbai and Biharcircles in January 20<strong>08</strong>, and for the Tamil Nadu (including Chennai) and Orissa circles in April 20<strong>08</strong>. Idea istargeting to roll out in Mumbai and Bihar circles in the second quarter, and Tamil Nadu (including Chennai)and Orissa circles in the third quarter of FY 20<strong>08</strong>-09. This is a significant move towards its Pan India presence.Idea has formed a 16:42:42 joint venture for sharing the tower infrastructure with Vodafone and BhartiInfratel. The new company, named Indus Towers Limited, will cover 16 circles, which include 10 existing circlesand 6 new circles of Idea. This will give Idea a ready access to the tower infrastructure in 6 out of the 9 newcircles for speedy rollout.Business OutlookThe outlook for the telecom sector is positive. India has surpassed the United States to become the world’ssecond largest wireless network in the world after China with 261.09 million subscribers as on 31 st March,20<strong>08</strong>. Going forward also, lower cellular penetration in India provides ample growth opportunities given thefact that India is the 2 nd largest population centre in the world. With the telecom space growing rapidly, webelieve Idea Cellular is on a high growth trajectory and will continue to gain momentum.FINANCIAL SERVICESThe financial services business in India has high growth potential. Strong macro economic growth coupledwith rising savings and low penetration of investment products suggest that the sector should grow rapidlyin the years to come.The financial services business of your Company is progressing well. Currently, your Company is operating invarious financial services verticals such as Life Insurance, Mutual Fund, distribution and wealth management,non-banking finance and insurance advisory. In each of these businesses, the aim is to build leadershipposition in both quantitative and qualitative sense, through expansion of distribution infrastructure acrosschannels, launching innovative products and strengthening brand loyalty supported by strong talentedteam.The financial services business of your Company is also exploring potential entry into some new financialservices segments with a vision to become a broad-based and integrated financial services player.(14)

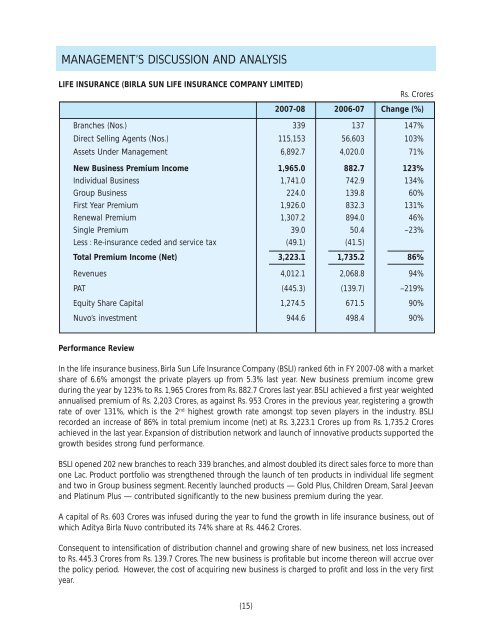

MANAGEMENT’S DISCUSSION AND ANALYSISLIFE INSURANCE (BIRLA SUN LIFE INSURANCE COMPANY LIMITED)Rs. Crores<strong>2007</strong>-<strong>08</strong> 2006-07 Change (%)Branches (Nos.) 339 137 147%Direct Selling Agents (Nos.) 115,153 56,603 103%Assets Under Management 6,892.7 4,020.0 71%New Business Premium Income 1,965.0 882.7 123%Individual Business 1,741.0 742.9 134%Group Business 224.0 139.8 60%First Year Premium 1,926.0 832.3 131%Renewal Premium 1,307.2 894.0 46%Single Premium 39.0 50.4 –23%Less : Re-insurance ceded and service tax (49.1) (41.5)Total Premium Income (Net) 3,223.1 1,735.2 86%Revenues 4,012.1 2,068.8 94%PAT (445.3) (139.7) –219%Equity Share Capital 1,274.5 671.5 90%<strong>Nuvo</strong>’s investment 944.6 498.4 90%Performance ReviewIn the life insurance business, <strong>Birla</strong> Sun Life Insurance Company (BSLI) ranked 6th in FY <strong>2007</strong>-<strong>08</strong> with a marketshare of 6.6% amongst the private players up from 5.3% last year. New business premium income grewduring the year by 123% to Rs. 1,965 Crores from Rs. 882.7 Crores last year. BSLI achieved a first year weightedannualised premium of Rs. 2,203 Crores, as against Rs. 953 Crores in the previous year, registering a growthrate of over 131%, which is the 2 nd highest growth rate amongst top seven players in the industry. BSLIrecorded an increase of 86% in total premium income (net) at Rs. 3,223.1 Crores up from Rs. 1,735.2 Croresachieved in the last year. Expansion of distribution network and launch of innovative products supported thegrowth besides strong fund performance.BSLI opened 202 new branches to reach 339 branches, and almost doubled its direct sales force to more thanone Lac. Product portfolio was strengthened through the launch of ten products in individual life segmentand two in Group business segment. Recently launched products — Gold Plus, Children Dream, Saral Jeevanand Platinum Plus — contributed significantly to the new business premium during the year.A capital of Rs. 603 Crores was infused during the year to fund the growth in life insurance business, out ofwhich <strong>Aditya</strong> <strong>Birla</strong> <strong>Nuvo</strong> contributed its 74% share at Rs. 446.2 Crores.Consequent to intensification of distribution channel and growing share of new business, net loss increasedto Rs. 445.3 Crores from Rs. 139.7 Crores. The new business is profitable but income thereon will accrue overthe policy period. However, the cost of acquiring new business is charged to profit and loss in the very firstyear.(15)