SCHEDULESSCHEDULE 19 (Contd.)SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTS(xvi) CONTINGENT LIABILITIES AND PROVISIONSContingent Liabilities are possible but not probable obligations as on the Balance Sheet date, based on theavailable evidence.Department appeals, in respect of cases won by the Company, are also considered as Contingent Liabilities.Provisions are recognised when there is a present obligation as a result of past event; and it is probable that anoutflow of resources will be required to settle the obligation, in respect of which a reliable estimate can be made.Provisions are determined based on best estimate required to settle the obligation at the Balance Sheet date.B. NOTES ON ACCOUNTSRs. CroresCurrent Year Previous Year1. Estimated amount of contracts remaining to be executed oncapital account and not provided for (Net of Advances) 69.21 51.902. Contingent Liabilities not provided for:a) Claims against the Company not acknowledged as debtsi) Income Tax 74.18 44.48ii) Custom Duty 2.45 2.58iii) Excise Duty 33.30 14.75iv) Sales Tax 7.49 9.94v) Service Tax 1.11 0.45vi) Others 51.06 27.16b) Uncalled Liability on shares partly paid up — 49.58c) Bills discounted with Banks 80.35 60.74d) Corporate Guarantees given to Banks/Financial Institutions for loanstaken/Preference Shares issued by subsidiaries/other companies 476.99 110.52e) Customs Duty on capital goods and raw materials imported under advancelicensing/EPCG scheme, against which export obligation is to be fulfilled 13.87 10.94f) Under the Jute Packaging Material (Compulsory use of Packing Commodities) Act, 1987, a specified percentageof fertilisers dispatched was required to be supplied in Jute Bags upto 31.<strong>08</strong>.2001. The Company made consciousefforts to use jute-packaging material as required under the Act. However, due to non-availability of materialas per the Company’s product specifications as well as due to strong customer resistance to use of Jute Bags,the specified percentage could not be adhered to. The Company has received a show cause notice, againstwhich a writ petition has been filed with the High Court, which is awaiting hearing. The Company has beenadvised that the said levy is bad in law.3. The Company has agreed to acquire Employees Stock Option issued by its subsidiary, <strong>Aditya</strong> <strong>Birla</strong> Minacs Worldwide<strong>Ltd</strong>., at shadow prices on fulfilling conditions specified in their stock option plan. The commitment of optionsoutstanding as on 31 st March, 20<strong>08</strong>, works out to Rs. 0.83 Crores (Previous Year: Rs.1.05 Crores).4. In accordance with the members’ approval in the extra-ordinary general meeting of the Company, held on February06, 20<strong>08</strong>, the Company has, on a preferential basis, issued 20,500,000 warrants of Rs. 10/- each to the Promoter and/or Promoter Group, pursuant to the provision of the Securities and Exchange Board of India (Disclosure andInvestor Protection) Guidelines, 2000.(92)

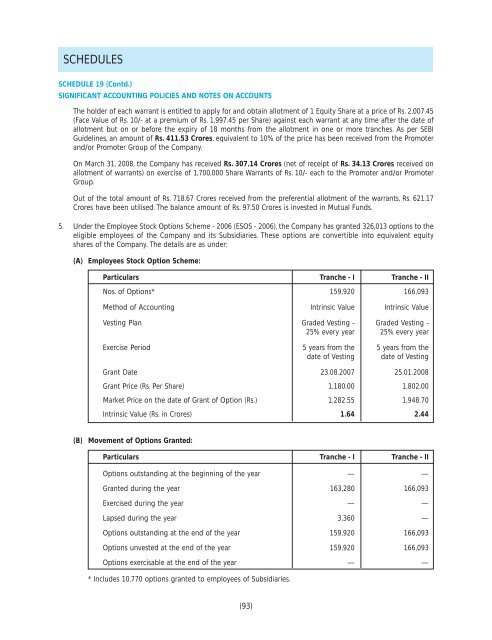

SCHEDULESSCHEDULE 19 (Contd.)SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTSThe holder of each warrant is entitled to apply for and obtain allotment of 1 Equity Share at a price of Rs. 2,007.45(Face Value of Rs. 10/- at a premium of Rs. 1,997.45 per Share) against each warrant at any time after the date ofallotment but on or before the expiry of 18 months from the allotment in one or more tranches. As per SEBIGuidelines, an amount of Rs. 411.53 Crores, equivalent to 10% of the price has been received from the Promoterand/or Promoter Group of the Company.On March 31, 20<strong>08</strong>, the Company has received Rs. 307.14 Crores (net of receipt of Rs. 34.13 Crores received onallotment of warrants) on exercise of 1,700,000 Share Warrants of Rs. 10/- each to the Promoter and/or PromoterGroup.Out of the total amount of Rs. 718.67 Crores received from the preferential allotment of the warrants, Rs. 621.17Crores have been utilised. The balance amount of Rs. 97.50 Crores is invested in Mutual Funds.5. Under the Employee Stock Options Scheme - 2006 (ESOS - 2006), the Company has granted 326,013 options to theeligible employees of the Company and its Subsidiaries. These options are convertible into equivalent equityshares of the Company. The details are as under:(A)Employees Stock Option Scheme:Particulars Tranche - I Tranche - IINos. of Options* 159,920 166,093Method of Accounting Intrinsic Value Intrinsic ValueVesting Plan Graded Vesting - Graded Vesting -25% every year 25% every yearExercise Period 5 years from the 5 years from thedate of Vesting date of VestingGrant Date 23.<strong>08</strong>.<strong>2007</strong> 25.01.20<strong>08</strong>Grant Price (Rs. Per Share) 1,180.00 1,802.00Market Price on the date of Grant of Option (Rs.) 1,282.55 1,948.70Intrinsic Value (Rs. in Crores) 1.64 2.44(B)Movement of Options Granted:Particulars Tranche - I Tranche - IIOptions outstanding at the beginning of the year — —Granted during the year 163,280 166,093Exercised during the year — —Lapsed during the year 3,360 —Options outstanding at the end of the year 159,920 166,093Options unvested at the end of the year 159,920 166,093Options exercisable at the end of the year — —* Includes 10,770 options granted to employees of Subsidiaries.(93)