2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

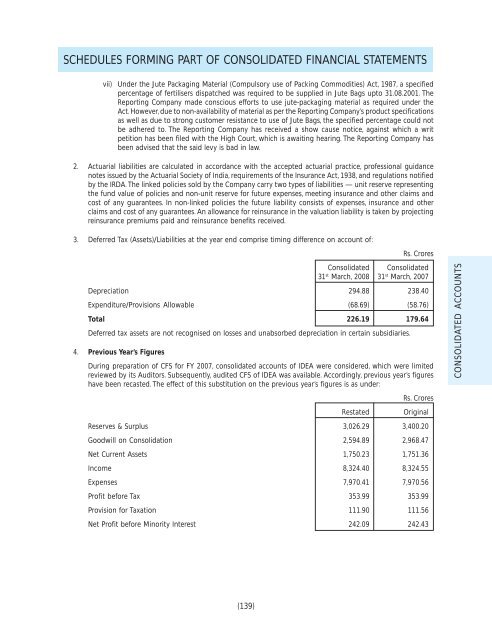

SCHEDULES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTSvii)Under the Jute Packaging Material (Compulsory use of Packing Commodities) Act, 1987, a specifiedpercentage of fertilisers dispatched was required to be supplied in Jute Bags upto 31.<strong>08</strong>.2001. TheReporting Company made conscious efforts to use jute-packaging material as required under theAct. However, due to non-availability of material as per the Reporting Company’s product specificationsas well as due to strong customer resistance to use of Jute Bags, the specified percentage could notbe adhered to. The Reporting Company has received a show cause notice, against which a writpetition has been filed with the High Court, which is awaiting hearing. The Reporting Company hasbeen advised that the said levy is bad in law.2. Actuarial liabilities are calculated in accordance with the accepted actuarial practice, professional guidancenotes issued by the Actuarial Society of India, requirements of the Insurance Act, 1938, and regulations notifiedby the IRDA. The linked policies sold by the Company carry two types of liabilities — unit reserve representingthe fund value of policies and non-unit reserve for future expenses, meeting insurance and other claims andcost of any guarantees. In non-linked policies the future liability consists of expenses, insurance and otherclaims and cost of any guarantees. An allowance for reinsurance in the valuation liability is taken by projectingreinsurance premiums paid and reinsurance benefits received.3. Deferred Tax (Assets)/Liabilities at the year end comprise timing difference on account of:Rs. CroresConsolidated Consolidated31 st March, 20<strong>08</strong> 31 st March, <strong>2007</strong>Depreciation 294.88 238.40Expenditure/Provisions Allowable (68.69) (58.76)Total 226.19 179.64Deferred tax assets are not recognised on losses and unabsorbed depreciation in certain subsidiaries.4. Previous Year’s FiguresDuring preparation of CFS for FY <strong>2007</strong>, consolidated accounts of IDEA were considered, which were limitedreviewed by its Auditors. Subsequently, audited CFS of IDEA was available. Accordingly, previous year’s figureshave been recasted. The effect of this substitution on the previous year’s figures is as under:RestatedRs. CroresOriginalReserves & Surplus 3,026.29 3,400.20Goodwill on Consolidation 2,594.89 2,968.47Net Current Assets 1,750.23 1,751.36Income 8,324.40 8,324.55Expenses 7,970.41 7,970.56Profit before Tax 353.99 353.99Provision for Taxation 111.90 111.56Net Profit before Minority Interest 242.09 242.43CONSOLIDATED ACCOUNTS(139)