2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

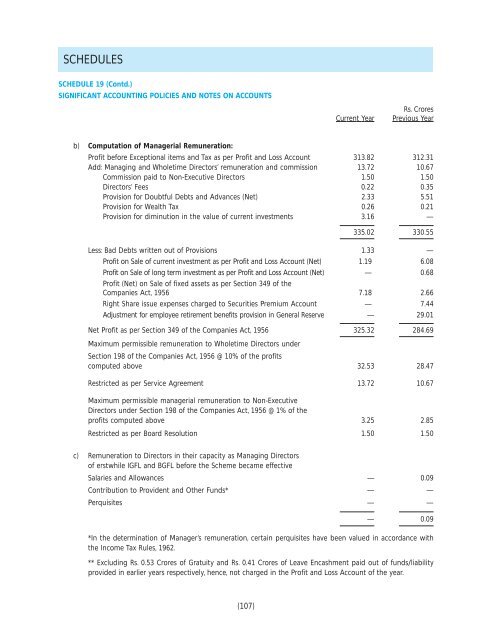

SCHEDULESSCHEDULE 19 (Contd.)SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTSCurrent YearRs. CroresPrevious Yearb) Computation of Managerial Remuneration:Profit before Exceptional items and Tax as per Profit and Loss Account 313.82 312.31Add: Managing and Wholetime Directors’ remuneration and commission 13.72 10.67Commission paid to Non-Executive Directors 1.50 1.50Directors’ Fees 0.22 0.35Provision for Doubtful Debts and Advances (Net) 2.33 5.51Provision for Wealth Tax 0.26 0.21Provision for diminution in the value of current investments 3.16 —335.02 330.55Less: Bad Debts written out of Provisions 1.33 —Profit on Sale of current investment as per Profit and Loss Account (Net) 1.19 6.<strong>08</strong>Profit on Sale of long term investment as per Profit and Loss Account (Net) — 0.68Profit (Net) on Sale of fixed assets as per Section 349 of theCompanies Act, 1956 7.18 2.66Right Share issue expenses charged to Securities Premium Account — 7.44Adjustment for employee retirement benefits provision in General Reserve — 29.01Net Profit as per Section 349 of the Companies Act, 1956 325.32 284.69Maximum permissible remuneration to Wholetime Directors underSection 198 of the Companies Act, 1956 @ 10% of the profitscomputed above 32.53 28.47Restricted as per Service Agreement 13.72 10.67Maximum permissible managerial remuneration to Non-ExecutiveDirectors under Section 198 of the Companies Act, 1956 @ 1% of theprofits computed above 3.25 2.85Restricted as per Board Resolution 1.50 1.50c) Remuneration to Directors in their capacity as Managing Directorsof erstwhile IGFL and BGFL before the Scheme became effectiveSalaries and Allowances — 0.09Contribution to Provident and Other Funds* — —Perquisites — —— 0.09*In the determination of Manager’s remuneration, certain perquisites have been valued in accordance withthe Income Tax Rules, 1962.** Excluding Rs. 0.53 Crores of Gratuity and Rs. 0.41 Crores of Leave Encashment paid out of funds/liabilityprovided in earlier years respectively, hence, not charged in the Profit and Loss Account of the year.(107)