2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

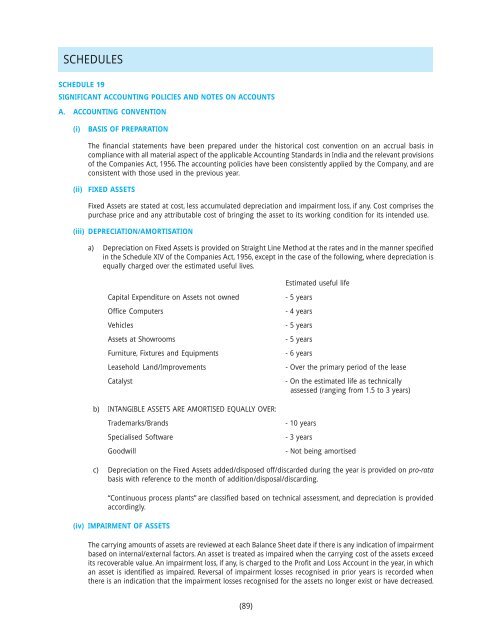

SCHEDULESSCHEDULE 19SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTSA. ACCOUNTING CONVENTION(i)BASIS OF PREPARATIONThe financial statements have been prepared under the historical cost convention on an accrual basis incompliance with all material aspect of the applicable Accounting Standards in India and the relevant provisionsof the Companies Act, 1956. The accounting policies have been consistently applied by the Company, and areconsistent with those used in the previous year.(ii)FIXED ASSETSFixed Assets are stated at cost, less accumulated depreciation and impairment loss, if any. Cost comprises thepurchase price and any attributable cost of bringing the asset to its working condition for its intended use.(iii) DEPRECIATION/AMORTISATIONa) Depreciation on Fixed Assets is provided on Straight Line Method at the rates and in the manner specifiedin the Schedule XIV of the Companies Act, 1956, except in the case of the following, where depreciation isequally charged over the estimated useful lives.Estimated useful lifeCapital Expenditure on Assets not ownedOffice ComputersVehiclesAssets at ShowroomsFurniture, Fixtures and EquipmentsLeasehold Land/ImprovementsCatalyst- 5 years- 4 years- 5 years- 5 years- 6 years- Over the primary period of the lease- On the estimated life as technicallyassessed (ranging from 1.5 to 3 years)b) INTANGIBLE ASSETS ARE AMORTISED EQUALLY OVER:Trademarks/BrandsSpecialised SoftwareGoodwill- 10 years- 3 years- Not being amortisedc) Depreciation on the Fixed Assets added/disposed off/discarded during the year is provided on pro-ratabasis with reference to the month of addition/disposal/discarding.“Continuous process plants” are classified based on technical assessment, and depreciation is providedaccordingly.(iv) IMPAIRMENT OF ASSETSThe carrying amounts of assets are reviewed at each Balance Sheet date if there is any indication of impairmentbased on internal/external factors. An asset is treated as impaired when the carrying cost of the assets exceedits recoverable value. An impairment loss, if any, is charged to the Profit and Loss Account in the year, in whichan asset is identified as impaired. Reversal of impairment losses recognised in prior years is recorded whenthere is an indication that the impairment losses recognised for the assets no longer exist or have decreased.(89)