2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

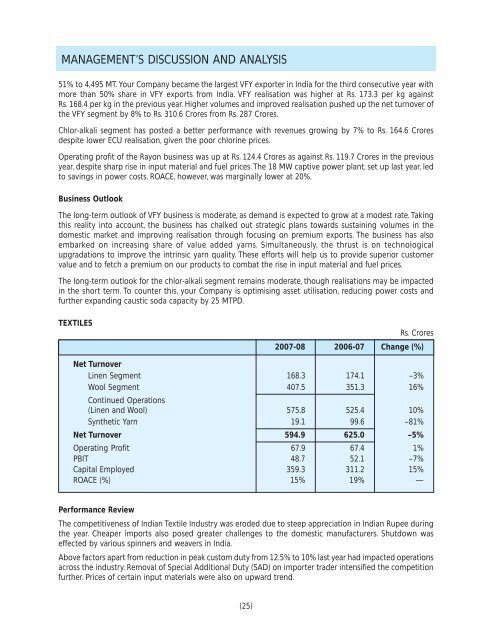

MANAGEMENT’S DISCUSSION AND ANALYSIS51% to 4,495 MT. Your Company became the largest VFY exporter in India for the third consecutive year withmore than 50% share in VFY exports from India. VFY realisation was higher at Rs. 173.3 per kg againstRs. 168.4 per kg in the previous year. Higher volumes and improved realisation pushed up the net turnover ofthe VFY segment by 8% to Rs. 310.6 Crores from Rs. 287 Crores.Chlor-alkali segment has posted a better performance with revenues growing by 7% to Rs. 164.6 Croresdespite lower ECU realisation, given the poor chlorine prices.Operating profit of the Rayon business was up at Rs. 124.4 Crores as against Rs. 119.7 Crores in the previousyear, despite sharp rise in input material and fuel prices. The 18 MW captive power plant, set up last year, ledto savings in power costs. ROACE, however, was marginally lower at 20%.Business OutlookThe long-term outlook of VFY business is moderate, as demand is expected to grow at a modest rate. Takingthis reality into account, the business has chalked out strategic plans towards sustaining volumes in thedomestic market and improving realisation through focusing on premium exports. The business has alsoembarked on increasing share of value added yarns. Simultaneously, the thrust is on technologicalupgradations to improve the intrinsic yarn quality. These efforts will help us to provide superior customervalue and to fetch a premium on our products to combat the rise in input material and fuel prices.The long-term outlook for the chlor-alkali segment remains moderate, though realisations may be impactedin the short term. To counter this, your Company is optimising asset utilisation, reducing power costs andfurther expanding caustic soda capacity by 25 MTPD.TEXTILESRs. Crores<strong>2007</strong>-<strong>08</strong> 2006-07 Change (%)Net TurnoverLinen Segment 168.3 174.1 –3%Wool Segment 407.5 351.3 16%Continued Operations(Linen and Wool) 575.8 525.4 10%Synthetic Yarn 19.1 99.6 –81%Net Turnover 594.9 625.0 –5%Operating Profit 67.9 67.4 1%PBIT 48.7 52.1 –7%Capital Employed 359.3 311.2 15%ROACE (%) 15% 19% —Performance ReviewThe competitiveness of Indian Textile Industry was eroded due to steep appreciation in Indian Rupee duringthe year. Cheaper imports also posed greater challenges to the domestic manufacturers. Shutdown waseffected by various spinners and weavers in India.Above factors apart from reduction in peak custom duty from 12.5% to 10% last year had impacted operationsacross the industry. Removal of Special Additional Duty (SAD) on importer trader intensified the competitionfurther. Prices of certain input materials were also on upward trend.(25)