2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

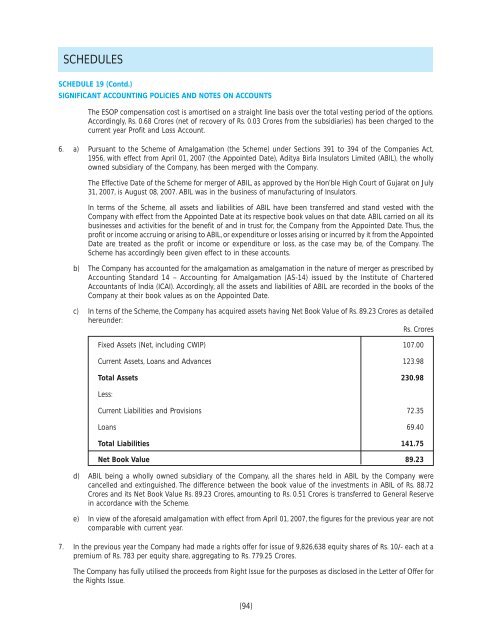

SCHEDULESSCHEDULE 19 (Contd.)SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTSThe ESOP compensation cost is amortised on a straight line basis over the total vesting period of the options.Accordingly, Rs. 0.68 Crores (net of recovery of Rs. 0.03 Crores from the subsidiaries) has been charged to thecurrent year Profit and Loss Account.6. a) Pursuant to the Scheme of Amalgamation (the Scheme) under Sections 391 to 394 of the Companies Act,1956, with effect from April 01, <strong>2007</strong> (the Appointed Date), <strong>Aditya</strong> <strong>Birla</strong> Insulators Limited (ABIL), the whollyowned subsidiary of the Company, has been merged with the Company.The Effective Date of the Scheme for merger of ABIL, as approved by the Hon’ble High Court of Gujarat on July31, <strong>2007</strong>, is August <strong>08</strong>, <strong>2007</strong>. ABIL was in the business of manufacturing of Insulators.In terms of the Scheme, all assets and liabilities of ABIL have been transferred and stand vested with theCompany with effect from the Appointed Date at its respective book values on that date. ABIL carried on all itsbusinesses and activities for the benefit of and in trust for, the Company from the Appointed Date. Thus, theprofit or income accruing or arising to ABIL, or expenditure or losses arising or incurred by it from the AppointedDate are treated as the profit or income or expenditure or loss, as the case may be, of the Company. TheScheme has accordingly been given effect to in these accounts.b) The Company has accounted for the amalgamation as amalgamation in the nature of merger as prescribed byAccounting Standard 14 – Accounting for Amalgamation (AS-14) issued by the Institute of CharteredAccountants of India (ICAI). Accordingly, all the assets and liabilities of ABIL are recorded in the books of theCompany at their book values as on the Appointed Date.c) In terns of the Scheme, the Company has acquired assets having Net Book Value of Rs. 89.23 Crores as detailedhereunder:Rs. CroresFixed Assets (Net, including CWIP) 107.00Current Assets, Loans and Advances 123.98Total Assets 230.98Less:Current Liabilities and Provisions 72.35Loans 69.40Total Liabilities 141.75Net Book Value 89.23d) ABIL being a wholly owned subsidiary of the Company, all the shares held in ABIL by the Company werecancelled and extinguished. The difference between the book value of the investments in ABIL of Rs. 88.72Crores and its Net Book Value Rs. 89.23 Crores, amounting to Rs. 0.51 Crores is transferred to General Reservein accordance with the Scheme.e) In view of the aforesaid amalgamation with effect from April 01, <strong>2007</strong>, the figures for the previous year are notcomparable with current year.7. In the previous year the Company had made a rights offer for issue of 9,826,638 equity shares of Rs. 10/- each at apremium of Rs. 783 per equity share, aggregating to Rs. 779.25 Crores.The Company has fully utilised the proceeds from Right Issue for the purposes as disclosed in the Letter of Offer forthe Rights Issue.(94)