2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

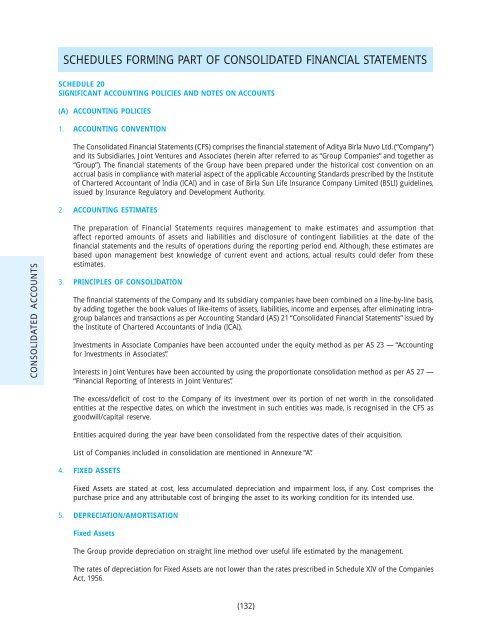

SCHEDULES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTSSCHEDULE 20SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTS(A)ACCOUNTING POLICIES1. ACCOUNTING CONVENTIONThe Consolidated Financial Statements (CFS) comprises the financial statement of <strong>Aditya</strong> <strong>Birla</strong> <strong>Nuvo</strong> <strong>Ltd</strong>. (“Company”)and its Subsidiaries, Joint Ventures and Associates (herein after referred to as “Group Companies” and together as“Group”). The financial statements of the Group have been prepared under the historical cost convention on anaccrual basis in compliance with material aspect of the applicable Accounting Standards prescribed by the Instituteof Chartered Accountant of India (ICAI) and in case of <strong>Birla</strong> Sun Life Insurance Company Limited (BSLI) guidelines,issued by Insurance Regulatory and Development Authority.2. ACCOUNTING ESTIMATESCONSOLIDATED ACCOUNTSThe preparation of Financial Statements requires management to make estimates and assumption thataffect reported amounts of assets and liabilities and disclosure of contingent liabilities at the date of thefinancial statements and the results of operations during the reporting period end. Although, these estimates arebased upon management best knowledge of current event and actions, actual results could defer from theseestimates.3. PRINCIPLES OF CONSOLIDATIONThe financial statements of the Company and its subsidiary companies have been combined on a line-by-line basis,by adding together the book values of like-items of assets, liabilities, income and expenses, after eliminating intragroupbalances and transactions as per Accounting Standard (AS) 21 “Consolidated Financial Statements” issued bythe Institute of Chartered Accountants of India (ICAI).Investments in Associate Companies have been accounted under the equity method as per AS 23 — “Accountingfor Investments in Associates”.Interests in Joint Ventures have been accounted by using the proportionate consolidation method as per AS 27 —“Financial Reporting of Interests in Joint Ventures”.The excess/deficit of cost to the Company of its investment over its portion of net worth in the consolidatedentities at the respective dates, on which the investment in such entities was made, is recognised in the CFS asgoodwill/capital reserve.Entities acquired during the year have been consolidated from the respective dates of their acquisition.List of Companies included in consolidation are mentioned in Annexure “A”.4. FIXED ASSETSFixed Assets are stated at cost, less accumulated depreciation and impairment loss, if any. Cost comprises thepurchase price and any attributable cost of bringing the asset to its working condition for its intended use.5. DEPRECIATION/AMORTISATIONFixed AssetsThe Group provide depreciation on straight line method over useful life estimated by the management.The rates of depreciation for Fixed Assets are not lower than the rates prescribed in Schedule XIV of the CompaniesAct, 1956.(132)