2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

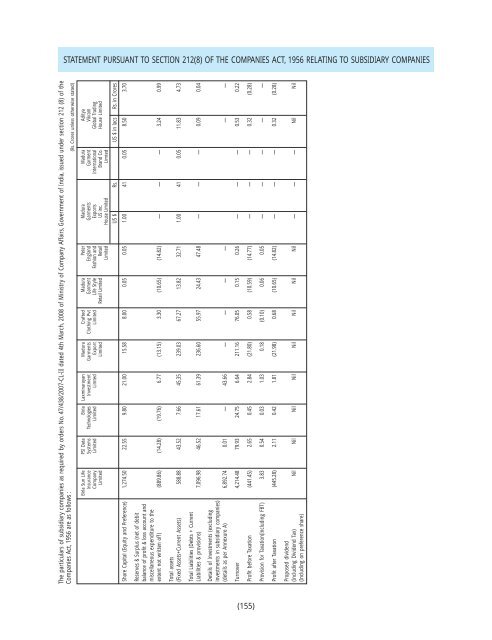

STATEMENT PURSUANT TO SECTION 212(8) OF THE COMPANIES ACT, 1956 RELATING TO SUBSIDIARY COMPANIESThe particulars of subsidiary companies as required by orders No. 47/438/<strong>2007</strong>-CL-III dated 4th March, 20<strong>08</strong> of Ministry of Company Affairs, Government of India, issued under section 212 (8) of theCompanies Act, 1956 are as follows :(Rs. Crores unless otherwise stated)<strong>Birla</strong> Sun Life PSI Data <strong>Birla</strong> Laxminarayan Madura Crafted Madura Peter Madura Madura <strong>Aditya</strong>Insurance Systems Technologies Investment Garments Clothing Pvt Garment England Garments Garment VikramCompany Limited Limited Limted Export Limited Life Style Fashion and Exports International Global TradingLimited Limited Retail Limited Retail US inc. Brand Co. House LimitedLimited House Limited LimtedUS $ Rs. US $ in lacs Rs. in CroresShare Capital (Equity and Preference) 1,274.50 22.55 9.80 21.00 15.58 8.00 0.05 0.05 1.00 41 0.05 8.50 3.70Reserves & Surplus (net of debitbalance of profit & loss account andmiscellaneous expenditure to theextent not written off) (889.86) (14.28) (19.76) 6.77 (13.15) 3.30 (10.65) (14.82) — — — 3.24 0.99Total assets(Fixed Assets+Current Assets) 588.88 43.52 7.66 45.35 239.03 67.27 13.82 32.71 1.00 41 0.05 11.83 4.73Total Liabilities (Debts + CurrentLiabilities & provisions) 7,096.98 46.52 17.61 61.39 236.60 55.97 24.43 47.48 — — — 0.09 0.04Details of Investments (excludinginvestments in subsidiary companies)(details as per Annexure A) 6,892.74 0.01 — 43.66 — — — — — —Turnover 4,214.48 79.93 24.75 6.64 211.16 76.05 0.15 0.26 — — — 0.53 0.22Profit before Taxation (441.45) 2.65 0.45 2.84 (21.80) 0.58 (10.59) (14.77) — — — 0.32 (0.28)Provision for Taxation(Including FBT) 3.83 0.54 0.03 1.03 0.18 (0.10) 0.06 0.05 — — — — —Profit after Taxation (445.28) 2.11 0.42 1.81 (21.98) 0.68 (10.65) (14.82) — — — 0.32 (0.28)Proposed dividend(Including Dividend Tax) Nil Nil Nil Nil Nil Nil Nil Nil — — — Nil Nil(Including on preference share)(155)