2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

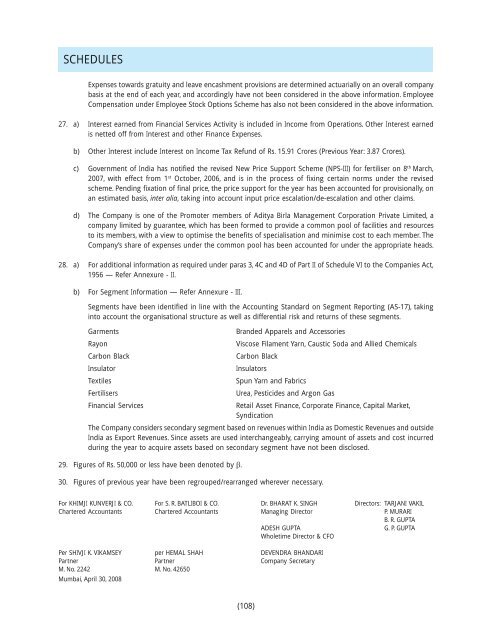

SCHEDULESExpenses towards gratuity and leave encashment provisions are determined actuarially on an overall companybasis at the end of each year, and accordingly have not been considered in the above information. EmployeeCompensation under Employee Stock Options Scheme has also not been considered in the above information.27. a) Interest earned from Financial Services Activity is included in Income from Operations. Other Interest earnedis netted off from Interest and other Finance Expenses.b) Other Interest include Interest on Income Tax Refund of Rs. 15.91 Crores (Previous Year: 3.87 Crores).c) Government of India has notified the revised New Price Support Scheme (NPS-III) for fertiliser on 8 th March,<strong>2007</strong>, with effect from 1 st October, 2006, and is in the process of fixing certain norms under the revisedscheme. Pending fixation of final price, the price support for the year has been accounted for provisionally, onan estimated basis, inter alia, taking into account input price escalation/de-escalation and other claims.d) The Company is one of the Promoter members of <strong>Aditya</strong> <strong>Birla</strong> Management Corporation Private Limited, acompany limited by guarantee, which has been formed to provide a common pool of facilities and resourcesto its members, with a view to optimise the benefits of specialisation and minimise cost to each member. TheCompany’s share of expenses under the common pool has been accounted for under the appropriate heads.28. a) For additional information as required under paras 3, 4C and 4D of Part II of Schedule VI to the Companies Act,1956 — Refer Annexure - II.b) For Segment Information — Refer Annexure - III.Segments have been identified in line with the Accounting Standard on Segment Reporting (AS-17), takinginto account the organisational structure as well as differential risk and returns of these segments.GarmentsRayonCarbon BlackInsulatorTextilesFertilisersFinancial ServicesBranded Apparels and AccessoriesViscose Filament Yarn, Caustic Soda and Allied ChemicalsCarbon BlackInsulatorsSpun Yarn and FabricsUrea, Pesticides and Argon GasRetail Asset Finance, Corporate Finance, Capital Market,SyndicationThe Company considers secondary segment based on revenues within India as Domestic Revenues and outsideIndia as Export Revenues. Since assets are used interchangeably, carrying amount of assets and cost incurredduring the year to acquire assets based on secondary segment have not been disclosed.29. Figures of Rs. 50,000 or less have been denoted by β.30. Figures of previous year have been regrouped/rearranged wherever necessary.For KHIMJI KUNVERJI & CO. For S. R. BATLIBOI & CO. Dr. BHARAT K. SINGH Directors: TARJANI VAKILChartered Accountants Chartered Accountants Managing Director P. MURARIB. R. GUPTAADESH GUPTAG. P. GUPTAWholetime Director & CFOPer SHIVJI K. VIKAMSEY per HEMAL SHAH DEVENDRA BHANDARIPartner Partner Company SecretaryM. No. 2242 M. No. 42650Mumbai, April 30, 20<strong>08</strong>(1<strong>08</strong>)