2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

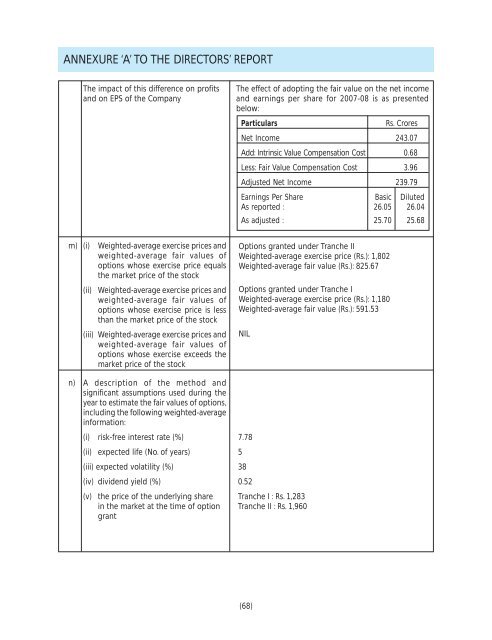

ANNEXURE ‘A’ TO THE DIRECTORS’ REPORTThe impact of this difference on profitsand on EPS of the CompanyThe effect of adopting the fair value on the net incomeand earnings per share for <strong>2007</strong>-<strong>08</strong> is as presentedbelow:ParticularsRs. CroresNet Income 243.07Add: Intrinsic Value Compensation Cost 0.68Less: Fair Value Compensation Cost 3.96Adjusted Net Income 239.79Earnings Per Share Basic DilutedAs reported : 26.05 26.04As adjusted : 25.70 25.68m) (i) Weighted-average exercise prices andweighted-average fair values ofoptions whose exercise price equalsthe market price of the stock(ii) Weighted-average exercise prices andweighted-average fair values ofoptions whose exercise price is lessthan the market price of the stock(iii) Weighted-average exercise prices andweighted-average fair values ofoptions whose exercise exceeds themarket price of the stockOptions granted under Tranche IIWeighted-average exercise price (Rs.): 1,802Weighted-average fair value (Rs.): 825.67Options granted under Tranche IWeighted-average exercise price (Rs.): 1,180Weighted-average fair value (Rs.): 591.53NILn) A description of the method andsignificant assumptions used during theyear to estimate the fair values of options,including the following weighted-averageinformation:(i) risk-free interest rate (%) 7.78(ii) expected life (No. of years) 5(iii) expected volatility (%) 38(iv) dividend yield (%) 0.52(v) the price of the underlying share Tranche I : Rs. 1,283in the market at the time of option Tranche II : Rs. 1,960grant(68)