2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

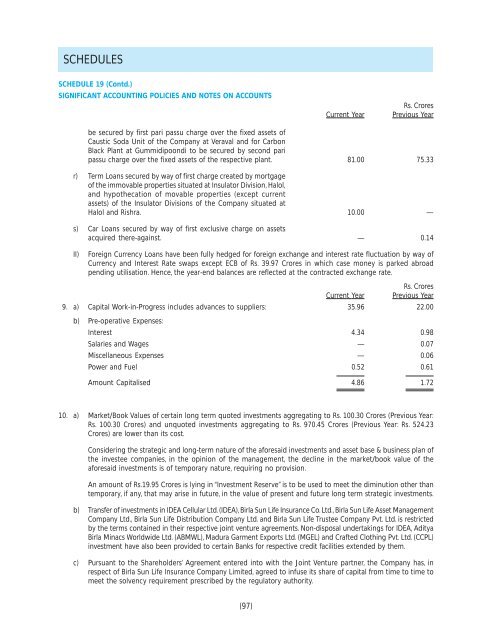

SCHEDULESSCHEDULE 19 (Contd.)SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTSCurrent YearRs. CroresPrevious Yearbe secured by first pari passu charge over the fixed assets ofCaustic Soda Unit of the Company at Veraval and for CarbonBlack Plant at Gummidipoondi to be secured by second paripassu charge over the fixed assets of the respective plant. 81.00 75.33r) Term Loans secured by way of first charge created by mortgageof the immovable properties situated at Insulator Division, Halol,and hypothecation of movable properties (except currentassets) of the Insulator Divisions of the Company situated atHalol and Rishra. 10.00 —s) Car Loans secured by way of first exclusive charge on assetsacquired there-against. — 0.14II)Foreign Currency Loans have been fully hedged for foreign exchange and interest rate fluctuation by way ofCurrency and Interest Rate swaps except ECB of Rs. 39.97 Crores in which case money is parked abroadpending utilisation. Hence, the year-end balances are reflected at the contracted exchange rate.Rs. CroresCurrent Year Previous Year9. a) Capital Work-in-Progress includes advances to suppliers: 35.96 22.00b) Pre-operative Expenses:Interest 4.34 0.98Salaries and Wages — 0.07Miscellaneous Expenses — 0.06Power and Fuel 0.52 0.61Amount Capitalised 4.86 1.7210. a) Market/Book Values of certain long term quoted investments aggregating to Rs. 100.30 Crores (Previous Year:Rs. 100.30 Crores) and unquoted investments aggregating to Rs. 970.45 Crores (Previous Year: Rs. 524.23Crores) are lower than its cost.Considering the strategic and long-term nature of the aforesaid investments and asset base & business plan ofthe investee companies, in the opinion of the management, the decline in the market/book value of theaforesaid investments is of temporary nature, requiring no provision.An amount of Rs.19.95 Crores is lying in “Investment Reserve” is to be used to meet the diminution other thantemporary, if any, that may arise in future, in the value of present and future long term strategic investments.b) Transfer of investments in IDEA Cellular <strong>Ltd</strong>. (IDEA), <strong>Birla</strong> Sun Life Insurance Co. <strong>Ltd</strong>., <strong>Birla</strong> Sun Life Asset ManagementCompany <strong>Ltd</strong>., <strong>Birla</strong> Sun Life Distribution Company <strong>Ltd</strong>. and <strong>Birla</strong> Sun Life Trustee Company Pvt. <strong>Ltd</strong>. is restrictedby the terms contained in their respective joint venture agreements. Non-disposal undertakings for IDEA, <strong>Aditya</strong><strong>Birla</strong> Minacs Worldwide <strong>Ltd</strong>. (ABMWL), Madura Garment Exports <strong>Ltd</strong>. (MGEL) and Crafted Clothing Pvt. <strong>Ltd</strong>. (CCPL)investment have also been provided to certain Banks for respective credit facilities extended by them.c) Pursuant to the Shareholders’ Agreement entered into with the Joint Venture partner, the Company has, inrespect of <strong>Birla</strong> Sun Life Insurance Company Limited, agreed to infuse its share of capital from time to time tomeet the solvency requirement prescribed by the regulatory authority.(97)