2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

2007-08 - Aditya Birla Nuvo, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

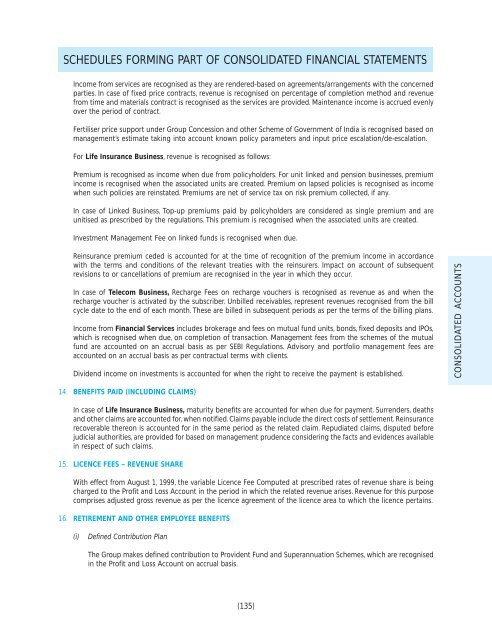

SCHEDULES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTSIncome from services are recognised as they are rendered-based on agreements/arrangements with the concernedparties. In case of fixed price contracts, revenue is recognised on percentage of completion method and revenuefrom time and materials contract is recognised as the services are provided. Maintenance income is accrued evenlyover the period of contract.Fertiliser price support under Group Concession and other Scheme of Government of India is recognised based onmanagement’s estimate taking into account known policy parameters and input price escalation/de-escalation.For Life Insurance Business, revenue is recognised as follows:Premium is recognised as income when due from policyholders. For unit linked and pension businesses, premiumincome is recognised when the associated units are created. Premium on lapsed policies is recognised as incomewhen such policies are reinstated. Premiums are net of service tax on risk premium collected, if any.In case of Linked Business, Top-up premiums paid by policyholders are considered as single premium and areunitised as prescribed by the regulations. This premium is recognised when the associated units are created.Investment Management Fee on linked funds is recognised when due.Reinsurance premium ceded is accounted for at the time of recognition of the premium income in accordancewith the terms and conditions of the relevant treaties with the reinsurers. Impact on account of subsequentrevisions to or cancellations of premium are recognised in the year in which they occur.In case of Telecom Business, Recharge Fees on recharge vouchers is recognised as revenue as and when therecharge voucher is activated by the subscriber. Unbilled receivables, represent revenues recognised from the billcycle date to the end of each month. These are billed in subsequent periods as per the terms of the billing plans.Income from Financial Services includes brokerage and fees on mutual fund units, bonds, fixed deposits and IPOs,which is recognised when due, on completion of transaction. Management fees from the schemes of the mutualfund are accounted on an accrual basis as per SEBI Regulations. Advisory and portfolio management fees areaccounted on an accrual basis as per contractual terms with clients.Dividend income on investments is accounted for when the right to receive the payment is established.CONSOLIDATED ACCOUNTS14. BENEFITS PAID (INCLUDING CLAIMS)In case of Life Insurance Business, maturity benefits are accounted for when due for payment. Surrenders, deathsand other claims are accounted for, when notified. Claims payable include the direct costs of settlement. Reinsurancerecoverable thereon is accounted for in the same period as the related claim. Repudiated claims, disputed beforejudicial authorities, are provided for based on management prudence considering the facts and evidences availablein respect of such claims.15. LICENCE FEES – REVENUE SHAREWith effect from August 1, 1999, the variable Licence Fee Computed at prescribed rates of revenue share is beingcharged to the Profit and Loss Account in the period in which the related revenue arises. Revenue for this purposecomprises adjusted gross revenue as per the licence agreement of the licence area to which the licence pertains.16. RETIREMENT AND OTHER EMPLOYEE BENEFITS(i)Defined Contribution PlanThe Group makes defined contribution to Provident Fund and Superannuation Schemes, which are recognisedin the Profit and Loss Account on accrual basis.(135)