- Page 7: Corporate InformationGROUP COMPANY

- Page 10 and 11: Axiata Group Berhad • 010Tan Sri

- Page 12 and 13: Chairman’s StatementI am pleased

- Page 14 and 15: Chairman’s Statement3 The World B

- Page 16 and 17: Chairman’s StatementDato’ Sri J

- Page 20 and 21: O P E R A T I N G C O M P A N I E S

- Page 22 and 23: President & GCEO’s Business Revie

- Page 24 and 25: President & GCEO’s Business Revie

- Page 26 and 27: Reporting byGeographical LocationMA

- Page 28 and 29: Simplified GroupBalance SheetTotal

- Page 30 and 31: Major Milestones1994February 1994A

- Page 32 and 33: Major Milestones2007June 2007Indoce

- Page 34 and 35: Axiata GalleryAxiata Group Berhad

- Page 36 and 37: Awards & AccoladesAxiata Group Berh

- Page 38 and 39: Feature article:The Future of Mobil

- Page 41 and 42: Strengthin DiversityDiversity is ke

- Page 43 and 44: Axiata’s vision is to be a region

- Page 45 and 46: Major Associates/AffiliatesINDIAIDE

- Page 47 and 48: 24.42%Samart I-Mobile PublicCompany

- Page 49 and 50: From left to right:Dato’ Sri Jama

- Page 51 and 52: Dato’ Sri Jamaludin IbrahimAge 51

- Page 53 and 54: Datuk Azzat KamaludinAge 64, Malays

- Page 55 and 56: Dr. Farid Mohamed SaniAge 34, Malay

- Page 57 and 58: From left to right:Dr Hans Wijayasu

- Page 59 and 60: Suryani HusseinGroup Company Secret

- Page 61 and 62: 04Michael KuehnerManaging Director

- Page 63 and 64: Profile of Operating Companies’ M

- Page 65 and 66: THE BOARD OF DIRECTORSRole and Resp

- Page 67 and 68: Statement on Corporate GovernanceAx

- Page 69 and 70:

Where any direction or decision is

- Page 71 and 72:

Statement on Corporate GovernanceAm

- Page 73 and 74:

Board CommitteesFour standing Board

- Page 75 and 76:

Statement on Corporate GovernanceES

- Page 77 and 78:

In ensuring fairness and promoting

- Page 79 and 80:

INTRODUCTIONPursuant to Paragraph 1

- Page 81 and 82:

Statement on Internal Control1.2 Bo

- Page 83 and 84:

A process was introduced in 2009 to

- Page 85 and 86:

Statement on Internal Control3.3 Re

- Page 87 and 88:

Risks Identified by The GroupAPPEND

- Page 89 and 90:

The Board of Directors of Axiata is

- Page 91 and 92:

Others• Reviewed and approved Axi

- Page 93 and 94:

Board Audit Committee Reportiii)iv)

- Page 95 and 96:

iii)iv)Discuss problems and reserva

- Page 97 and 98:

Board Audit Committee Reportvii) Re

- Page 99 and 100:

7.0 REVIEW & EVALUATION PROCEDURES

- Page 101:

Subscriptions by TechnologYReported

- Page 104 and 105:

Business ReviewAbout CelcomCelcom i

- Page 106 and 107:

Business ReviewREVENUERM (Billion)E

- Page 108 and 109:

EBITDA (RM Million)+ 14.3%+ 6.0%+ 1

- Page 110 and 111:

Celcom SuksesPrabayar Celcom Sukses

- Page 112 and 113:

Business ReviewAbout XLXL, which st

- Page 114 and 115:

REVENUEIDR (Billion)EBITDAIDR (Bill

- Page 116 and 117:

EBITDA (IDR Billion)+ 92.5%+ 17.5%+

- Page 118 and 119:

Business ReviewAbout DIALOGDialog i

- Page 120 and 121:

REVENUESLR (Billion)EBITDASLR (Bill

- Page 122 and 123:

EBITDA (SLR Million)+ > 100%+ 19.3%

- Page 124 and 125:

Business ReviewAbout ROBIRobi is a

- Page 126 and 127:

REVENUEBDT (Billion)EBITDABDT (Bill

- Page 128 and 129:

Business ReviewABOUT HELLOA pioneer

- Page 130 and 131:

REVENUEUSD (Million)EBITDAUSD (Mill

- Page 132 and 133:

Business ReviewABOUT IDEAIdea is a

- Page 134 and 135:

REVENUEINR (Billion)EBITDAINR (Bill

- Page 136 and 137:

Business ReviewABOUT M1M1 is a lead

- Page 138 and 139:

REVENUESGD (Million)EBITDASGD (Mill

- Page 140 and 141:

PAKISTANMULTINET PAKISTAN(PRIVATE)

- Page 142 and 143:

Feature article:Mobile App Storesa

- Page 145 and 146:

AdvancingAsiaAxiata is committed to

- Page 147 and 148:

Axiata provides affordableand innov

- Page 149 and 150:

Talent AttractionAxiata is also tak

- Page 151 and 152:

Corporate ResponsibilityCommunity P

- Page 153 and 154:

XL also collaborated with ICT Watch

- Page 155 and 156:

156 Directors’ Responsibility Sta

- Page 157 and 158:

Directors’ ReportThe Directors ha

- Page 159 and 160:

EMPLOYEES SHARE OPTIONS SCHEME (“

- Page 161 and 162:

Directors’ ReportDIRECTORS’

- Page 163 and 164:

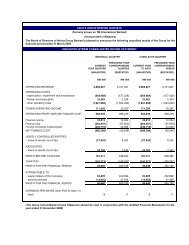

Income StatementsFOR THE FINANCIAL

- Page 165 and 166:

Balance SheetsAS AT 31 DECEMBER 200

- Page 167 and 168:

Consolidated Statement of Changes i

- Page 169 and 170:

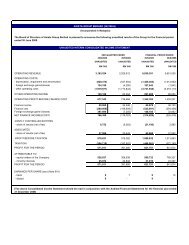

Cash Flow StatementsFOR THE FINANCI

- Page 171 and 172:

3. BASIS OF PREPARATION OF THE FINA

- Page 173 and 174:

Notes to the Financial StatementsFO

- Page 175 and 176:

3. BASIS OF PREPARATION OF THE FINA

- Page 177 and 178:

Notes to the Financial StatementsFO

- Page 179 and 180:

4 SIGNIFICANT ACCOUNTING POLICIES (

- Page 181 and 182:

Notes to the Financial StatementsFO

- Page 183 and 184:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 185 and 186:

Notes to the Financial StatementsFO

- Page 187 and 188:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 189 and 190:

Notes to the Financial StatementsFO

- Page 191 and 192:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 193 and 194:

Notes to the Financial StatementsFO

- Page 195 and 196:

5. CRITICAL ACCOUNTING ESTIMATES AN

- Page 197 and 198:

Notes to the Financial StatementsFO

- Page 199 and 200:

6. SIGNIFICANT GROUP RESTRUCTURING,

- Page 201 and 202:

Notes to the Financial StatementsFO

- Page 203 and 204:

8(c) DIRECTORS’ REMUNERATIONGroup

- Page 205 and 206:

Notes to the Financial StatementsFO

- Page 207 and 208:

13. SHARE CAPITALGroupCompany2009 2

- Page 209 and 210:

Notes to the Financial StatementsFO

- Page 211 and 212:

14. EMPLOYEES’ SHARE OPTION SCHEM

- Page 213 and 214:

Notes to the Financial StatementsFO

- Page 215 and 216:

14. EMPLOYEES’ SHARE OPTION SCHEM

- Page 217 and 218:

Notes to the Financial StatementsFO

- Page 219 and 220:

14. EMPLOYEES’ SHARE OPTION SCHEM

- Page 221 and 222:

Notes to the Financial StatementsFO

- Page 223 and 224:

16. BORROWINGS (CONTINUED)2009 2008

- Page 225 and 226:

Notes to the Financial StatementsFO

- Page 227 and 228:

18. AMOUNTS DUE FROM/(TO) SUBSIDIAR

- Page 229 and 230:

Notes to the Financial StatementsFO

- Page 231 and 232:

21. INTANGIBLE ASSETS (CONTINUED)(a

- Page 233 and 234:

Notes to the Financial StatementsFO

- Page 235 and 236:

22. PROPERTY, PLANT AND EQUIPMENT (

- Page 237 and 238:

Notes to the Financial StatementsFO

- Page 239 and 240:

24. PREPAID LEASE PAYMENTS (CONTINU

- Page 241 and 242:

Notes to the Financial StatementsFO

- Page 243 and 244:

27. ASSOCIATES (CONTINUED)(ii)Axiat

- Page 245 and 246:

Notes to the Financial StatementsFO

- Page 247 and 248:

30. INVENTORIESGroup2009 2008RM’0

- Page 249 and 250:

Notes to the Financial StatementsFO

- Page 251 and 252:

34. CASH FLOWS FROM/(USED IN) OPERA

- Page 253 and 254:

Notes to the Financial StatementsFO

- Page 255 and 256:

35. CONTINGENCIES AND COMMITMENTS (

- Page 257 and 258:

Notes to the Financial StatementsFO

- Page 259 and 260:

36. HEDGING TRANSACTIONS (CONTINUED

- Page 261 and 262:

Notes to the Financial StatementsFO

- Page 263 and 264:

40. SEGMENTAL REPORTING (CONTINUED)

- Page 265 and 266:

Notes to the Financial StatementsFO

- Page 267 and 268:

41. FINANCIAL RISK MANAGEMENT OBJEC

- Page 269 and 270:

Notes to the Financial StatementsFO

- Page 271 and 272:

42. INTEREST RATE RISK (CONTINUED)M

- Page 273 and 274:

Notes to the Financial StatementsFO

- Page 275 and 276:

45. LIST OF SUBSIDIARIESThe subsidi

- Page 277 and 278:

Notes to the Financial StatementsFO

- Page 279 and 280:

45. LIST OF SUBSIDIARIES (CONTINUED

- Page 281 and 282:

Notes to the Financial StatementsFO

- Page 283 and 284:

48. RELATED PARTY TRANSACTIONS (CON

- Page 285 and 286:

Statement by DirectorsPURSUANT TO S

- Page 287 and 288:

Independent Auditors’ ReportTO TH

- Page 289 and 290:

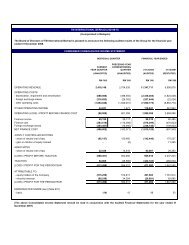

OPERATING COSTSFor FY09 the Group

- Page 291 and 292:

Intangible AssetsIntangible assets

- Page 293 and 294:

DIRECTORS’ DIRECT AND INDIRECT IN

- Page 295 and 296:

Shareholding StatisticsAS AT 30 APR

- Page 297 and 298:

No.Compliance Issue6. VARIATION IN

- Page 299 and 300:

TransactingCompaniesTransactingRela

- Page 301 and 302:

List of Top Ten PropertiesAS AT 31

- Page 303 and 304:

Glossary3GThe third generation of m

- Page 305 and 306:

LOALimits of AuthorityLTELong Term

- Page 307 and 308:

Notice ofAnnual General MeetingNOTI

- Page 309 and 310:

Notice of Annual General MeetingNot

- Page 311 and 312:

AdministrativeDetails for the 18thA

- Page 313 and 314:

Proxy Form(Before completing the fo