Download - Axiata Group Berhad - Investor Relations

Download - Axiata Group Berhad - Investor Relations

Download - Axiata Group Berhad - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

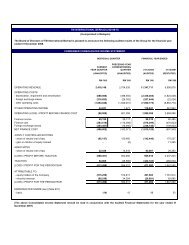

22. PROPERTY, PLANT AND EQUIPMENT (CONTINUED)(a)The net book value of plant and machineries held under hire purchase and finance lease arrangements are asfollows:2009 2008RM’000 RM’000Telecommunication network equipment 5,587 9,527Movable plant and equipment 2,019 3,6147,606 13,141(b)During the financial year, the <strong>Group</strong> incurred net impairment losses of RM83.6 million (2008: RM12.8 million). Theallowance for the impairment losses relates primarily to the write down of certain telecommunication networkassets in which the assets had been written down to its recoverable values, net of reversal of impairment lossesof RM5.2 million (2008: RM16.0 million) in relation to capital work-in-progress made on a subsidiary’s longoutstanding projects which are now completed.(c)Net book value of property, plant and equipment of certain subsidiaries pledged as security for borrowings (Note16(a) and (b) to the financial statements) are as follow:2009 2008RM’000 RM’000Telecommunication network 1,761,655 1,600,651Movable plant and equipment 66,067 73,538Computer support systems 2,518 5,889Land 6,013 7,189Buildings 20,281 21,9761,856,534 1,709,243(d)There had been a change in the expected pattern of consumptions of future economic benefits embodied incertain telecommunication network equipment of subsidiaries within the <strong>Group</strong> due to physical verification exerciseand assets replacement plans. The revision was accounted for as a change in accounting estimate and hasincreased the depreciation charge during the financial year for the <strong>Group</strong> by RM300.9 million (2008: RM295.7million).(e)XL owns land located throughout Indonesia with Building Use Rights (Hak Guna Bangunan or “HGB”) for periodsof 20 to 30 years which will expire between 2012 to 2039.As at 31 December 2009, there are 129 locations with a total book value of RM17.3 million and for which HGBcertificates are in process.Annual Report 2009 • 235