- Page 1 and 2: COUNTRY BACKGROUND I. Physical Char

- Page 3 and 4: COUNTRY BACKGROUND Minerals The exa

- Page 5 and 6: COUNTRY BACKGROUND Bhutan is the le

- Page 7 and 8: COUNTRY BACKGROUND personnel polici

- Page 9 and 10: CHAPTER 2 ECONOMIC PERFORMANCEECONO

- Page 11 and 12: 2: Gross Domestic Product 1980 —

- Page 13 and 14: Figure 2.2 Economic Performance IV.

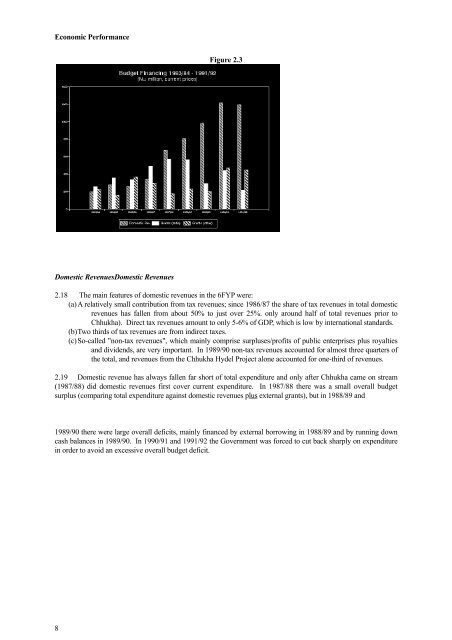

- Page 15: Table 2.4 Government Expenditures 1

- Page 19 and 20: Figure 2.5 Economic Performance 2.2

- Page 21 and 22: Economic Performance of Infant Mort

- Page 23 and 24: Approach to Development · sustaina

- Page 25 and 26: Approach to Development 3.19 The fo

- Page 27 and 28: Environment and Sustainable Develop

- Page 29 and 30: Environment and Sustainable Develop

- Page 31 and 32: Women's Involvement in Development

- Page 33 and 34: CHAPTER 6 PRIVATISATION AND PUBLIC

- Page 35 and 36: unacceptably high inequalities of i

- Page 37 and 38: CHAPTER 7 ECONOMIC OUTLOOKECONOMIC

- Page 39 and 40: Economic Outlook 7.9 This section e

- Page 41 and 42: Table 7.2 Seventh Plan Outlay and S

- Page 43 and 44: Figure 7.2 Figure 7.3 Capital Expen

- Page 45 and 46: Economic Outlook economic sector wi

- Page 47 and 48: Economic Outlook recurrent expendit

- Page 49 and 50: Financing GapFinancing Gap Table 7.

- Page 51 and 52: Fiscal and Monetary Policy Table 8.

- Page 53 and 54: Fiscal and Monetary Policy Strategy

- Page 55 and 56: Fiscal and Monetary Policy Table 8.

- Page 57 and 58: Fiscal and Monetary Policy TABLE 8.

- Page 59 and 60: I. IntroductionI. Introduction CHAP

- Page 61 and 62: Aid Policy 9.9 Sectoral Allocation

- Page 63 and 64: Aid Policy 9.20 Sector Ministries,

- Page 65 and 66: Aid Policy Aid and the Private Sect

- Page 67 and 68:

Culture and Religion Dratshangs and

- Page 69 and 70:

Culture and Religion and documented

- Page 71 and 72:

Culture and Religion V. Financial a

- Page 73 and 74:

Education Table 11.1 Educational In

- Page 75 and 76:

Education Higher EducationHigher Ed

- Page 77 and 78:

Education 11.24 In 1986, the enrolm

- Page 79 and 80:

Education Table 11.3 Enrolment Targ

- Page 81 and 82:

Education particularly of the natio

- Page 83 and 84:

Education writing and numeracy and

- Page 85 and 86:

CHAPTER 12 Human Resource Developme

- Page 87 and 88:

of Bhutan + Corporation Planning Co

- Page 89 and 90:

Joint and Public Sector IndustriesJ

- Page 91 and 92:

Table 12.5 Sectoral Training Funded

- Page 93 and 94:

Human Resource Development IV. Manp

- Page 95 and 96:

CHAPTER 13 HEALTH SERVICESHEALTH SE

- Page 97 and 98:

Table 13.2 Health Institutions July

- Page 99 and 100:

A. Objectives and Strategies in the

- Page 101 and 102:

Table 13.5 Goals for Children and W

- Page 103 and 104:

Health Services IV. Health Sector P

- Page 105 and 106:

Mother and Child Health (MCH)Mother

- Page 107 and 108:

TOTALS FOR Health 1992/93 1993/94 1

- Page 109 and 110:

Human Settlements Chhukha. Certifie

- Page 111 and 112:

Human Settlements Lack of Skilled M

- Page 113 and 114:

Human Settlements only a fraction -

- Page 115 and 116:

Human Settlements awareness of the

- Page 117 and 118:

CHAPTER 15 TRANSPORT SECTORTRANSPOR

- Page 119 and 120:

Table 15.2 Passenger Carriage by Dr

- Page 121 and 122:

Civil AviationCivil Aviation Transp

- Page 123 and 124:

Transport Sector 15.25 In the 7FYP,

- Page 125 and 126:

Transport Sector target for formati

- Page 127 and 128:

Transport Sector 11

- Page 129 and 130:

CHAPTER 16 COMMUNICATIONS SECTORCOM

- Page 131 and 132:

Table 16.1 Telephone Facilities 199

- Page 133 and 134:

A. Objectives for the 7FYPA. Object

- Page 135 and 136:

Communications Sector Dzongkhags -D

- Page 137 and 138:

TOTALS FOR Department of Post, Tele

- Page 139 and 140:

Renewable Natural Resources Table 1

- Page 141 and 142:

Renewable Natural Resources earning

- Page 143 and 144:

Renewable Natural Resources 17.27 T

- Page 145 and 146:

Renewable Natural Resources Table 1

- Page 147 and 148:

Renewable Natural Resources coopera

- Page 149 and 150:

Renewable Natural Resources Institu

- Page 151 and 152:

Renewable Natural Resources 17.67 A

- Page 153 and 154:

Renewable Natural Resources Wildlif

- Page 155 and 156:

Renewable Natural Resources TOTALS

- Page 157 and 158:

Chapter 18 MANUFACTURING AND TRADEM

- Page 159 and 160:

18.8 (see Chapter 19 on Mineral Dev

- Page 161 and 162:

Input supplyInput supply Manufactur

- Page 163 and 164:

Manufacturing and Trade Polythene P

- Page 165 and 166:

Manufacturing and Trade Formulation

- Page 167 and 168:

Manufacturing and Trade V. Financia

- Page 169 and 170:

Mineral Development Coal mining and

- Page 171 and 172:

Mineral Development Table 19.2 Esti

- Page 173 and 174:

Mineral Development be purchased: 3

- Page 175 and 176:

CHAPTER 20 ENERGY SECTORENERGY SECT

- Page 177 and 178:

Exports and ImportsExports and Impo

- Page 179 and 180:

Energy Sector 20.21 Most of the rur

- Page 181 and 182:

shortages. Energy Sector 20.34 Alte

- Page 183:

Energy Sector items will include pu