COUNTRY BACKGROUND - Gross National Happiness Commission

COUNTRY BACKGROUND - Gross National Happiness Commission

COUNTRY BACKGROUND - Gross National Happiness Commission

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Economic Outlook<br />

projects. The Ferro-Silicon Project is expected to begin production in 1993/94 and a revenue of approximately Nu.<br />

20m per year has been included in the forecast. A new power tariff was negotiated with the Government of India at<br />

the end of the 6FYP, which took effect in 1991, increasing from Nu.0.16 to Nu.0.27 per unit. The tariff will be<br />

negotiated again in 1994/5 and thus it is likely that power revenues will increase further. Revenues have been<br />

estimated to increase from Nu. 384m in the first 2 years of 7FYP to Nu 513m from 1994/95 onwards as a result of<br />

increase in tariff rate from Nu. 0.27 to Nu 0.37 per unit. The tariff rate is assumed to remain at that level until the<br />

end of 7FYP. In addition, the forecast made by the Department of Revenue and Customs was revised to include the<br />

planned commissioning of 2 minor power generating projects:<br />

the Chhukha Tail Race and Bunakha Reservoir Scheme. The Chhukha Tail Race is expected to be commissioned in<br />

1994/95 bringing in additional revenue of Nu 24m per year and the Bunakha Reservoir Scheme is expected to be<br />

commissioned in 1995/96 generating an additional revenue of Nu. 50m per year. The Dungsum Cement Project is<br />

assumed to start production in 1996/97 contributing Nu 40m in that year. By taking account of these additional<br />

revenues, total domestic revenue is projected at Nu. 5306m for the 7FYP in nominal prices.<br />

High Revenue scenarioHigh Revenue scenario<br />

7.23 There are two main differences between the scenarios. Firstly, the high revenue scenario assumes that the<br />

revenue in 1992/93 will be higher by Nu. 162m compared to the amount for that year shown in low revenue<br />

scenario. The increase is expected to come about through greater effort in tax collection, revision of rates,<br />

introduction of new taxes, increases in user charges as well as revenue from new industrial projects. Secondly, the<br />

1992/93 revenue of Nu 1,060 is projected to keep pace with inflation, at 10% per annum. The additional revenue<br />

arising from revision of the Chhukha power tariff and revenue generated by the Ferro-Silicon Project, Chhukha Tail<br />

Race, Bunakha Reservoir Scheme and Dungsum Cement Project are also included in this projection. The 7FYP<br />

total revenue according to this more optimistic forecast is Nu. 6730m in nominal terms, ( Nu.5489m in real terms).<br />

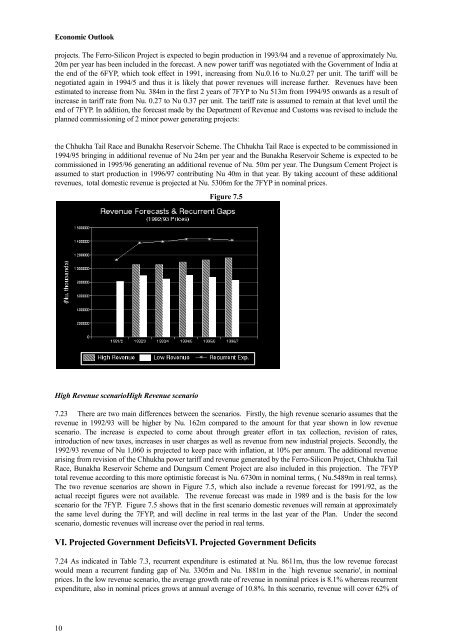

The two revenue scenarios are shown in Figure 7.5, which also include a revenue forecast for 1991/92, as the<br />

actual receipt figures were not available. The revenue forecast was made in 1989 and is the basis for the low<br />

scenario for the 7FYP. Figure 7.5 shows that in the first scenario domestic revenues will remain at approximately<br />

the same level during the 7FYP, and will decline in real terms in the last year of the Plan. Under the second<br />

scenario, domestic revenues will increase over the period in real terms.<br />

VI. Projected Government DeficitsVI. Projected Government Deficits<br />

7.24 As indicated in Table 7.3, recurrent expenditure is estimated at Nu. 8611m, thus the low revenue forecast<br />

would mean a recurrent funding gap of Nu. 3305m and Nu. 1881m in the `high revenue scenario', in nominal<br />

prices. In the low revenue scenario, the average growth rate of revenue in nominal prices is 8.1% whereas recurrent<br />

expenditure, also in nominal prices grows at annual average of 10.8%. In this scenario, revenue will cover 62% of<br />

10<br />

Figure 7.5